Please use a PC Browser to access Register-Tadawul

Tyson Foods (TSN) Is Up 8.6% After Raised Outlook and Xbox President Named to Board

Tyson Foods, Inc. Class A TSN | 59.91 59.91 | +0.59% 0.00% Pre |

- Earlier this week, Tyson Foods announced the appointment of Sarah Bond, President of Xbox at Microsoft, as a new independent director effective immediately, and reported third-quarter earnings with sales of US$13.88 billion, beating analyst expectations and raising its fiscal 2025 revenue outlook to 2–3% growth.

- Alongside these results, Tyson affirmed its quarterly dividend, expanded its share repurchase program, and reported a goodwill impairment of US$343 million, reflecting both a continued commitment to shareholder returns and ongoing challenges in its Beef segment.

- We’ll examine how robust chicken sales and a raised revenue forecast are shifting the outlook for Tyson Foods' investment narrative.

The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Tyson Foods Investment Narrative Recap

To be a Tyson Foods shareholder, you need to believe the company can leverage sustained consumer demand for protein and drive margin improvements, even as its Beef segment faces ongoing supply constraints and weak profits. The appointment of Sarah Bond as an independent director brings valuable outside expertise but does not materially change the near-term outlook, where the main catalyst remains the rebound in chicken sales and the biggest risk centers on persistent beef headwinds.

Among the latest announcements, Tyson’s raised guidance for 2025 revenue growth to 2–3% stands out, reflecting management’s confidence in its core operations despite margin pressures and a sizable goodwill impairment related to its Beef unit. This update is especially relevant as investors focus on top-line catalysts and the challenge of offsetting elevated raw material costs.

By contrast, investors should be aware that continued losses in the Beef segment might...

Tyson Foods' outlook anticipates $57.7 billion in revenue and $2.3 billion in earnings by 2028. This scenario assumes a 2.1% annual revenue growth and a $1.5 billion earnings increase from the current $784 million.

Uncover how Tyson Foods' forecasts yield a $63.25 fair value, a 11% upside to its current price.

Exploring Other Perspectives

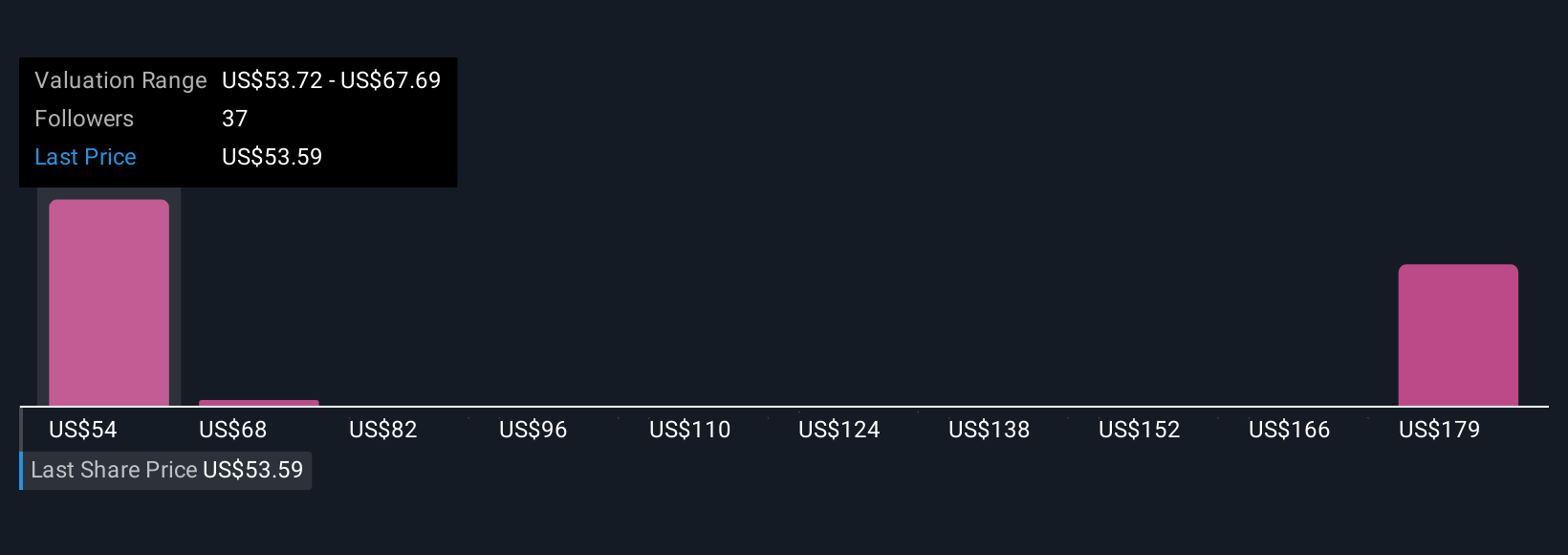

Simply Wall St Community members provided 9 fair value estimates for Tyson Foods, ranging from US$53.72 to US$165.69 per share. As higher costs and beef segment challenges remain critical factors, you can compare these differing opinions to your own view on the company’s future prospects.

Explore 9 other fair value estimates on Tyson Foods - why the stock might be worth over 2x more than the current price!

Build Your Own Tyson Foods Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Tyson Foods research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Tyson Foods research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Tyson Foods' overall financial health at a glance.

Ready For A Different Approach?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.