Please use a PC Browser to access Register-Tadawul

TriNet Group (TNET) Is Up 7.7% After Q2 Results and Maintained Annual Guidance - What's Changed

TriNet Group, Inc. TNET | 59.29 | +1.68% |

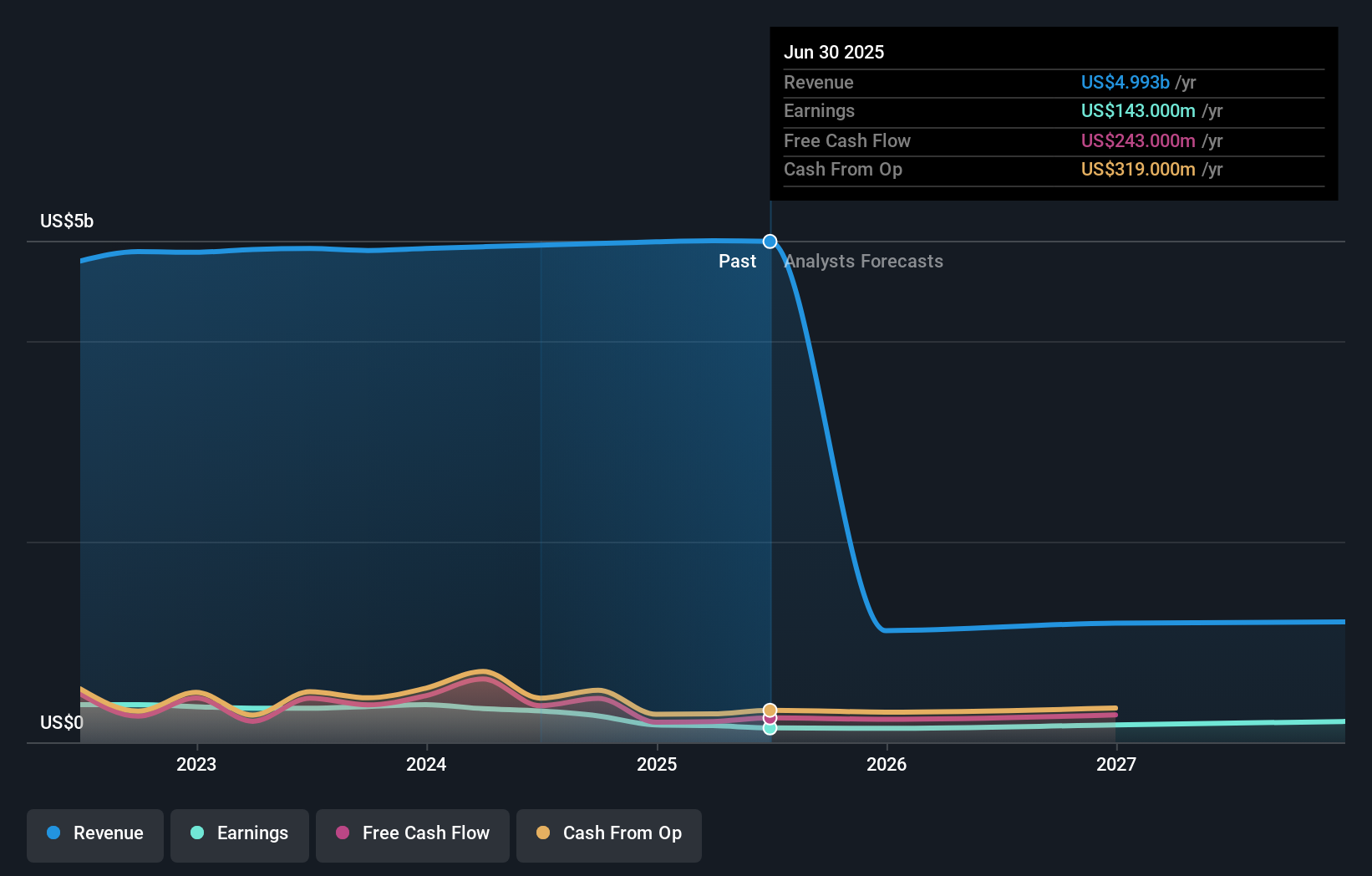

- TriNet Group recently reported its second quarter 2025 results, posting revenue of US$1.24 billion and net income of US$37 million, both lower than the same period last year, and reiterated its full-year guidance for revenue between US$4.95 billion and US$5.14 billion with diluted net income per share projected at US$1.90 to US$3.40.

- Despite decreased quarterly profitability, TriNet updated progress on its long-running share buyback, having repurchased over 35.65 million shares for about US$2.56 billion since 2014, signaling ongoing capital return to shareholders.

- With TriNet maintaining its annual guidance despite recent earnings pressure, we'll consider how this shapes the longer-term investment outlook.

TriNet Group Investment Narrative Recap

To be a shareholder in TriNet Group, you need to have conviction in their ability to grow by serving small and medium-sized businesses with HR and benefits solutions, while navigating fluctuations in client confidence and new business sales. The recent quarterly earnings showed lower revenue and net income, but these results did not materially impact the company’s reaffirmed full-year guidance, so the most important short term catalyst, maintaining revenue growth through retention and pricing, remains in place, while the biggest risk still stems from ongoing pressure on customer hiring and healthcare costs. Among the latest updates, TriNet’s ongoing share buyback stands out. Since 2014, TriNet has repurchased over 35.65 million shares, signaling an ongoing commitment to capital return despite period-to-period profitability challenges, and this continues to complement their long-term EPS growth goals as outlined in their recent strategic initiatives. However, it is important to be aware that, despite reiterated guidance, the persistence of low new sales conversion rates could disrupt growth, especially if...

TriNet Group's outlook forecasts $404.2 million in revenue and $206.4 million in earnings by 2028. This reflects a -56.8% annual revenue decline and a $39.4 million earnings increase from the current $167.0 million.

Exploring Other Perspectives

Simply Wall St Community members set TriNet’s fair value tightly between US$80.00 and US$80.95 based on two perspectives. While some see earnings growth potential, continued weakness in sales conversions highlights why opinions on future performance can vary, consider the full set of views.

Build Your Own TriNet Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your TriNet Group research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free TriNet Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate TriNet Group's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.