Please use a PC Browser to access Register-Tadawul

Tri Pointe Homes (TPH): Evaluating Valuation Following New Austin-Area Land Acquisitions and Expansion Plans

TRI Pointe Group Inc TPH | 33.70 | -0.12% |

If you’re keeping an eye on Tri Pointe Homes (TPH), their latest move in the Austin area may give you something to think about. The company just announced the acquisition of two land parcels in Leander, Texas, with plans for two new residential neighborhoods: Ridgeview Reserve and Noven. These projects, which will feature premium amenities and are slated to debut in 2026, signal a clear push to solidify Tri Pointe’s presence in one of Texas’ most competitive real estate markets. For investors, this kind of expansion in a high-growth region is a compelling story, but as with any new build, it also comes with execution risks and assumptions about continued demand.

Looking at the stock’s journey of late, Tri Pointe Homes’ performance has had its ups and downs. After a lengthy period of lackluster movement, shares surged 3.1% on the announcement of this Texas land deal, shaking off the relative stability that has defined the past year. Broader market jitters have weighed on homebuilders, and Tri Pointe’s returns reflect that, with the stock down about 21% over the past twelve months despite strong gains over the past three years. Still, the recent uptick could suggest renewed optimism or that markets see fresh value ahead.

So after a year of sliding returns, is this a chance to buy Tri Pointe Homes on the cusp of a new growth phase, or are investors simply pricing in longer-term bullishness already?

Most Popular Narrative: 10.5% Undervalued

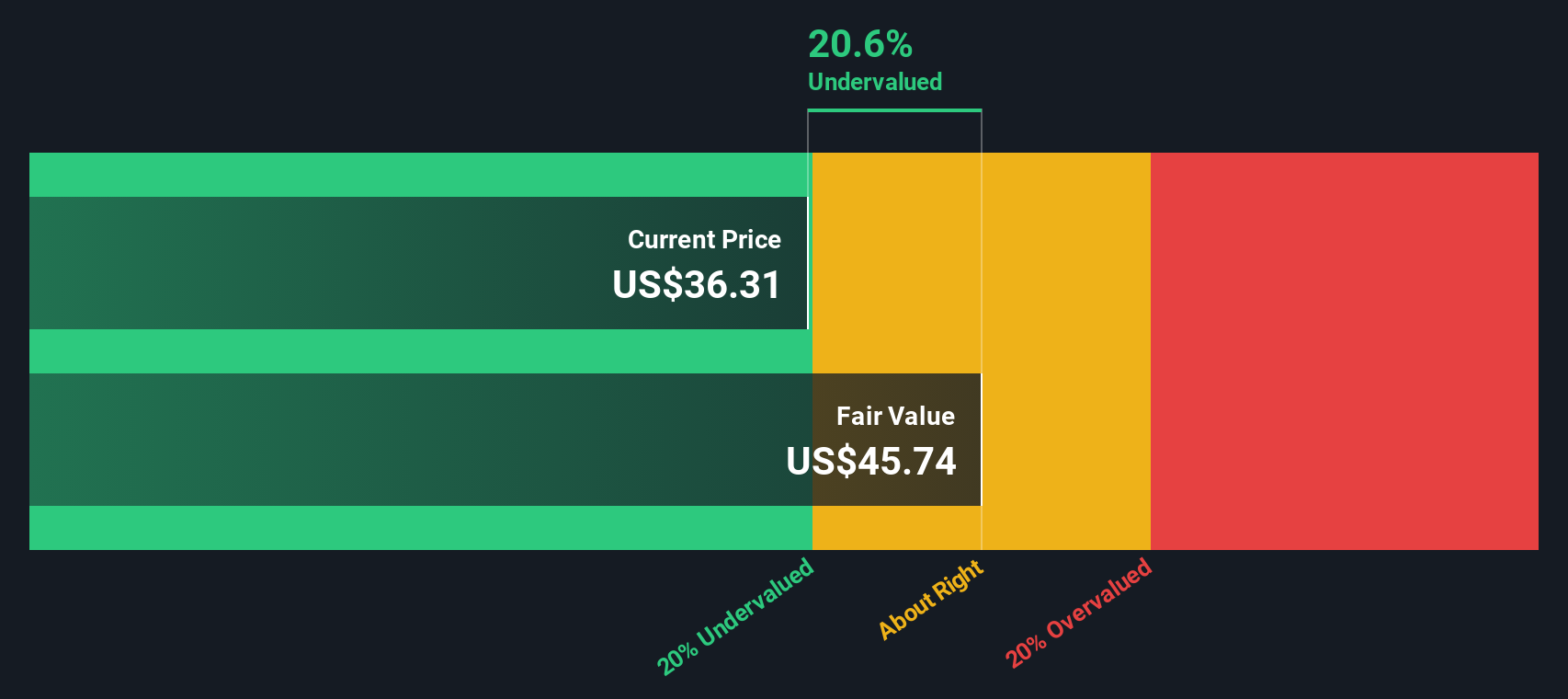

According to the most widely followed narrative, Tri Pointe Homes is currently trading below its estimated fair value, suggesting the market may be underestimating its long-term potential.

“Ongoing expansion into high-growth Sun Belt and Southeastern markets (Florida, Coastal Carolinas, Utah) broadens Tri Pointe's geographic footprint and capitalizes on migration patterns and hybrid/remote work trends. This is expected to support higher sales volumes and revenue visibility.”

Curious what drives this optimism? The story hinges on a surprising combination of ambitious expansion plans, bold assumptions about performance, and financial projections that might not be what you expect. Want to know if analysts are betting on a sharp turnaround or simply stretching current valuations to fit a growth thesis? The answer is hidden in the numbers behind this compelling price target.

Result: Fair Value of $39.4 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent affordability challenges and declining home orders compared to peers could undermine Tri Pointe’s growth prospects if market conditions remain soft.

Find out about the key risks to this Tri Pointe Homes narrative.Another View: SWS DCF Model Weighs In

On the other hand, our DCF model paints a different picture and suggests Tri Pointe Homes could be even more undervalued than the price targets imply. Does this back up the optimism or add a new kind of risk?

Build Your Own Tri Pointe Homes Narrative

If you think there’s more to the story or want to dig into the numbers on your own terms, you can easily create your own narrative in just a few minutes. Do it your way.

A great starting point for your Tri Pointe Homes research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Take action and uncover smart investment opportunities before the crowd catches on. With the Simply Wall Street Screener, you can pinpoint stocks that truly align with your goals.

- Power up your portfolio with steady returns by searching for dividend stocks that yield over 3% through dividend stocks with yields > 3%.

- Ride the artificial intelligence wave and tap into the next generation of tech leaders by seeking out potential with AI penny stocks.

- Capitalize on genuine bargains by targeting undervalued shares based on cash flows using undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.