Please use a PC Browser to access Register-Tadawul

UGI (UGI): Assessing Valuation After Pennsylvania Approves New Natural Gas Rate Settlement and Customer Initiatives

UGI Corporation UGI | 38.05 | -0.37% |

Most Popular Narrative: 15.2% Undervalued

According to the narrative favored by most analysts, UGI is currently trading well below its estimated fair value. This perspective sees the stock as presenting a notable upside based on projected future performance and discounted cash flow.

Strategic investments in renewable natural gas (RNG) projects, bonus depreciation potential, and stronger regulatory incentives through recent legislation (such as the One Big Beautiful Bill Act) are expected to drive long-term EBITDA growth and improve net margins. Increased activity and demand for distributed energy solutions and on-site LNG/LPG infrastructure in key markets like Pennsylvania create robust medium-term growth opportunities, expanding both the addressable customer base and stabilized cash flows.

Curious how much future growth can move the needle for a utility stock? The analyst narrative hints at ambitious operational shifts and regulatory tailwinds that could change everything for UGI. Want a glimpse of the bold assumptions driving this sharply higher fair value? The details might surprise you.

Result: Fair Value of $41.00 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent declines in LPG demand overseas or accelerated customer attrition in AmeriGas could put a damper on the bullish outlook for UGI.

Find out about the key risks to this UGI narrative.Another View: Industry Pricing Comparison

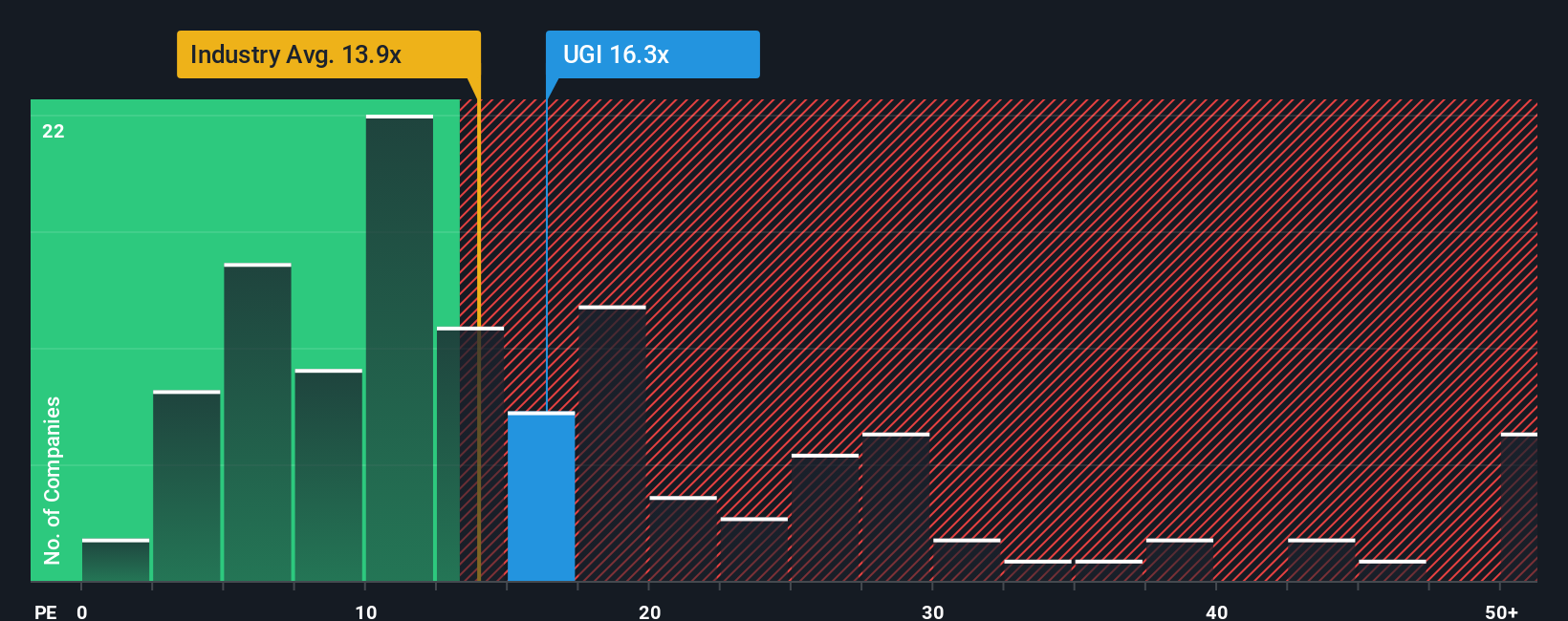

Looking at UGI’s price compared to others in its global industry tells a slightly different story. By this comparison, the shares appear expensive, as the company trades higher than many peers. Is the optimism fully justified, or does risk now outweigh reward?

Build Your Own UGI Narrative

If you see UGI’s story differently, or want to dig deeper on your own, you can create your own take with just a few clicks. Do it your way

A great starting point for your UGI research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Take your investing up a notch with tailored ideas that fit your goals. Don’t let the next big opportunity pass you by. See what else is gaining momentum right now.

- Spot growing potential with high-yield companies packed with steady returns using the filter for dividend stocks with yields > 3%.

- Tap into groundbreaking advancements in artificial intelligence and let the innovation leaders inspire your next move with AI penny stocks.

- Zero in on undervalued gems poised for recovery and find those rare bargains hiding in plain sight through undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.