Please use a PC Browser to access Register-Tadawul

Trane Technologies (TT): Valuation Spotlight as Sustainability Retrofit and New AI Lab Spark Investor Interest

TRANE TECHNOLOGIES PLC TT | 391.19 396.00 | -3.02% +1.23% Pre |

Trane Technologies, a global climate innovator, recently caught investors’ attention after completing a large-scale electrification and decarbonization retrofit at New York City’s biggest office building. The company also launched a new AI Lab to advance HVAC technologies.

It has certainly been an eventful year for Trane Technologies, with headline-grabbing innovation and a leadership transition helping the company remain in the spotlight. While the latest share price sits at $423.53, total shareholder return over the past year stands at a solid 10%, and the five-year total return of roughly 249% points to steady long-term outperformance. This indicates that momentum persists even as valuations grow richer.

If Trane’s push into AI-powered building solutions piqued your curiosity, the next logical step is to explore what’s happening across the high-growth tech and AI sector — See the full list for free.

With steady gains and optimism fueled by innovation, the big question for investors now is whether Trane Technologies is undervalued after its recent run, or if the market has already priced in its expected growth.

Most Popular Narrative: 7.4% Undervalued

Trane Technologies’ latest fair value estimate has been set at $457.60, a premium over its last close. This narrative is underpinned by forecasts for robust growth and margin improvement, which set it apart within the sector.

"The focus on energy efficiency and the ability to deliver attractive paybacks for customers could bolster future sales and market share, positively impacting revenue. The strategic emphasis on innovation and a direct sales force enables Trane Technologies to consistently outgrow its end markets. This approach supports long-term revenue expansion and potential margin improvement due to enhanced market positioning and customer engagement."

Want to decode how Trane’s valuation leap is justified? The answer lies in bold profit margin expansion and growth assumptions usually reserved for top-tier tech players. Ready to uncover the full storyline and the numbers that fuel it?

Result: Fair Value of $457.60 (UNDERVALUED)

However, risks remain, including possible slowdowns in key sectors such as data centers or challenges with passing cost increases on to customers.

Another View: What Does The Market Multiple Say?

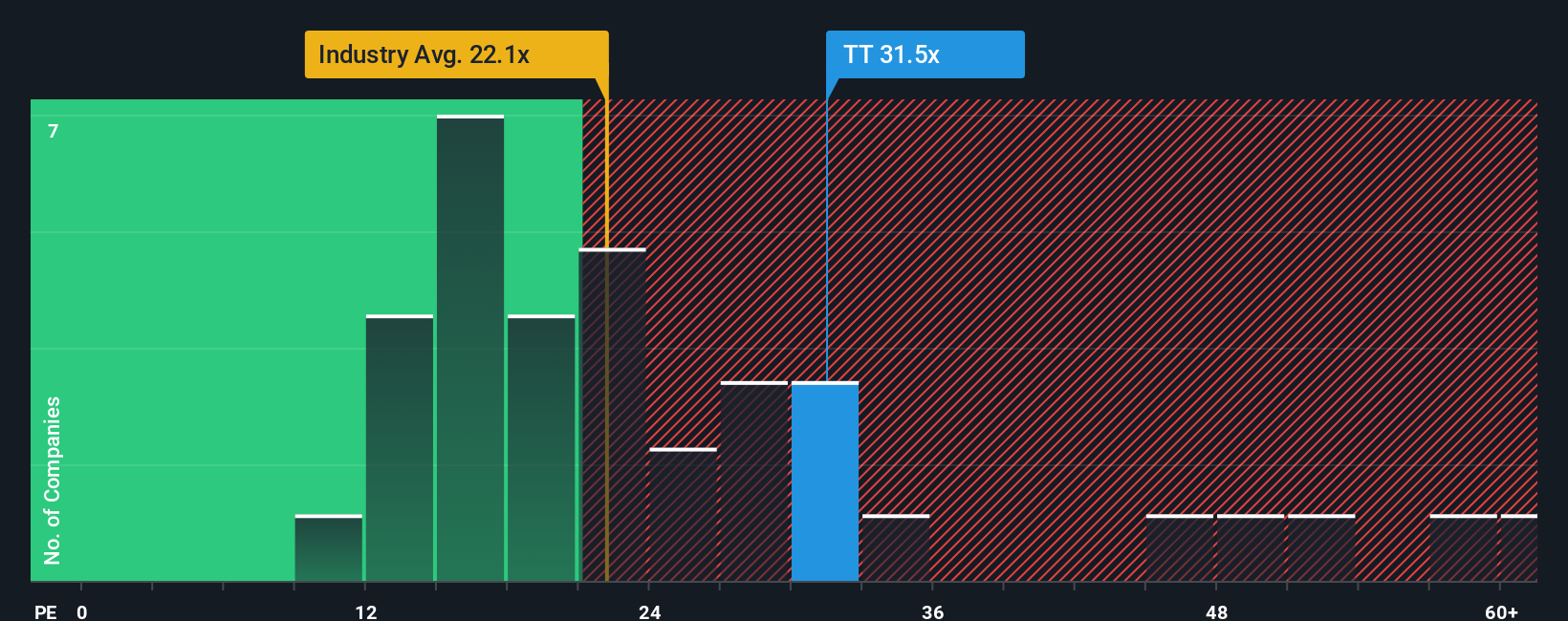

Looking instead at valuation through the lens of the price-to-earnings ratio, Trane Technologies stands out as more expensive than both its industry peers and the fair ratio. Its 32.8x multiple outpaces the US Building industry’s 21.8x and a fair ratio of 28.6x, which could increase valuation risks if growth falls short. Is this premium a sign of quality or a warning for cautious investors?

Build Your Own Trane Technologies Narrative

If you see things differently or want to dive into the data on your own terms, it takes less than three minutes to create your own perspective. Do it your way

A great starting point for your Trane Technologies research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Take your next step toward smarter investing. Don’t miss out on alternative stocks and fresh sectors that could be tomorrow’s standouts. Here are three avenues smart investors are already acting on:

- Tap into the AI revolution by investigating these 24 AI penny stocks that are positioned to benefit from exponential industry growth and advances in machine learning.

- Boost your passive income strategy by checking out these 19 dividend stocks with yields > 3% with yields above 3% for resilient cash flow in any market.

- Ride the next wave in financial innovation by examining these 78 cryptocurrency and blockchain stocks that are poised to capitalize on the expanding world of digital assets and blockchain.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.