Please use a PC Browser to access Register-Tadawul

UFC Vietnam Deal Tests TKO Growth Story And Rich Valuation

TKO Group Holdings, Inc. Class A TKO | 211.12 | +1.17% |

- UFC has signed a multi year exclusive media rights agreement with FPT Play to broadcast UFC events in Vietnam.

- The deal gives FPT Play exclusive rights to distribute UFC content to viewers across Vietnam.

For TKO Group Holdings (NYSE:TKO), which owns UFC, this agreement adds another piece to its international media footprint. UFC already has a global fan base, and Vietnam is a market with growing interest in combat sports and digital streaming. Partnering with an exclusive local distributor can help TKO align UFC content with how viewers in Vietnam already consume sports and entertainment.

For investors, the key angle is that this type of country specific media deal can open up new ways to monetize existing UFC content. Over time, agreements like this can affect how you think about TKO's geographic mix of media exposure, its reach in Asia, and the role of local partners in expanding UFC's audience.

Stay updated on the most important news stories for TKO Group Holdings by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on TKO Group Holdings.

Quick Assessment

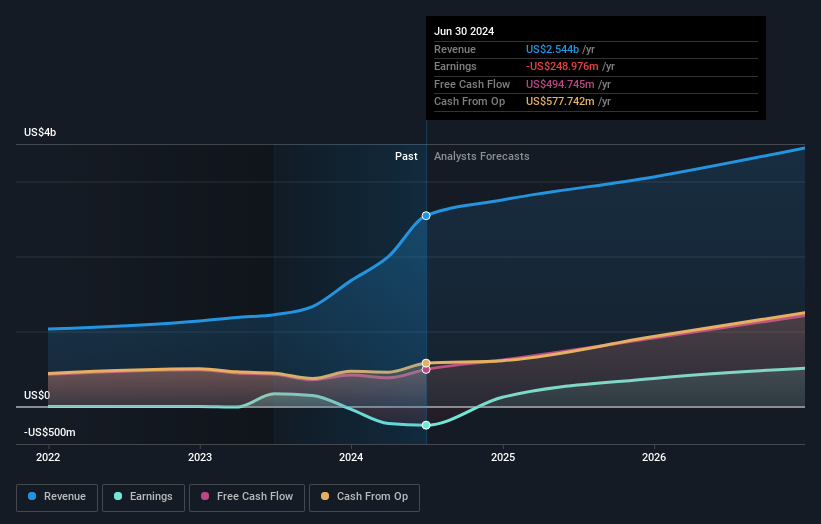

- ❌ Price vs Analyst Target: At US$204.91, TKO trades about 9.8% below the US$227.32 analyst target, with estimates spanning US$171 to US$251.

- ❌ Simply Wall St Valuation: Shares are described as trading 26.7% above estimated fair value, which points to an overvalued status.

- ❌ Recent Momentum: The 30 day return is about a 5.8% decline, which flags weak short term momentum.

Check out Simply Wall St's in depth valuation analysis for TKO Group Holdings.

Key Considerations

- 📊 The Vietnam media rights deal extends UFC’s reach into a new market using existing content, which can support TKO’s international media footprint.

- 📊 It may be useful to watch how this and similar agreements influence media revenue mix, margins in Entertainment, and whether the current P/E of 70.69 moves closer to the industry average of 21.07.

- ⚠️ One flagged risk is that large one off items can impact reported results, so it is worth separating underlying earnings quality from headline numbers when assessing the impact of new deals.

Dig Deeper

For the full picture including more risks and rewards, check out the complete TKO Group Holdings analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.