Please use a PC Browser to access Register-Tadawul

Tractor Supply (TSCO) Reiterates 2025 Guidance, Reports Q2 Earnings And Completes Buyback

Tractor Supply Company TSCO | 52.42 | -0.95% |

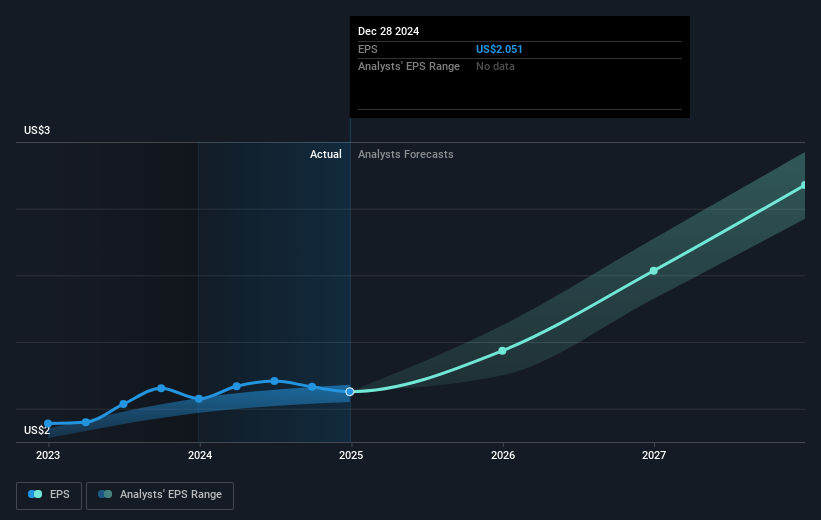

Tractor Supply (TSCO) recently reported a quarterly sales increase to $4,440 million and a net income rise to $430 million, alongside continued aggressive share buybacks, repurchasing 1.4 million shares. While its net income for the half-year decreased slightly, the company's new product line announcement and stable earnings growth forecast between 4% to 8% for 2025 provided positive signals. The company's share price increased by 22% last quarter, a significant movement compared to the broader market's 2% rise over the same period, exemplifying stronger investor confidence in its strategic direction and market expansion efforts.

The recent news about Tractor Supply's quarterly sales and net income increases, along with its aggressive share buybacks, could potentially bolster the company's reputation for financial health and operational efficiency. The share buybacks, specifically, reduce the number of shares outstanding, which could elevate earnings per share (EPS), possibly having a ripple effect on future earnings forecasts.

Tractor Supply's shares experienced substantial growth over the past five years, with a total return, including dividends, of very large. This long-term performance provides a robust backdrop to the recent quarterly upsurge and surpasses the industry average return of 9.7% over the past year. Such outperformance suggests investor confidence might extend beyond immediate quarterly results, influenced by the company's initiatives like PetRx integration and a strategic supply chain shift.

The company's current share price of US$59.62 is above the consensus analyst price target of US$56.12, indicating a potential overvaluation from an analyst perspective. The analysts believe the shares are trading 5.9% above their fair value, considering a price-to-earnings ratio of 25.9x on projected 2028 earnings. If Tractor Supply meets its earnings forecasts, its approach of diversifying supply chains combined with growing categories could lead to enhanced revenue and margins, aligning more closely with analysts' valuation expectations. However, investors should evaluate these projections against broader economic indicators and market conditions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.