Please use a PC Browser to access Register-Tadawul

TriNet Unveils AI Assistant And Sales Training As Shares Trade Below Targets

TriNet Group, Inc. TNET | 38.48 | -9.84% |

- TriNet Group (NYSE:TNET) has introduced an AI-powered TriNet Assistant to support clients with HR tasks.

- The company is also expanding its TriNet Ascend sales training program into additional U.S. regions.

- These moves represent new product and talent development efforts beyond routine financial updates.

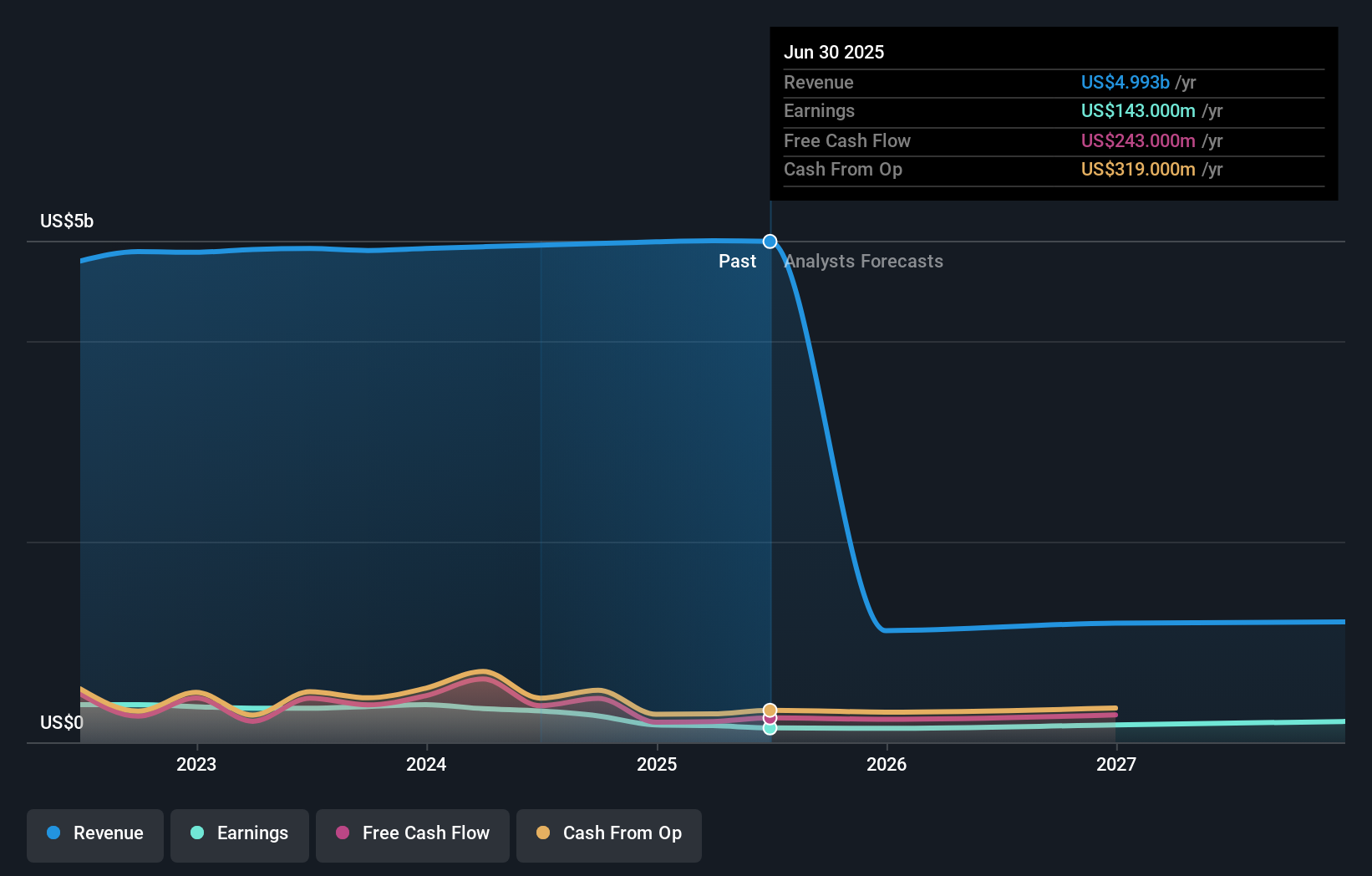

TriNet Group comes into this news with a share price of $39.82 and a value score of 5, alongside multi year share price pressure. The stock has seen a 28.8% decline over the past week, 36.5% over the past month, and 30.3% year to date, with a 47.8% decline over the past year and 55.1% over three years.

In this context, the launch of TriNet Assistant and the broader rollout of TriNet Ascend give investors new information about how the company is investing in its service platform and salesforce. As you assess NYSE:TNET, these initiatives add fresh context around product direction and go to market efforts that may influence how the business evolves over time.

Stay updated on the most important news stories for TriNet Group by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on TriNet Group.

Quick Assessment

- ✅ Price vs Analyst Target: At US$39.82 versus a consensus target of US$54.80, the price sits about 27% below where analysts currently model the stock.

- ✅ Simply Wall St Valuation: Simply Wall St estimates the shares are trading about 71.6% below its DCF based fair value, which points to a wide valuation gap.

- ❌ Recent Momentum: The 30 day return of roughly 36% decline shows weak short term sentiment despite the new AI assistant and sales training rollout.

There is only one way to know the right time to buy, sell or hold TriNet Group. Head to Simply Wall St's company report for the latest analysis of TriNet Group's Fair Value.

Key Considerations

- 📊 TriNet Assistant and the expanded Ascend program show the company putting resources into its tech stack and salesforce, which may influence how it competes in Professional Services.

- 📊 Watch whether AI driven tools support revenue per client and whether sales productivity metrics move in step with the wider rollout.

- ⚠️ The balance sheet carries a high level of debt, so investors may want to see that new initiatives translate into resilient cash generation over time.

Dig Deeper

For the full picture including more risks and rewards, check out the complete TriNet Group analysis. Alternatively, you can check out the community page for TriNet Group to see how other investors believe this latest news will impact the company's narrative.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.