Uber Technologies, Inc.'s (NYSE:UBER) 30% Share Price Surge Not Quite Adding Up

Uber Technologies,Inc. UBER | 0.00 |

Uber Technologies, Inc. (NYSE:UBER) shareholders have had their patience rewarded with a 30% share price jump in the last month. Looking further back, the 22% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

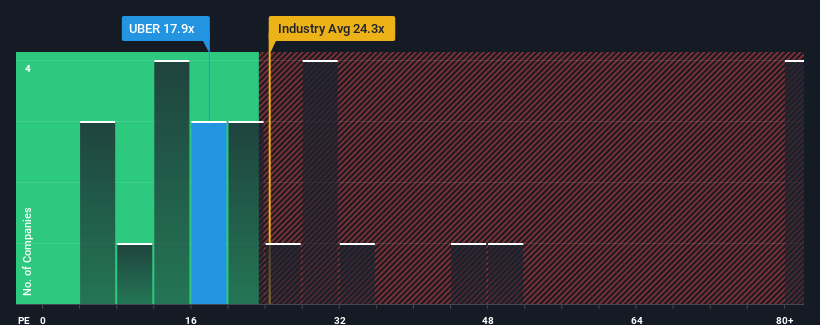

Even after such a large jump in price, you could still be forgiven for feeling indifferent about Uber Technologies' P/E ratio of 17.9x, since the median price-to-earnings (or "P/E") ratio in the United States is also close to 17x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Our free stock report includes 2 warning signs investors should be aware of before investing in Uber Technologies. Read for free now.Uber Technologies certainly has been doing a good job lately as it's been growing earnings more than most other companies. It might be that many expect the strong earnings performance to wane, which has kept the P/E from rising. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

How Is Uber Technologies' Growth Trending?

The only time you'd be comfortable seeing a P/E like Uber Technologies' is when the company's growth is tracking the market closely.

Retrospectively, the last year delivered an exceptional 408% gain to the company's bottom line. However, the latest three year period hasn't been as great in aggregate as it didn't manage to provide any growth at all. Therefore, it's fair to say that earnings growth has been inconsistent recently for the company.

Shifting to the future, estimates from the analysts covering the company suggest earnings growth is heading into negative territory, declining 4.1% per annum over the next three years. With the market predicted to deliver 10% growth per annum, that's a disappointing outcome.

With this information, we find it concerning that Uber Technologies is trading at a fairly similar P/E to the market. Apparently many investors in the company reject the analyst cohort's pessimism and aren't willing to let go of their stock right now. Only the boldest would assume these prices are sustainable as these declining earnings are likely to weigh on the share price eventually.

The Key Takeaway

Its shares have lifted substantially and now Uber Technologies' P/E is also back up to the market median. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

Our examination of Uber Technologies' analyst forecasts revealed that its outlook for shrinking earnings isn't impacting its P/E as much as we would have predicted. Right now we are uncomfortable with the P/E as the predicted future earnings are unlikely to support a more positive sentiment for long. Unless these conditions improve, it's challenging to accept these prices as being reasonable.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Recommend

- Sahm Platform 19/11 06:27

Stock Ratings | Loop Capital raised its target price for Alphabet (GOOG) stock to $320, while Stifel maintained its "buy" rating on Nvidia stock, raising its target price from $212 to $250.

Sahm Platform 19/11 07:20Fundbox and Wave Partner to Deliver Seamless, Data-Driven Access to Capital for Small Businesses

Reuters 19/11 14:00Uber, Shake Shack Launch Robot Deliveries In Chicago

Benzinga News 19/11 17:34Live On CNBC, Bryn Talkington Announces Sold Uber Technologies

Benzinga News 19/11 17:42Starship Technologies And Uber Technologies Announce Collaboration To Roll Out Autonomous Sidewalk Robot Delivery Across Multiple Markets; First Deployment Before The End Of The Year In The UK; Multiple European Countries In 2026; U.S. Expansion B...

Benzinga News 20/11 15:04Ross Gerber Praises Tesla FSD V14 Improvements: Piper Sandler Analyst Predicts Over 25% Upside For TSLA Stock

Benzinga News Today 05:34Tesla To Expand Rental Program Across Multiple US Cities With Unlimited Miles, Free Supercharging From $60/Day

Benzinga News Today 07:52