Please use a PC Browser to access Register-Tadawul

Trump's Major AI Policy Drops Today: Which Stocks Will Benefit Most? | Exclusive

NVIDIA Corporation NVDA | 170.94 | -3.81% |

Advanced Micro Devices, Inc. AMD | 198.11 | -5.29% |

Intel Corporation INTC | 36.05 | -3.38% |

Broadcom Limited AVGO | 326.02 | -4.48% |

Micron Technology, Inc. MU | 225.52 | -3.01% |

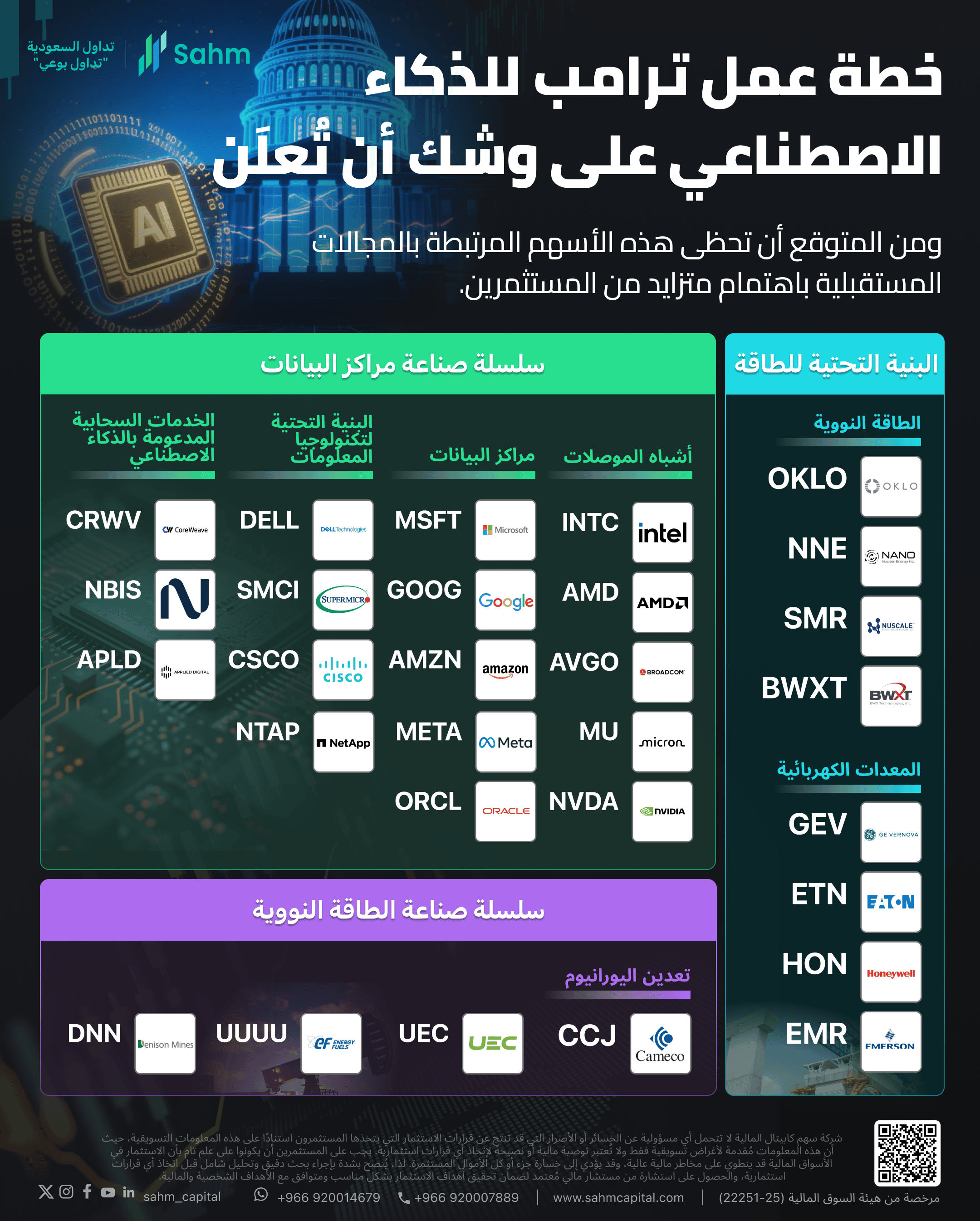

Editor's Note: The "AI Action Plan" will be unveiled this week with major impact! Trump is expected to distribute policy benefits across multiple industries including technology, semiconductors, and energy.

Sahm brings you a quick overview of the investment logic >>

Trump plans to deliver a speech at the "Winning the AI Race" event on July 23. The market expects this speech to comprehensively introduce the Trump administration's AI action plan.

According to sources familiar with the matter, Trump may announce the AI plan and multiple executive orders this week, marking a crucial step in shaping U.S. AI policy that will impact the technology, semiconductor, and energy industries.

Among these, the executive order promoting U.S. chip and AI tool exports has drawn the most market attention. The plan will also streamline data center approvals and facilitate their energy supply to meet AI computing demands.

In fact, after Trump began his "Presidential Career 2.0," he had already announced a $100 billion AI data center investment plan involving SoftBank Group, OpenAI, and Oracle Corporation(ORCL.US). Furthermore, to encourage innovation, the U.S. government lifted Biden-era export restrictions on AI chips, making it easier for U.S. allies to access advanced AI chips manufactured by NVIDIA Corporation(NVDA.US) and Advanced Micro Devices, Inc.(AMD.US).

What is the "AI Action Plan"?

The plan's core focuses on clearing obstacles for U.S. AI industry growth through a series of administrative measures, emphasizing key technology exports and accelerating data center construction. This plan reflects the "support AI growth" and "light regulation" policy orientation, aimed at ensuring America maintains its lead in the global AI race.

According to media reports, the plan specifically includes:

Focus on AI Exports

The upcoming executive order will promote U.S. semiconductor and AI tool exports, leveraging institutions like the Export-Import Bank to ensure friendly countries use American technology. This institutionalizes previous efforts to promote NVIDIA high-performance AI chip exports to the UAE, providing support for U.S. companies to expand markets.

Accelerate Data Center Approvals

The plan will streamline data center construction approvals, guarantee energy supply, and accelerate related energy projects. Previously in Pittsburgh, officials expressed support for hundreds of billions of dollars in such project investments. On July 15, Trump announced Pennsylvania would receive $92 billion in investment for data center construction, creating an energy and AI hub.

"Light Regulation" Framework, Avoiding Industry Controversies

The 20-page action plan adheres to "non-interference" and "pro-growth" principles, including content soliciting information from private enterprises, focusing on Trump's second-term objectives. It avoids issues like AI-generated content copyright and model transparency, using "light-touch" regulation to give companies innovation space, though this may allow controversies to persist. Additionally, the White House plans to issue orders requiring AI companies receiving federal contracts to maintain political neutrality.

Which Themes May Benefit?

Based on the Trump administration's previous actions and revealed AI action plan directions, multiple categories of tech stocks may welcome policy benefits.

Recently, Morgan Stanley's latest research report indicated that global data center construction will require approximately $2.9 trillion in investment by 2028. The AI-driven capital expenditure wave is not only massive in scale, but between 2025-2026, data center construction and power infrastructure-related investments will contribute up to 40 basis points to U.S. real GDP growth.

Morgan Stanley analysts noted that while these tech giants' internal operating cash flows have been the primary funding source, with surging investment demands and the need to consider cash reserves and shareholder returns, relying solely on internal funds can no longer meet all future expenditures. By 2028, only about $1.4 trillion is expected to be covered by corporate funds, leaving a significant financing gap of $1.5 trillion.

Sanctuary Wealth analysts predict that by the end of 2025, artificial intelligence will drive the S&P 500 up 11% to 7,000 points. New developments in industries like artificial intelligence will bring profit growth, and the technology sector will continue to drive U.S. stock market gains.

Beyond the traditional semiconductor and data center industries, AI's enormous power demands are also driving the electricity and energy-related sectors.

According to Bloomberg New Energy Finance data, by 2035, AI data centers will account for 8.6% of total U.S. electricity demand, significantly higher than the current 3.5%. The Trump administration is also actively advocating for nuclear power generation to support the explosive growth of the AI industry.