Please use a PC Browser to access Register-Tadawul

Tyson Foods (TSN) Valuation Check As Beef Losses Mount And Cattle Costs Stay Elevated

Tyson Foods, Inc. Class A TSN | 63.86 | -0.73% |

What Tyson’s beef losses and new bond issue mean for stock investors

Tyson Foods (TSN) is facing sustained pressure in its beef business, with consecutive quarterly losses tied to higher cattle costs and a smaller US herd, even as the company taps bond markets for fresh funding.

The recent bond issue, ongoing beef losses and a softer earnings quarter come against a backdrop where Tyson’s 90 day share price return of 19.16% and 1 year total shareholder return of 15.96% suggest momentum has been rebuilding from earlier weakness.

If this kind of volatility has you looking beyond traditional food producers, it could be a good moment to see what is happening across 23 top founder-led companies as another set of potential opportunities.

With Tyson shares up over the past year, trading around $63.94 and sitting at a reported 53.60% discount to an intrinsic value estimate, the key question is clear: is this genuine mispricing or is the market already baking in future growth?

Most Popular Narrative: 7.4% Undervalued

Tyson Foods’ most followed narrative pegs fair value at $69.08, slightly above the recent $63.94 share price, which puts the current beef losses and bond raise into a wider earnings story.

The company is capitalizing on strong, resilient consumer demand for protein across beef, pork, and chicken, with volume and dollar share gains in top brands such as Tyson, Hillshire Farm, and Jimmy Dean; this leverages growing global consumption of animal protein, and is expected to support sustained revenue growth and earnings expansion.

Curious how a low single digit margin business can still justify a higher fair value? The narrative leans on steadier profit margins, modest revenue growth and a future earnings multiple that needs to compress meaningfully from today’s level. The exact mix of these assumptions is where the real story sits.

Result: Fair Value of $69.08 (UNDERVALUED)

However, this depends on beef capacity changes and cattle supply risks not dragging on earnings for longer or forcing further write downs and margin pressure.

Another View: High P/E Tells A Different Story

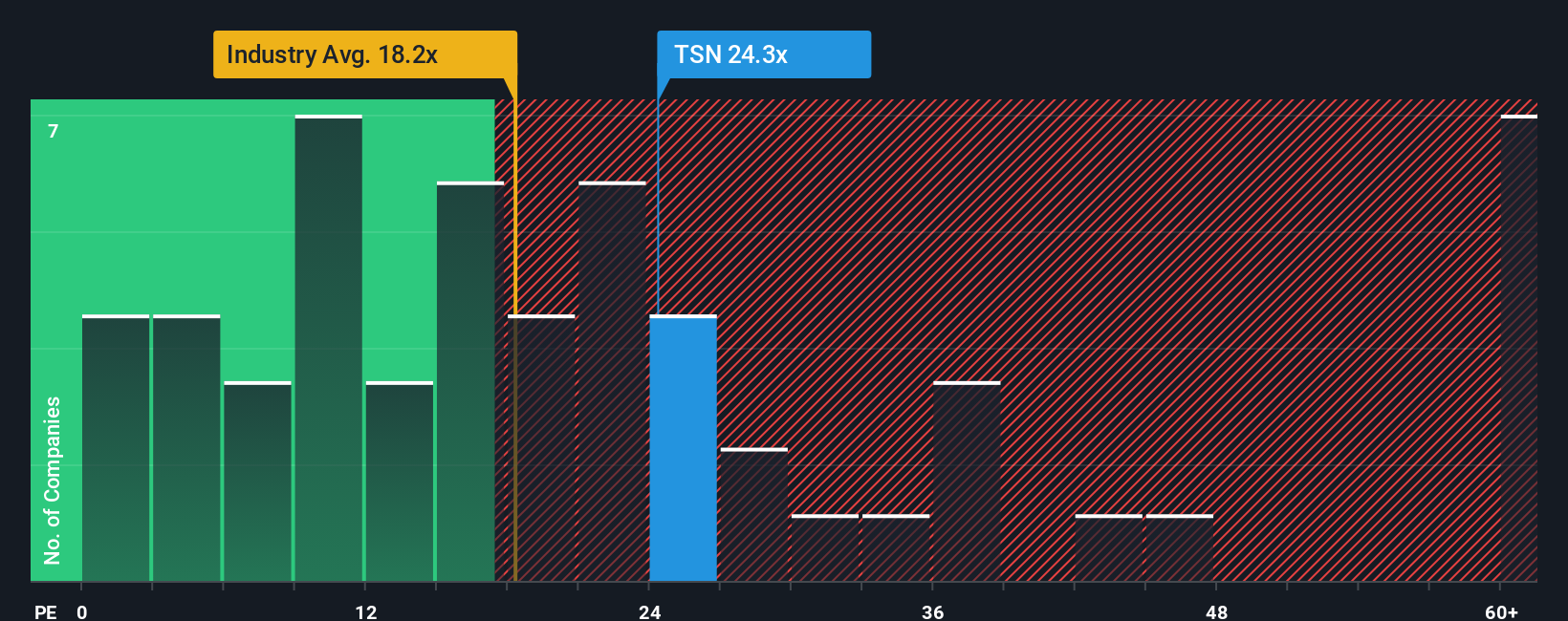

While our SWS model suggests Tyson looks undervalued on future cash flows, the current P/E of 112.6x is far above the US Food industry at 24.4x, the peer average at 17.6x, and even the fair ratio of 36.8x. This raises the question of whether this is a temporary mismatch or a sign expectations are already stretched.

Build Your Own Tyson Foods Narrative

If you look at Tyson’s data and come to a different conclusion, or simply prefer your own research, you can build a custom view in minutes, then Do it your way.

A great starting point for your Tyson Foods research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Tyson has you rethinking where your money works hardest, do not stop here. Widen your watchlist now so you are not late to the next opportunity.

- Target income first by scanning companies offering resilient payouts and higher yields with our list of 13 dividend fortresses that prioritize shareholder returns.

- Spot potential value early by checking screener containing 24 high quality undiscovered gems where strong fundamentals have not yet attracted broad attention.

- Build confidence in tougher markets by focusing on 83 resilient stocks with low risk scores that score well on stability and downside protection.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.