Please use a PC Browser to access Register-Tadawul

Trading Wisdom | A Starter's Guide to Ray Dalio's All-Weather Investment Strategy

SPDR Gold GLD | 458.00 | +1.37% |

20+ Year Trsy Bond Ishares TLT | 87.93 | +0.27% |

ETF-S&P 500 SPY | 689.23 | +0.04% |

Ishares 7-10 Year Treasury Bond ETF IEF | 95.95 | +0.17% |

Invesco DB Commodity Index Tracking Fund DBC | 24.18 | +1.85% |

More than anything else, what differentiates people who live up to their potential from those who don’t is a willingness to look at themselves and others objectively.

-- Ray Dalio

1/3

Who's Ray Dalio?

Ray Dalio is the founder of Bridgewater Associates, one of the world’s biggest hedge funds with over US$150 billion under management. He is also a best-selling author, investor, billionaire, and philanthropist.

Dalio was featured in the Times 100 Most Influential People in the World back in 2012. He is known for his teachings for success in work and life in his book Principles.

2/3

The "All-Weather" Theory

Ray Dalio's All Weather Investment Strategy is a risk-based asset allocation approach that differs from the traditional method of allocating assets based on the total amount of capital.

Here is a detailed explanation of this strategy:

1. Understanding Risk and Asset Allocation

1.1 Allocating by Capital

Traditional asset allocation usually divvies up capital, for example, 50% to stocks and 50% to bonds. This method appears to diversify risk, but in reality, the risk of the portfolio might be heavily concentrated in more volatile assets.

Example:

- Capital Allocation: 50% stocks, 50% bonds

- Risk Allocation: Approximately 95% of the risk comes from stocks

While this capital allocation seems balanced on the surface, due to the high volatility and risk associated with stocks, the overall portfolio risk is primarily concentrated in stocks.

Historical data from the 1970s to the 2010s shows that the S&P 500 Index experienced nine annual declines with a cumulative drop of 134%; during the same period, bonds had only three down years with a total loss of just 6%.

Hence, in a 50:50 portfolio, the risk from stocks would account for nearly 95% of the total risk.

1.2 Allocating by Risk

Ray Dalio’s strategy emphasizes risk allocation rather than capital allocation. By identifying the key economic factors that drive asset price changes, the strategy balances risk across different assets to ensure portfolio stability in various economic conditions.

Key Economic Factors:

- Inflation

- Deflation

- Rising Economic Growth

- Falling Economic Growth

![The Golden Butterfly vs the All Weather Portfolio: An In-Depth Guide [2024 ]](https://www.listenmoneymatters.com/wp-content/uploads/2019/02/All-Weather.jpg)

These factors represent four different economic environments, each potentially affecting asset prices differently.

The All-Weather Strategy distributes risks associated with these environments evenly, avoiding overexposure to any single economic condition.

3/3

Constructing the Portfolio

Asset Allocation Proportions

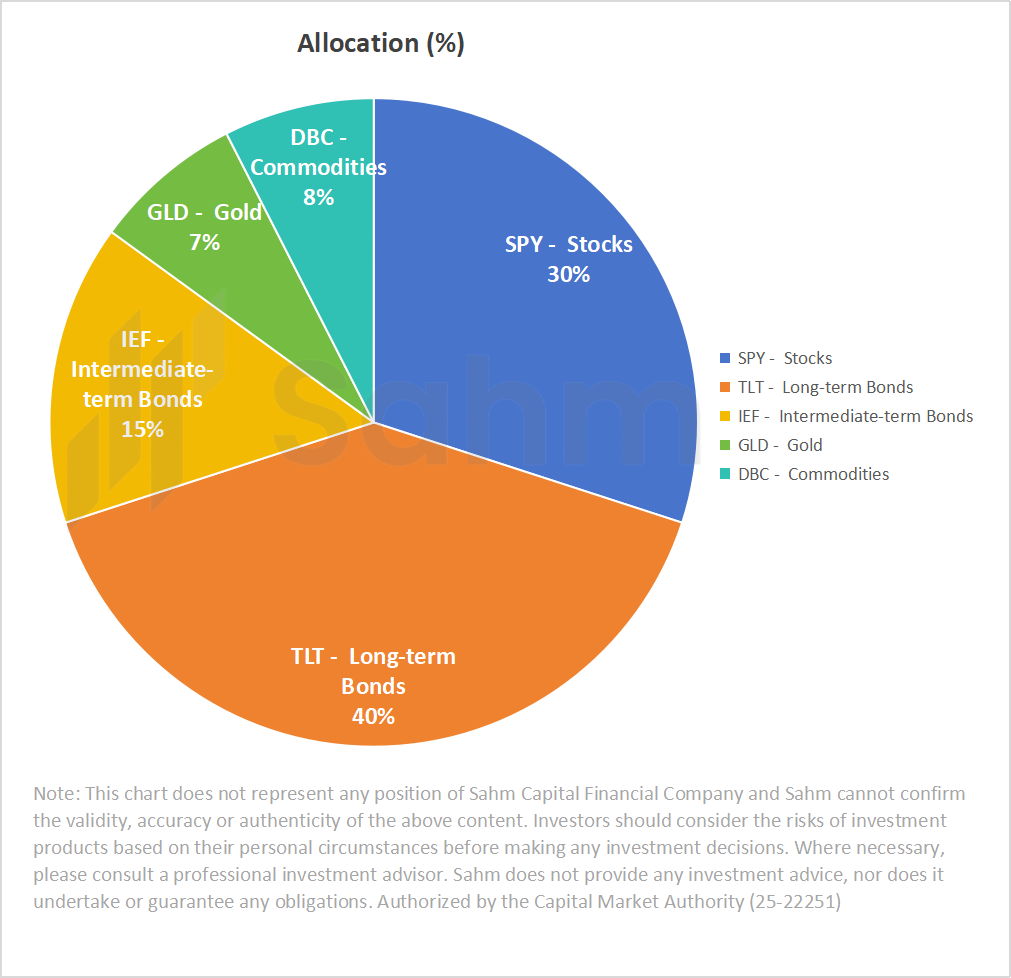

To maintain balanced risk across different economic environments, the All Weather Portfolio typically includes the following asset classes, allocated by risk proportion:

- Stocks: Representing the growth part of the economy

- Long-term Bonds: Counteracting deflation

- Intermediate-term Bonds: Ensuring liquidity

- Inflation-Protected Securities (TIPS): Guarding against inflation

- Commodities (such as gold): Hedging inflation and other systemic risks

Simplified Allocation Example

The table below shows a simplified version of the All-Weather Portfolio allocation:

In practice, Dalio also employs leverage to maximize returns. This strategy does not prioritize a high stock allocation; instead, it achieves stability through diversified asset allocation and leverage to balance risks, leading to strong performance in most scenarios.

Investment Performance and Risk Management

Based on historical data, the All-Weather Strategy performed as follows from 1984 to 2013:

- Average Annual Return: 9.72%

- Profitable Years: 86%

- Loss Years: Only 4 years with an average annual loss of 1.9%

- Worst Year Performance: 2008, with a decline of 3.93% (compared to a 37% drop in the S&P 500)

These figures demonstrate that the All-Weather Strategy can achieve steady returns and effectively mitigate risks across various economic conditions.

Adjustments for Younger Investors

Younger investors with a higher risk tolerance may consider increasing the proportion of stocks. However, regardless of age and risk preference, the core objective of asset allocation is to maintain stable returns in all economic environments, leading to financial freedom and peace of mind.