Please use a PC Browser to access Register-Tadawul

Twilio AEG Partnership Showcases Customer Data Platform As Stock Tests Valuation

Twilio, Inc. Class A TWLO | 113.14 | +1.96% |

- Twilio and AEG have entered a multi year partnership to use Twilio's customer data platform across key sports and entertainment properties.

- The collaboration covers Crypto.com Arena, the LA Kings, and the AXS ticketing platform, focusing on more personalized fan and attendee engagement.

- This agreement centers on real world deployments of Twilio's customer engagement tools in high profile live event settings.

Twilio, NYSE:TWLO, is aligning its customer data platform with one of the largest live entertainment operators, putting its tools in front of millions of fans. The company’s shares recently closed at $119.72, with a mixed return profile, including a 5.1% gain over the past year and a very large increase over 3 years, alongside a 66.3% decline over 5 years. Recent shorter term returns, including a 7.8% decline over the past week and a 15.5% decline over the past month, provide a cautious backdrop as this new partnership rolls out.

For investors watching NYSE:TWLO, this AEG deal offers a concrete example of how Twilio’s customer engagement tools can be used in large venues and ticketing platforms. The partnership may help the company show how its customer data platform works at scale across sports, concerts, and live events, which some investors use as a reference point when assessing how its technology fits into the broader entertainment and sports sector.

Stay updated on the most important news stories for Twilio by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on Twilio.

Quick Assessment

- ✅ Price vs Analyst Target: At US$119.72, Twilio trades below the US$145.77 analyst price target range midpoint.

- ✅ Simply Wall St Valuation: Simply Wall St flags the shares as trading close to estimated fair value.

- ❌ Recent Momentum: The stock has a 15.5% decline over the last 30 days, which signals weak short term momentum.

Check out Simply Wall St's in depth valuation analysis for Twilio.

Key Considerations

- 📊 The AEG partnership puts Twilio’s customer data platform in high traffic venues, which some investors may see as a proof point for real world usage.

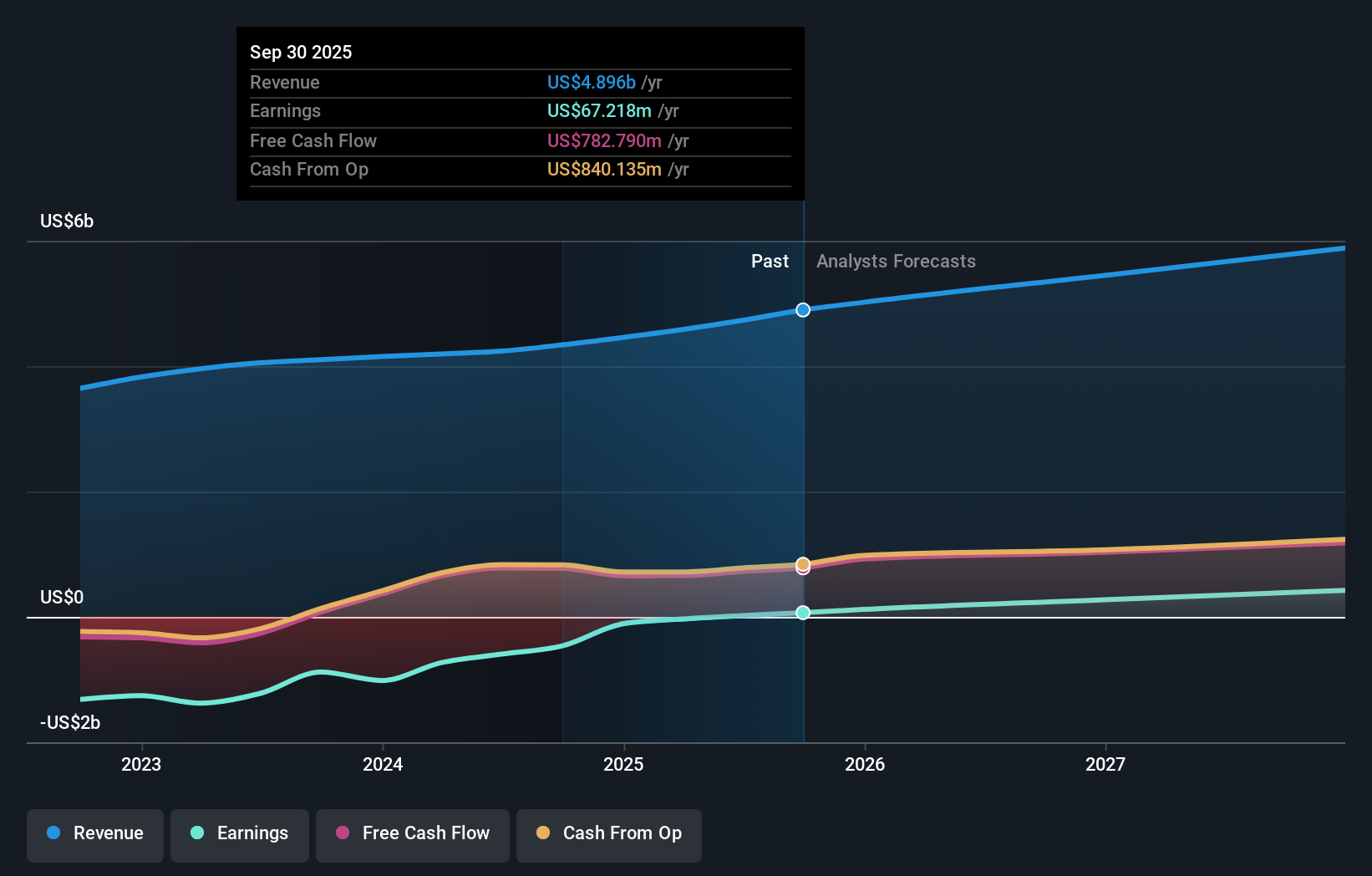

- 📊 Keep an eye on revenue and margin trends from customer engagement products, along with any disclosed metrics tied to ticketing or fan interaction campaigns.

- ⚠️ The 270x P/E versus an IT industry average of about 27x highlights sensitivity to any disappointment in execution or profitability.

Dig Deeper

For the full picture including more risks and rewards, check out the complete Twilio analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.