Please use a PC Browser to access Register-Tadawul

Unearthing 3 Undiscovered Gems in the US Market

Investors Title Company ITIC | 250.86 | -0.40% |

As the U.S. stock market experiences fluctuations with the S&P 500 retreating from record highs and mixed performances across major indices, investors are keenly observing economic indicators that suggest resilience amidst ongoing tariff concerns. In this dynamic environment, identifying promising opportunities often involves looking beyond well-known names to uncover stocks that exhibit strong fundamentals and potential for growth despite broader market sentiment.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Oakworth Capital | 42.08% | 15.43% | 7.31% | ★★★★★★ |

| Morris State Bancshares | 9.62% | 4.26% | 5.10% | ★★★★★★ |

| Wilson Bank Holding | 0.00% | 7.88% | 8.09% | ★★★★★★ |

| Senstar Technologies | NA | -20.82% | 14.32% | ★★★★★★ |

| Metalpha Technology Holding | NA | 81.88% | -4.97% | ★★★★★★ |

| Valhi | 43.01% | 1.55% | -2.64% | ★★★★★☆ |

| FRMO | 0.09% | 44.64% | 49.91% | ★★★★★☆ |

| Gulf Island Fabrication | 19.65% | -2.17% | 42.26% | ★★★★★☆ |

| Pure Cycle | 5.02% | 4.35% | -2.25% | ★★★★★☆ |

| Reitar Logtech Holdings | 31.39% | 231.46% | 41.38% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

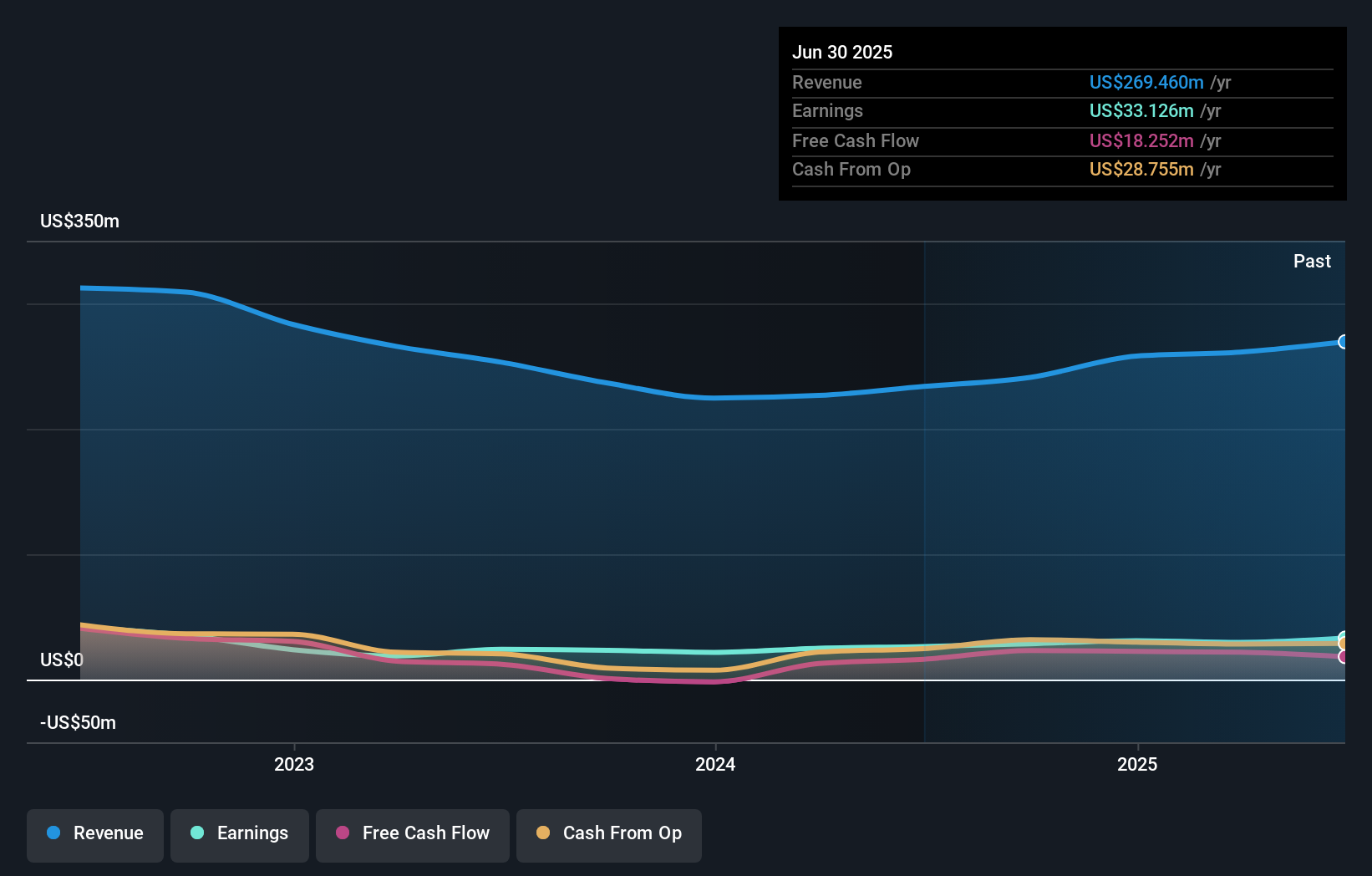

Investors Title (ITIC)

Simply Wall St Value Rating: ★★★★★★

Overview: Investors Title Company specializes in providing title insurance for various property types, including residential and commercial, with a market cap of $383.48 million.

Operations: The primary revenue stream for Investors Title Company is title insurance, generating $258.58 million. Exchange services contribute an additional $11.29 million in revenue. The company's net profit margin reflects its financial efficiency and profitability over recent periods.

Investors Title, a nimble player in the insurance sector, showcases a robust financial profile with no debt over the past five years and high-quality earnings. Despite an 18.7% growth in earnings last year surpassing industry averages, its net income for Q1 2025 was US$3.17 million, down from US$4.53 million the previous year. Trading at about 30% below its estimated fair value suggests potential upside for investors seeking undervalued opportunities in this space. Recent board changes and a declared dividend of $0.46 per share reflect ongoing corporate governance and shareholder returns focus amidst fluctuating earnings trends.

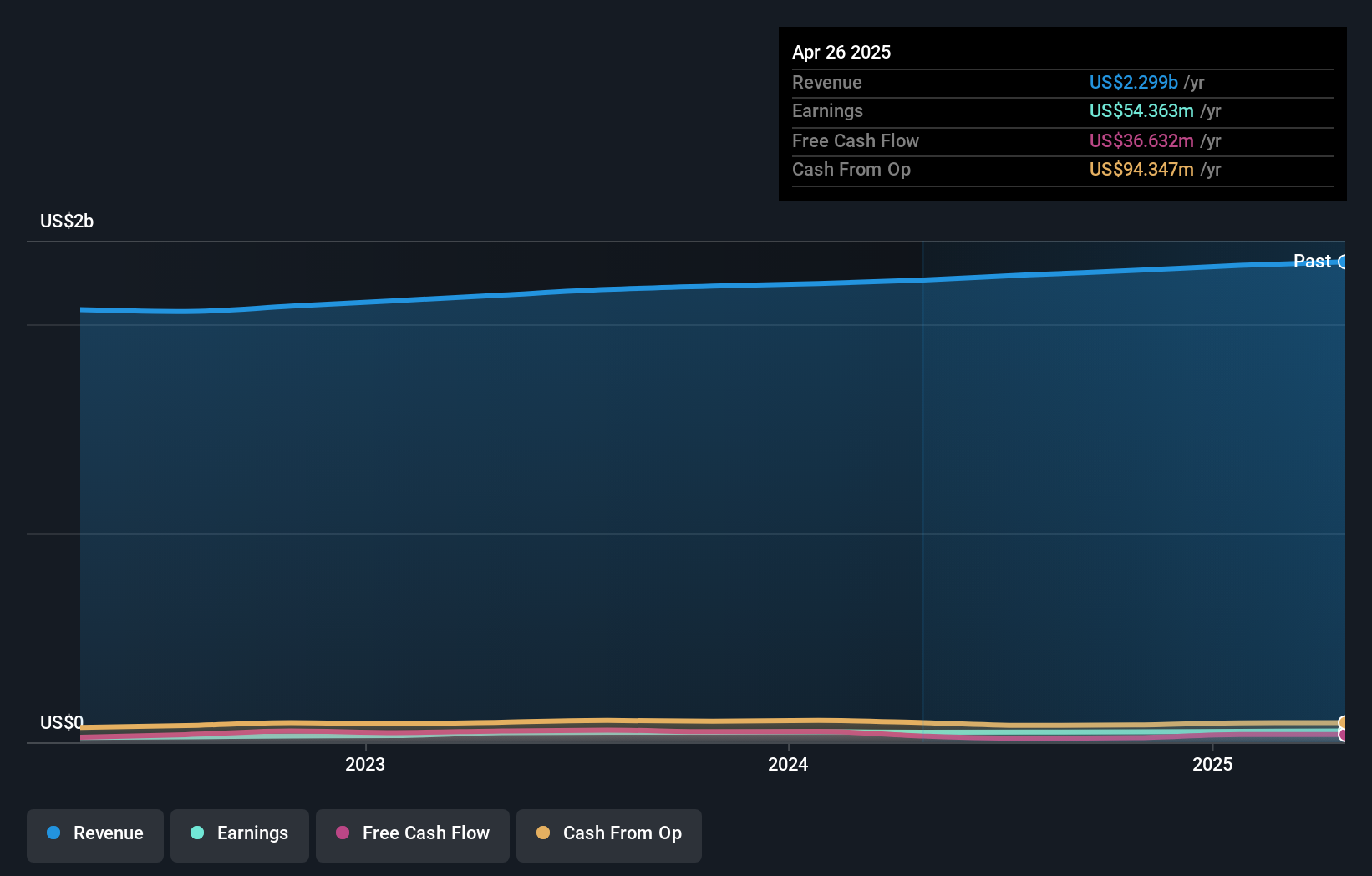

Village Super Market (VLGE.A)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Village Super Market, Inc. operates a chain of supermarkets in the United States with a market cap of $549.07 million.

Operations: The company's primary revenue stream is the retail sale of food and nonfood products, generating $2.30 billion.

Village Super Market is making waves with its recent performance, showcasing a 12.2% earnings growth over the past year, outpacing the Consumer Retailing industry's 7.4%. Trading at 25.8% below its estimated fair value, it seems undervalued in today's market. Despite significant insider selling recently, the company is on solid financial ground with more cash than debt and a debt to equity ratio that increased from 2.4 to 12.8 over five years. Its high-quality earnings are reflected in robust sales figures of US$563 million for Q3 and net income rising to US$11 million from US$9 million last year.

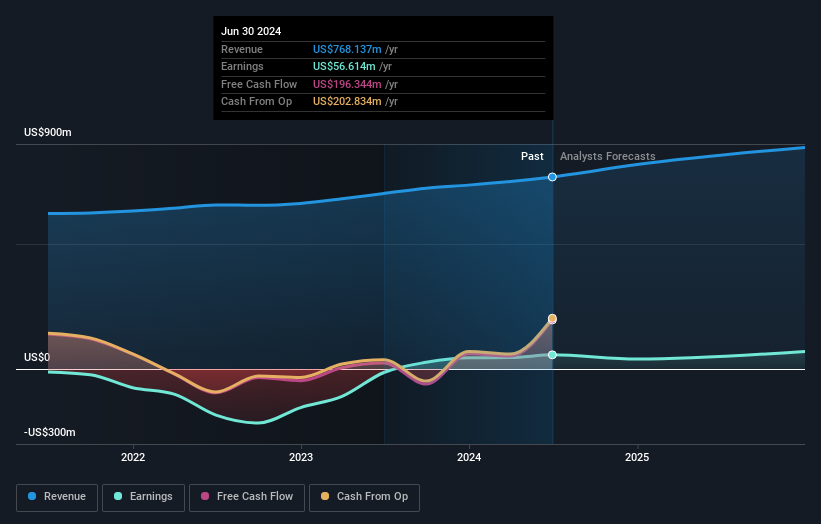

Heritage Insurance Holdings (HRTG)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Heritage Insurance Holdings, Inc. operates through its subsidiaries to offer personal and commercial residential insurance products, with a market capitalization of $641.81 million.

Operations: Heritage Insurance Holdings generates revenue primarily from its property and casualty insurance segment, which reported $837.20 million. The company's financial performance is influenced by the net profit margin, which has shown variability over recent periods.

Heritage Insurance Holdings, a nimble player in the insurance sector, has shown impressive earnings growth of 70.9% over the past year, outpacing the industry's 8.1%. The company trades at 44% below its estimated fair value and maintains an EBIT coverage of interest payments at a robust 10.8 times. Despite an increase in its debt-to-equity ratio from 28% to 28.8% over five years, Heritage remains financially sound with more cash than total debt and positive free cash flow. Recent additions to multiple Russell indices highlight its growing recognition in the market landscape.

Taking Advantage

- Investigate our full lineup of 279 US Undiscovered Gems With Strong Fundamentals right here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.