Please use a PC Browser to access Register-Tadawul

Tyson Foods (TSN): Assessing Valuation as Share Price Trends Shift in Recent Months

Tyson Foods, Inc. Class A TSN | 58.19 | -2.25% |

Tyson Foods (TSN) shares have recently fluctuated, catching the attention of investors curious about the broader trends driving the food producer’s performance. As the stock market digests recent results, many are weighing Tyson’s potential upside.

Tyson’s share price has drifted slightly lower in recent months as investors weigh food industry demand and shifting consumer trends, with the stock currently at $54.42. While momentum has faded lately, Tyson’s five-year total shareholder return remains in positive territory, which highlights its resilience over the long run.

If you’re rethinking your watchlist in light of the latest moves in food producers, now is an ideal moment to broaden your search and discover fast growing stocks with high insider ownership

With shares now trading below analyst price targets and fundamentals pointing to steady earnings growth, the central question is whether Tyson Foods presents an undervalued opportunity or if the market already anticipates the company’s future gains.

Most Popular Narrative: 13.7% Undervalued

Tyson Foods' most followed narrative suggests a fair value that is notably higher than its recent close, indicating analysts see meaningful upside from here. The path to this valuation is built on powerful operating trends and strategic moves that set the company apart from its peers.

Momentum in prepared and value-added foods, driven by a robust innovation pipeline and product launches targeting convenience and protein-oriented lifestyles, is shifting the product mix toward higher-margin categories and is expected to improve net margins and top-line growth.

What’s sparking all the buzz? This narrative hinges on aggressive targets for revenue expansion and margin improvement, all while projecting Tyson’s future potential through a lens not commonly seen for major food producers. If you’re wondering what specific bold numbers and key assumptions are supporting this above-market price target, the details may surprise you.

Result: Fair Value of $63.09 (UNDERVALUED)

However, persistent cattle supply constraints and rising input cost inflation could quickly put pressure on margins. This may potentially challenge Tyson's path to meaningful earnings growth.

Another View: Looking at Valuation Ratios

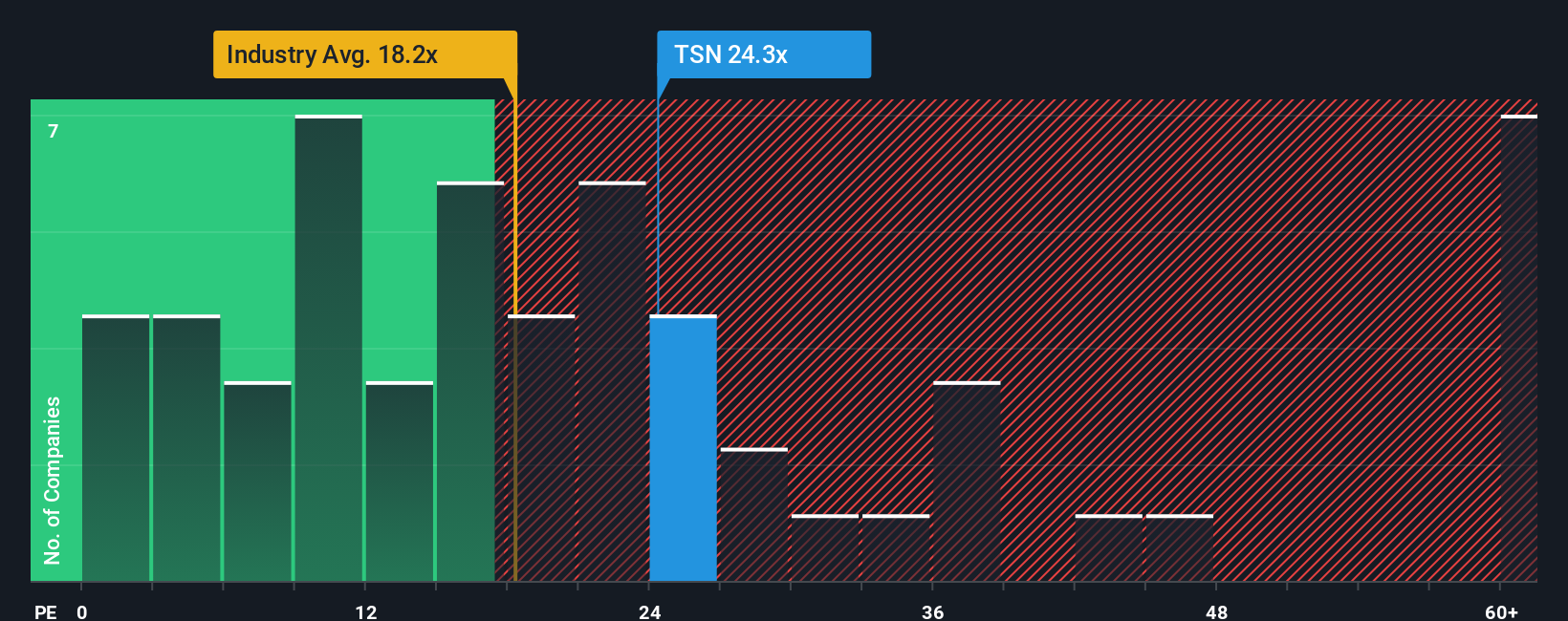

Taking a different approach, Tyson Foods is currently valued at a price-to-earnings ratio of 24.7x. This is higher than both the US Food industry average of 18x and its peer average of 18.1x. It sits below the estimated fair ratio of 32.7x. This higher multiple can signal market optimism, but it also raises the risk if expectations aren’t met. Will investors continue to pay a premium, or will sentiment shift with the next round of results?

Build Your Own Tyson Foods Narrative

If you’re not convinced by the mainstream narratives or simply want to dive deeper yourself, it takes just a few minutes to craft your own perspective. Do it your way.

A great starting point for your Tyson Foods research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t just stop with Tyson Foods. Give yourself the best shot at outperformance by scanning other game-changing opportunities available on the Simply Wall Street Screener.

- Tap into steady income streams by reviewing these 19 dividend stocks with yields > 3%, which offers yields above 3% and a track record of reliability.

- Accelerate your portfolio’s future with these 24 AI penny stocks, which are powering advancements in artificial intelligence and next-generation automation.

- Stay ahead of the curve by assessing these 907 undervalued stocks based on cash flows, which are poised for growth based on robust cash flow fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.