Please use a PC Browser to access Register-Tadawul

Trip.com Group (NasdaqGS:TCOM) Faces 10% Weekly Decline Amid US-China Trade Tensions

Trip.com International Ltd Sponsored ADR TCOM | 71.39 71.39 | +0.83% 0.00% Post |

Amidst a turbulent week for global equities, Trip.com Group (NasdaqGS:TCOM) saw a 10.8% decline in its share price. The company's performance was likely impacted by the broader market downturn influenced by escalating tariff tensions between the US and China. The overall market fell 9.5%, driven by fears of a trade war that saw the Nasdaq enter bear market territory, reflecting investor anxiety. The pervasive market sell-off hit technology and travel stocks particularly hard, as the S&P 500 also saw a significant decline. As such, Trip.com's stock movement aligned with broader market trends during this challenging period.

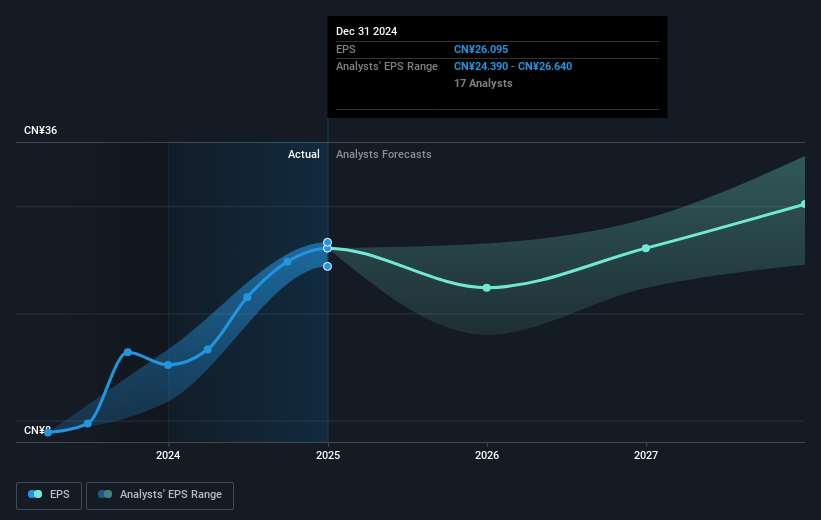

Over the last three years, Trip.com Group achieved a total return of 154.39%. This performance reflects a range of company-specific developments. Capital return initiatives, including a share repurchase and cash dividend program, were announced, enhancing shareholder value. Notably, the latest quarterly earnings for Q4 2024 showed substantial growth, with net income rising from CNY 1.30 billion to CNY 2.16 billion. This financial strength is complemented by advancements in AI-driven travel tools, which have improved customer engagement and contributed to revenue increases. Additionally, partnerships such as the one with Zhoushan aimed at cultural tourism signal a commitment to broadening market reach.

During the past year, Trip.com Group also stood out by outperforming both the US market and the US Hospitality industry. The company's earnings growth over the past year, which surpassed that of the Hospitality industry, reflects robust underlying business developments. This consistent financial performance underscores Trip.com's focus on diversified growth and resilience amidst market fluctuations.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.