Please use a PC Browser to access Register-Tadawul

UiPath (PATH) Deepens AI Alliances: Is Its Automation Platform Gaining an Unassailable Edge?

UiPath, Inc. PATH | 17.42 | -3.38% |

- Earlier this week, UiPath announced new collaborations with leading AI companies such as Nvidia, OpenAI, Snowflake, and Microsoft Azure, alongside unveiling its latest product enhancements at the Fusion conference. These initiatives reflect UiPath’s emphasis on integrating generative AI capabilities into its automation platform, positioning it at the forefront of enterprise productivity technology.

- We'll assess how UiPath's expanded AI partnerships may reinforce its position as an essential automation and AI integration platform.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

UiPath Investment Narrative Recap

To be a shareholder in UiPath, you have to believe in the accelerating need for enterprise automation powered by AI, and that partnerships with major players like Nvidia and OpenAI reinforce its role at the core of this trend. While these collaborations are promising and generated a surge in investor interest, the most important near-term catalyst for UiPath remains clear revenue and ARR growth, which could still be challenged by slow deal closures and cautious customer budgets; so far, the news does not materially change short-term risks. One particularly relevant announcement is UiPath’s deepened collaboration with OpenAI, including a new ChatGPT connector designed to simplify AI agent deployment for enterprises. This integration could directly address adoption friction and improve the commercial appeal of UiPath’s automation suite, supporting the company’s aim to become a leading AI and automation platform. Yet, despite upbeat product news, investors should be mindful that...

UiPath's outlook projects $1.9 billion in revenue and $243.6 million in earnings by 2028. This requires 8.6% annual revenue growth and a $311.1 million increase in earnings from the current -$67.5 million.

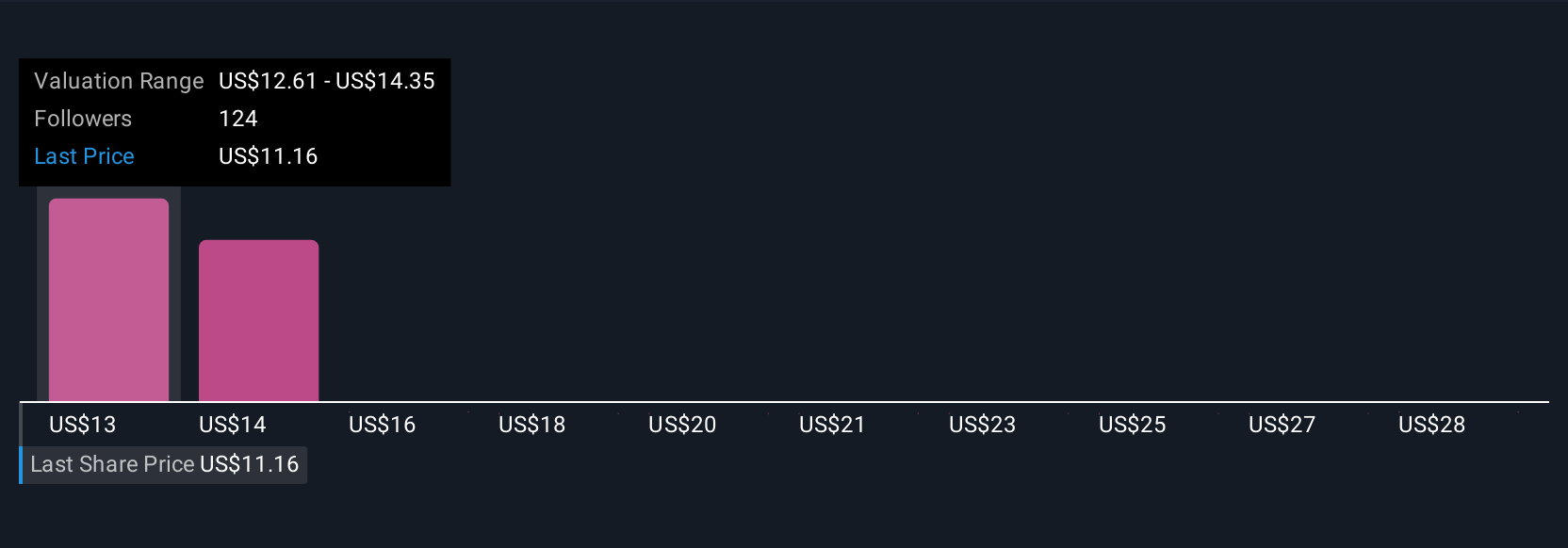

Uncover how UiPath's forecasts yield a $13.71 fair value, a 17% downside to its current price.

Exploring Other Perspectives

Simply Wall St Community members set UiPath’s fair value between US$13.05 and US$30 across 13 estimates, from conservative to bullish. Amid this spectrum, ongoing uncertainty in customer budgets remains a key consideration for future performance, explore these contrasting viewpoints to inform your own analysis.

Explore 13 other fair value estimates on UiPath - why the stock might be worth as much as 82% more than the current price!

Build Your Own UiPath Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your UiPath research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free UiPath research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate UiPath's overall financial health at a glance.

Curious About Other Options?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.