Please use a PC Browser to access Register-Tadawul

Twilio (TWLO) Is Up 5.7% After AI Launch Drives Record Free Cash Flow Is the Shift Sustainable?

Twilio, Inc. Class A TWLO | 113.14 | +1.96% |

- Twilio recently expanded its suite of offerings to include AI-powered communication solutions, fueling growth in its voice AI revenue and leading to record free cash flow.

- This innovation has drawn considerable interest from institutional investors, although insider selling activity has remained elevated over the past year.

- We'll now explore how Twilio's accelerated push into AI-powered communications could reshape the company's investment narrative and future outlook.

Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

Twilio Investment Narrative Recap

To be a Twilio shareholder, you generally need to believe that AI-powered communications will transform customer engagement, driving both sustainable revenue growth and improved profitability. The recent expansion into voice AI has supported free cash flow improvements and attracted institutional attention, but it does not materially change the current short-term catalyst: accelerating adoption of higher-margin software offerings to diversify away from low-margin messaging. The core risk remains Twilio’s ability to expand margins and compete against aggressive pricing in messaging and emerging AI solutions.

Among recent announcements, Twilio’s expanded partnership with Vodafone Spain to boost RCS messaging stands out, strengthening its position in omnichannel engagement. This move aligns with ongoing catalysts around product innovation and enterprise integration, which may help Twilio offset margin headwinds as AI-driven solutions evolve.

Yet, in contrast to these positive developments, persistent insider selling is information investors should be aware of...

Twilio's outlook anticipates $5.9 billion in revenue and $449.9 million in earnings by 2028. This projection is based on a 7.9% annual revenue growth rate and an earnings increase of $429.7 million from the current $20.2 million.

Uncover how Twilio's forecasts yield a $138.04 fair value, a 9% upside to its current price.

Exploring Other Perspectives

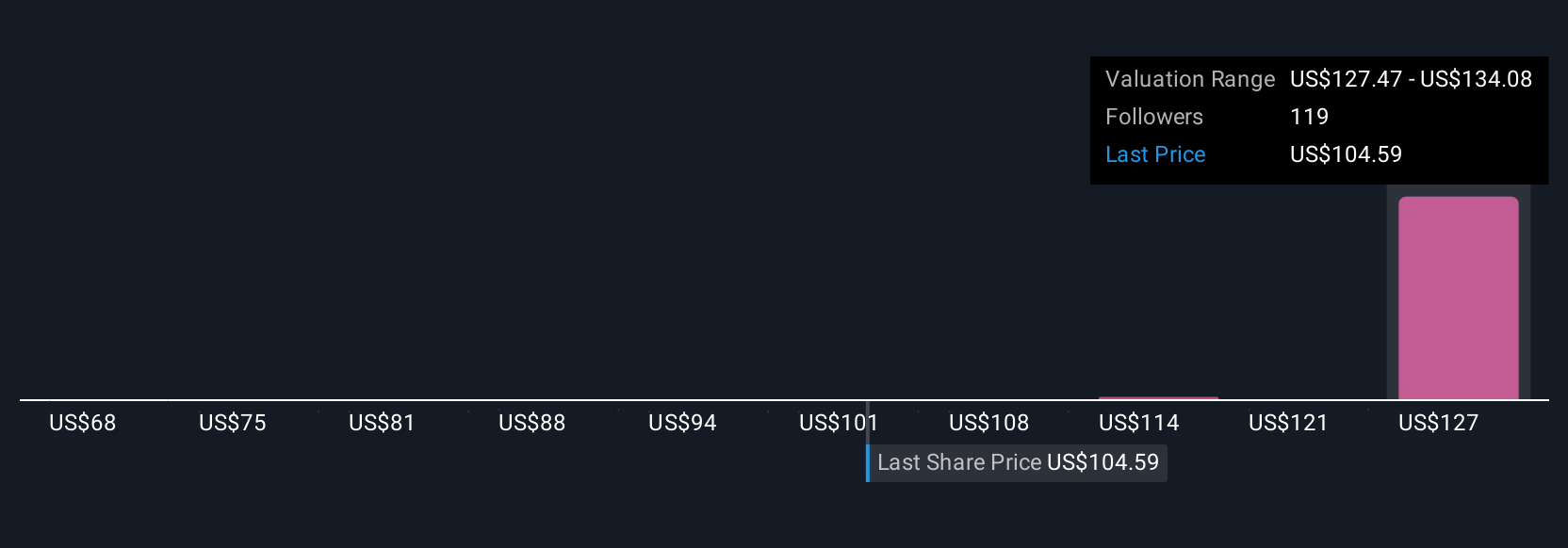

Simply Wall St Community members have set fair value estimates for Twilio between US$68 and US$138.04 based on 6 unique perspectives. While optimism about AI-powered growth is increasing, investors continue to weigh the risks of slower margin expansion and heightened competition when forming their own outlooks.

Explore 6 other fair value estimates on Twilio - why the stock might be worth 46% less than the current price!

Build Your Own Twilio Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Twilio research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Twilio research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Twilio's overall financial health at a glance.

Want Some Alternatives?

Our top stock finds are flying under the radar-for now. Get in early:

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.