Please use a PC Browser to access Register-Tadawul

Trade Desk (NasdaqGM:TTD) Shares Dip 17% As Securities Fraud Lawsuit Clouds Outlook

The Trade Desk TTD | 36.65 | -1.00% |

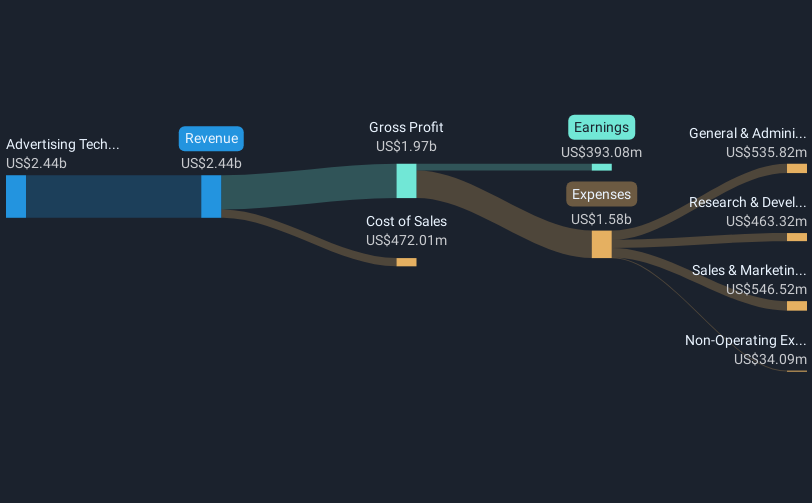

The Trade Desk (NasdaqGM:TTD) announced the appointment of Vivek Kundra as its new Chief Operating Officer, a move expected to sharpen global operations. Concurrently, the company faces a securities fraud class action lawsuit, alleging misrepresentation during the rollout of its AI tool, Kokai. Over the last week, shares of Trade Desk fell 16.9%, a stark contrast against a tech rally led by Nvidia and Palantir as well as broader market trends, with major indexes recovering some losses by week’s end. The market as a whole experienced a 2.2% decline for the week. The lawsuit’s impact and execution issues surrounding Kokai appear to have significantly influenced investor sentiment, overshadowing positive broader tech sector movements, and the anticipated stability from executive changes could not offset these challenges in improving investor confidence.

The Trade Desk's shares have delivered a total return of 217.29% over the past five years, illustrating significant long-term growth despite recent volatility. This impressive performance can partly be attributed to robust earnings growth, with earnings increasing substantially over the past year alone. A key factor in this might be the company's strategic initiatives, such as its partnership with foodpanda initiated in April 2024. This move arguably expanded The Trade Desk's influence across several Asian markets, potentially contributing to its continued revenue growth.

Further enhancing its market position, The Trade Desk launched Kokai, a cutting-edge AI-driven tool for digital ad buying in June 2023. The company's share buyback program, which completed repurchases totaling US$911.58 million since February 2023, likely bolstered shareholder value during this period. These factors, combined with strategic partnerships such as with iHeartMedia in December 2024, have likely been pivotal drivers behind its robust five-year total return.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.