Please use a PC Browser to access Register-Tadawul

Ultra Clean Holdings (UCTT) Valuation Check After AI Linked Stock Surge And Small Cap Outperformance

Ultra Clean Holdings, Inc. UCTT | 59.15 | +2.91% |

Ultra Clean Holdings (UCTT) has quickly moved onto investors’ radar after a 27.89% jump last week to a 52 week high of $46, following TSMC’s plans to ramp up AI and high performance chip spending.

That sharp move around TSMC’s AI spending plans sits on top of a strong 30 day share price return of 67.01% and a 59.19% year to date share price gain. The 1 year total shareholder return of 17.67% and 3 year total shareholder return of 30.29% point to building but recently volatile momentum around Ultra Clean’s role in semiconductor manufacturing for AI and high performance computing.

If you are tracking how AI related demand is reshaping the sector, it could be a good moment to widen your watchlist with high growth tech and AI stocks.

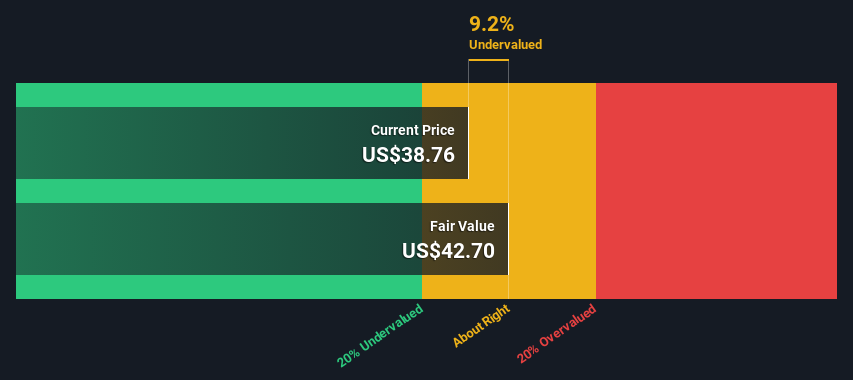

With UCTT now above its analyst price target and recent gains already steep, the key question is whether the stock still trades at a discount to its fundamentals or if the market is already pricing in future growth.

Most Popular Narrative: 12.2% Overvalued

Ultra Clean Holdings closed at $43.49, compared to a widely followed fair value estimate of about $38.75. This frames the recent rally against a slightly lower narrative valuation anchored on discounted future cash flows at an 11.95% rate.

Ongoing organizational flattening, cost reduction initiatives, and factory/site consolidation are producing tangible decreases in OpEx, with further improvements expected by Q4, providing sustainable margin enhancement as industry volumes recover.

Progress in vertical integration, particularly the Fluid Solutions business unit, along with deployment of company wide SAP systems, is set to improve operational efficiency and streamline customer engagement, driving higher margin mix and improved earnings beginning in early 2026.

Curious how cost cuts, margin rebuild and future earnings expectations connect to that fair value gap? The key assumptions behind this narrative might surprise you.

Result: Fair Value of $38.75 (OVERVALUED)

However, there are still clear pressure points, including high reliance on a few large customers and ongoing tariff related costs that could quickly challenge this upbeat earnings story.

Another View: Market Multiple Sends a Different Signal

Our DCF model suggests a fair value of about $19.49 per share, which is well below the current $43.49 price and flags Ultra Clean Holdings as overvalued on this cash flow view. That sits against the earlier 12.2% overvaluation narrative and raises a simple question: which story do you trust more?

Build Your Own Ultra Clean Holdings Narrative

If this setup does not quite match your view, or you would rather work directly with the numbers and assumptions yourself, you can build a custom thesis in just a few minutes with Do it your way.

A great starting point for your Ultra Clean Holdings research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If you stop at just one company, you could miss out on opportunities that better match your goals, risk comfort and time horizon across different corners of the market.

- Spot potential turnaround stories early by scanning these 3523 penny stocks with strong financials that already show solid financial foundations rather than only eye catching price swings.

- Target the intersection of AI and growth by focusing on these 23 AI penny stocks that tie real business models to artificial intelligence tailwinds.

- Hunt for price gaps by reviewing these 872 undervalued stocks based on cash flows where current market prices differ from cash flow based assessments.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.