Please use a PC Browser to access Register-Tadawul

Trane Technologies (TT): Evaluating Valuation Following Launch of AI Control and ARIA Solutions for Smart Buildings

TRANE TECHNOLOGIES PLC TT | 391.19 | -3.02% |

Trane Technologies (TT) just made headlines with the unveiling of its AI Control and ARIA solutions, two ambitious additions to its portfolio that put artificial intelligence at the heart of building optimization. These new tools are designed to make heating, cooling, and overall energy management smarter, and promise impressive results for both efficiency and sustainability. With energy savings and carbon reductions in the spotlight, many investors are likely weighing whether these launches could signal a turning point for the company’s long-term prospects.

This push into advanced digital offerings follows a period of noticeable swings in the share price, reflecting a market still working out what Trane Technologies’ innovation means for its true value. Over the past year, the stock is up 7%, building on healthy long-term momentum as the company leaned into new technologies and steady growth in earnings. While some investors are welcoming these changes as signs of broader transformation, others remain cautious, especially given shifts in the stock’s price-to-earnings ratio relative to the industry.

So after this mix of short-term volatility and product-driven growth, is Trane Technologies offering an opportunity for buyers, or has the market already priced in the gains from its latest innovations?

Most Popular Narrative: 11.1% Undervalued

According to the most widely followed narrative, Trane Technologies is seen as undervalued by more than 10%, based on a blend of forward-looking earnings projections, profit margins, and progressive strategic moves.

The strategic emphasis on innovation and a direct sales force enables Trane Technologies to consistently outgrow its end markets. This approach supports long-term revenue expansion and potential margin improvement due to enhanced market positioning and customer engagement.

Want to know the growth blueprint behind this high valuation? The narrative hints that sustained profit expansion and a premium future earnings multiple could reset expectations for Trane's stock. Curious about which financial drivers underpin the attractive price target? The full narrative reveals the pivotal projections and why analysts believe the market has not caught up to Trane’s bold upside case.

Result: Fair Value of $457.60 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, a slowdown in key verticals like data centers or challenges in passing cost increases to customers could limit Trane Technologies’ upbeat growth outlook.

Find out about the key risks to this Trane Technologies narrative.Another View: Market-Based Comparison

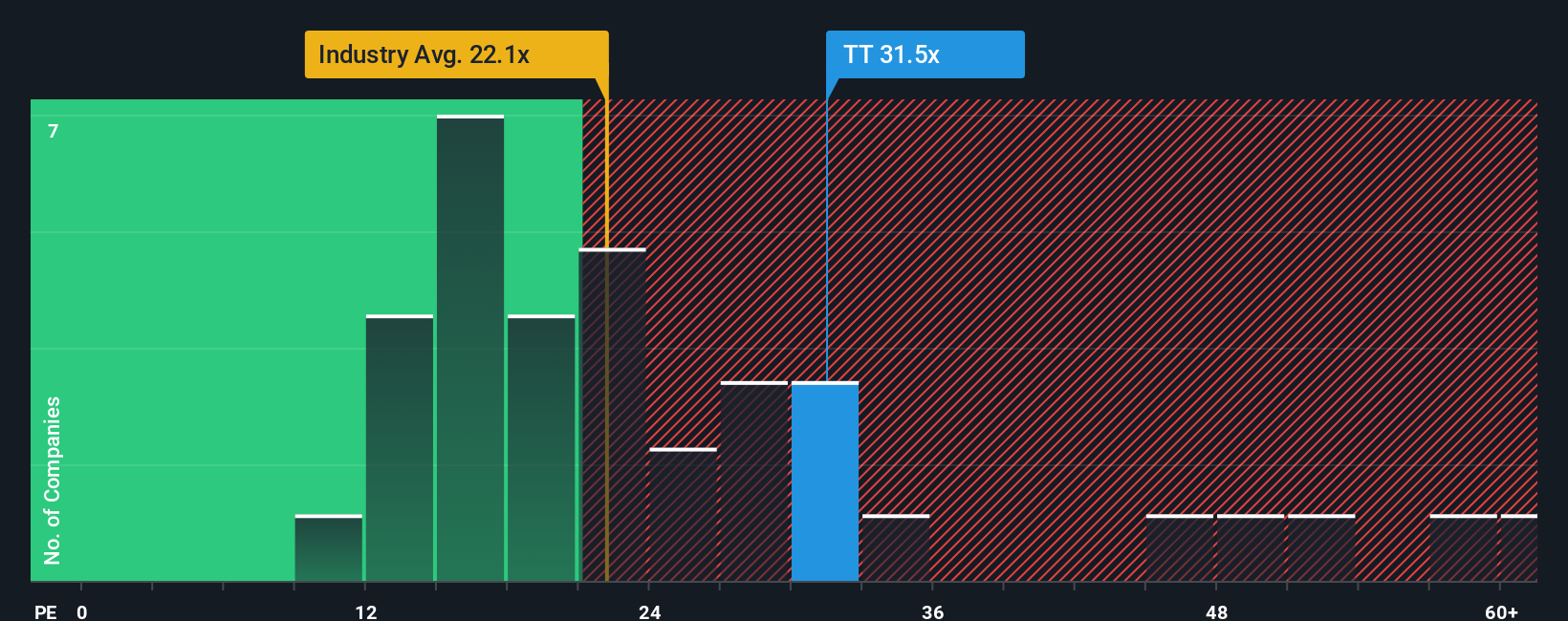

While analysts see Trane Technologies as undervalued based on future earnings growth, a simple comparison to others in the industry tells a different story. The shares currently trade well above the typical industry valuation. Could this high price be justified by stronger future results, or is the premium a warning sign for investors?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Trane Technologies Narrative

If you want to take a different perspective or prefer hands-on research, you can craft your personal view in just a few minutes. Do it your way.

A great starting point for your Trane Technologies research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Ways to Grow Your Portfolio?

Smart investors know that a single stock never tells the whole story. Make the most of your next move by exploring unique opportunities that can set your portfolio apart.

- Tap into steady income streams by evaluating top companies offering dividend stocks with yields > 3% and see which ones are outpacing bank rates.

- Hunt for tomorrow’s leaders in technology by reviewing groundbreaking firms in artificial intelligence with our expert-backed AI penny stocks.

- Focus on overlooked value by targeting stocks trading far below their true worth using our exclusive undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.