Please use a PC Browser to access Register-Tadawul

TreeHouse Foods (THS) Valuation Check As Mixed Returns Shape Expectations

TreeHouse Foods, Inc. THS | 24.43 | Delist |

What TreeHouse Foods stock data suggests right now

TreeHouse Foods (THS) is drawing interest after recent performance metrics showed a mixed picture, with short term share returns under pressure while the past 3 months and annual fundamentals point in different directions.

The share price sits at $23.49 after a modest 90 day share price return of 16%, while the 1 year total shareholder return of 31.26% decline signals fading longer term momentum despite recent stabilization.

If TreeHouse Foods has you reassessing your watchlist, it could be a useful moment to broaden your search and check out fast growing stocks with high insider ownership.

With the shares around $23.49, an intrinsic value estimate suggesting a discount of roughly 15%, and a price target slightly below the current price, the key question is whether TreeHouse Foods is genuinely undervalued or if the market already reflects any future growth.Most Popular Narrative Narrative: 10.2% Overvalued

With TreeHouse Foods last closing at $23.49 against a narrative fair value of $21.31, the current setup leans cautious on upside potential.

The analysts have a consensus price target of $21.312 for TreeHouse Foods based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $24.0, and the most bearish reporting a price target of just $19.0.

Want to see what is behind this tight range of outcomes? The whole story rests on modest revenue lift, margin repair, and a very specific future earnings multiple.

Result: Fair Value of $21.31 (OVERVALUED)

However, there are still a few pressure points to watch, such as ongoing volume softness and cost volatility in inputs like coffee, which could challenge this narrative.

Another view on valuation

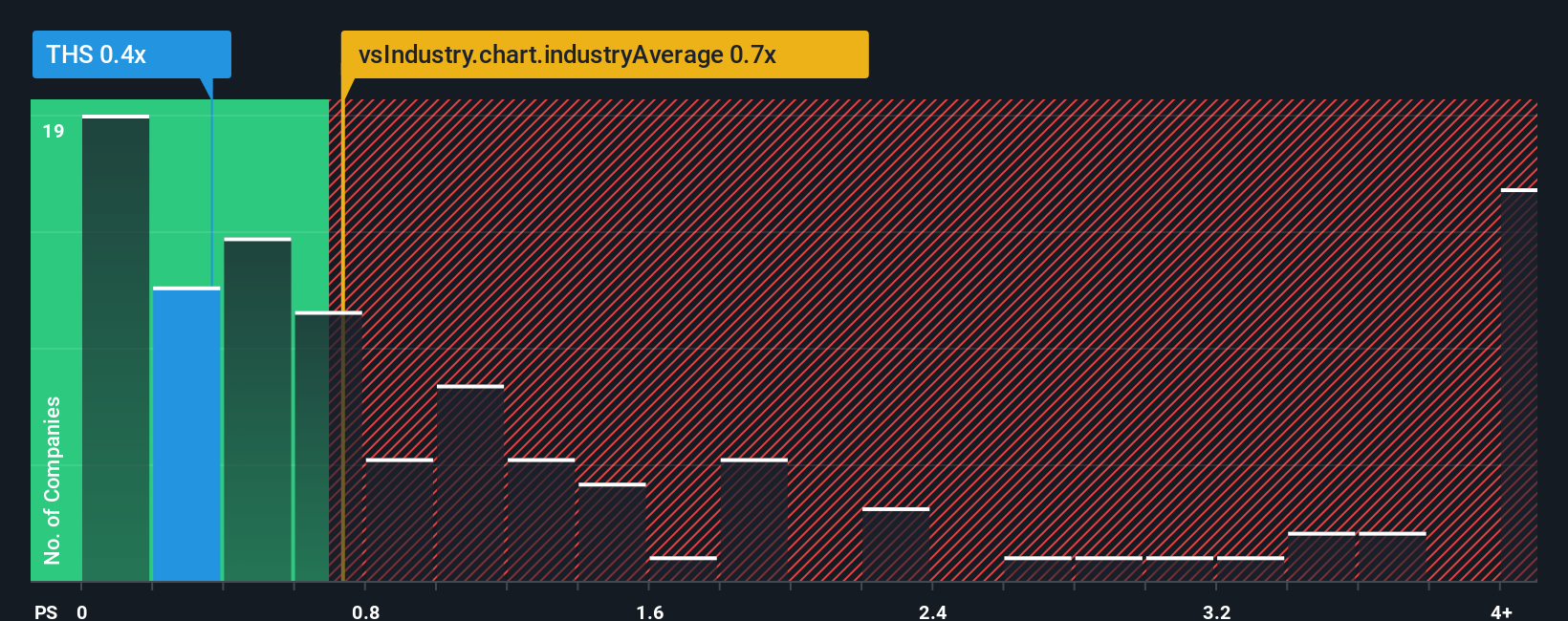

While the analyst narrative sees TreeHouse Foods as about 10% overvalued versus a fair value of $21.31, the SWS fair ratio based on P/S paints a different picture. At 0.4x P/S versus a fair ratio of 0.5x and a US Food industry average of 0.6x, the shares screen as cheap on sales. Is the market pricing in more risk than these numbers suggest?

Build Your Own TreeHouse Foods Narrative

If you see the numbers differently or prefer to piece together the story on your own, you can build a custom view in just a few minutes: Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding TreeHouse Foods.

Looking for more investment ideas?

If TreeHouse Foods got you thinking, do not stop here. The right mix of ideas can sharpen your portfolio and you do not want to miss what else is on the table.

- Target potential bargains by scanning these 878 undervalued stocks based on cash flows that trade below their estimated cash flow value and might offer a more attractive entry point.

- Tap into emerging tech themes with these 25 AI penny stocks that are linked to artificial intelligence and related applications across different sectors.

- Strengthen your income focus by reviewing these 14 dividend stocks with yields > 3% that already offer yields above 3% and may suit a cash flow oriented approach.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.