Please use a PC Browser to access Register-Tadawul

TransMedics Group (TMDX): Evaluating Valuation Following Analyst Upgrades and Positive Technical Signals

TransMedics Group TMDX | 126.79 | -0.65% |

TransMedics Group (TMDX) has been drawing attention after a series of analyst upgrades and improved technical signals. The company’s recent uptick in Relative Strength Rating and lower short interest suggest growing investor confidence in its outlook.

After a stretch of strong results, momentum has returned for TransMedics Group, with the share price climbing over 76% year-to-date and a recent surge fueled by analyst attention, upcoming earnings, and technical upgrades. Despite short-term volatility, its three-year and five-year total shareholder returns of 153% and nearly 788% underscore the company’s longer-term growth story and ability to capture investor optimism.

If TransMedics’ recent momentum has you interested in healthcare standouts, consider exploring the latest opportunities with See the full list for free.

With shares near their highs and multiple analysts projecting further gains, investors must now weigh whether TransMedics still offers upside at current levels or if the market has already priced in the next phase of growth.

Most Popular Narrative: 15.3% Undervalued

With TransMedics Group trading at $117.63 against a narrative fair value of $138.88, the most widely followed outlook signals substantial upside potential even after this year’s rally. Investors are watching for catalysts that could justify the current optimism as the valuation reflects high expectations for growth and expansion.

Structural increases in organ transplant demand, driven by the aging population and higher rates of chronic disease globally, are expected to expand the addressable market for TransMedics' OCS platform. This positions the company for sustained revenue growth as transplant volumes rise.

TransMedics’ ambitions stretch far beyond its recent performance. What forecasts are propelling such a premium valuation? Big calls on future market share, faster profit growth, and expanding international operations could shift the market narrative. Just wait until you see which forecasted milestones drive that fair value estimate.

Result: Fair Value of $138.88 (UNDERVALUED)

However, future success still depends on new competitors entering the market and regulatory shifts that could dampen TransMedics’ long-term growth projections.

Another View: Multiples Suggest a Higher Price Tag

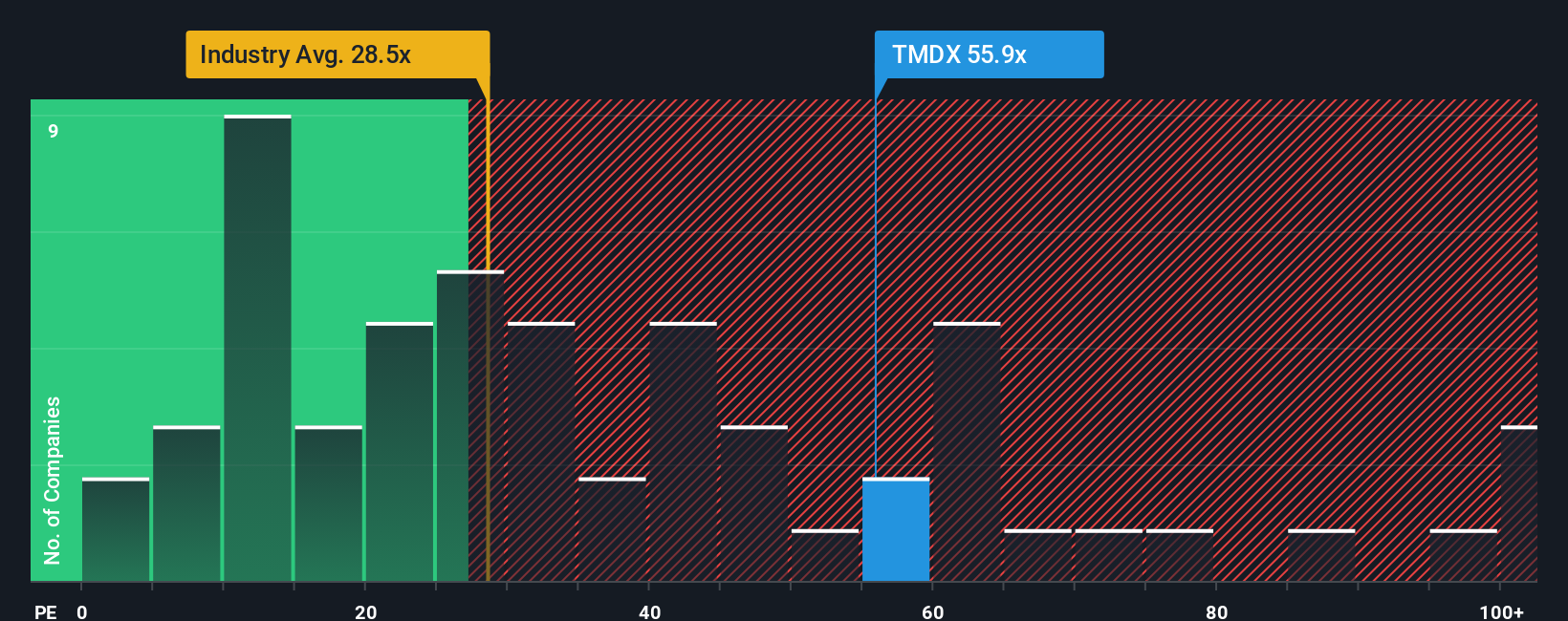

Looking at the usual price-to-earnings ratio, TransMedics trades at 56x earnings, much higher than both its industry peers (29.1x) and the fair ratio estimated by our models (37.4x). This means the market expects big things, but if growth stalls, that gap could turn risky. Is this optimism justified or has the stock run ahead of itself?

Build Your Own TransMedics Group Narrative

If you want to dig into the numbers and form your own perspective, our tools let you quickly create and share your unique analysis. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding TransMedics Group.

Looking for More Smart Investing Ideas?

Go beyond TransMedics and put your money to work with strategies shaped for today's markets. Don’t miss opportunities that could reshape your portfolio. Try these tailored screens now:

- Unlock hidden potential by checking out these 877 undervalued stocks based on cash flows featuring stocks trading below their intrinsic value for those seeking overlooked bargains.

- Target reliable income streams with these 18 dividend stocks with yields > 3% and gain access to companies delivering strong dividend yields above 3%.

- Ride the future of computing by starting with these 26 quantum computing stocks to spot pioneering businesses at the forefront of the quantum technology wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.