Please use a PC Browser to access Register-Tadawul

United Bankshares UBSI Margin Strength And 20.2% Earnings Growth Reinforce Bullish Narratives

United Bankshares, Inc. UBSI | 44.28 | +0.48% |

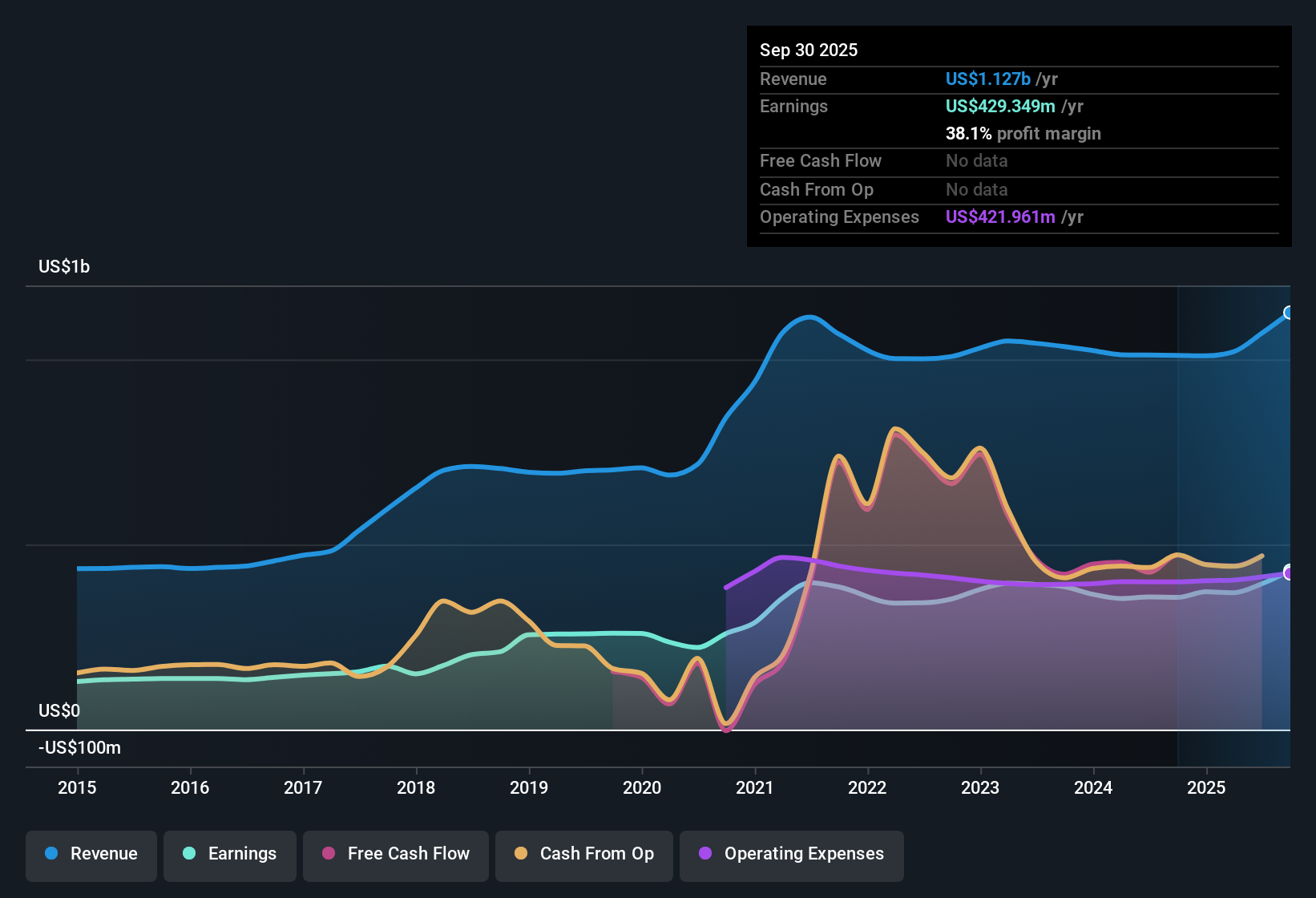

United Bankshares (UBSI) has just closed out FY 2025 with fourth quarter revenue of US$311.6 million and basic EPS of US$0.92, alongside trailing twelve month revenue of about US$1.2 billion and EPS of US$3.28, setting the tone for how investors assess the latest numbers. The company has seen quarterly revenue move from US$255.2 million in Q4 2024 to US$311.6 million in Q4 2025, while basic EPS shifted from US$0.70 to US$0.92 over the same period, giving you a clear view of how the top and bottom line are tracking into the new year.

See our full analysis for United Bankshares.With the headline figures on the table, the next step is to see how these results line up with the widely followed growth and income narratives around United Bankshares and where the earnings quality story might be challenged or reinforced.

20.2% earnings growth backed by higher margins

- Over the last 12 months, United Bankshares earned US$464.6 million on US$1.2b of revenue, with net profit margin at 38.1% compared with 35.3% in the prior year and earnings up 20.2% year over year.

- What stands out for the bullish view is that this margin strength lines up with the description of high quality earnings, yet it is paired with only moderate forecast growth of about 6.3% a year for earnings and 6.9% a year for revenue.

- This combination of 38.1% net margin and 20.2% earnings growth backs the bullish argument that the current profit level is not just a one off spike but has some depth behind it.

- At the same time, the more modest 6.3% and 6.9% annual growth forecasts set a different tone from the trailing figures and give bulls less support if they are looking for a repeat of last year’s pace.

Loan book growth with higher non performing balances

- Total loans in the quarterly data moved from US$21,680.5 million in Q4 2024 to US$24,531.2 million in Q3 2025, while reported non performing loans in that same comparison went from US$73.4 million to US$116.9 million.

- Critics focused on a cautious angle could point out that while the bank is working with a larger loan book, the increase in non performing balances sits uncomfortably next to the strong 38.1% net margin over the last year.

- The higher non performing loans in Q3 2025 contrast with the attractive net margin and 20.2% earnings growth, which a bearish reader might view as a reminder that credit quality still matters even when profitability looks strong.

- On the flip side, the fact that non performing loans moved around between US$65.2 million and US$116.9 million across the periods provided shows that credit costs are an active part of the story rather than a static risk.

Valuation gap versus DCF fair value and peers

- With the share price at US$42.75, the trailing P/E is about 14x compared with 12.1x for the US banks industry and 15.6x for peers, and an internal DCF fair value of US$60.88 suggests the shares are about 29.8% below that model’s estimate.

- What is interesting for bullish thinkers is how this mixed valuation picture intersects with the 3.56% dividend yield and the past year’s 20.2% earnings growth, and whether the discount to the DCF fair value or the premium to the wider industry carries more weight.

- The 14x P/E being above the 12.1x industry level fits with the idea that the market is willing to pay up somewhat for a bank with a 38.1% net margin and a dividend, even though earnings growth is only forecast at about 6.3% a year.

- At the same time, trading below the US$60.88 DCF fair value and below the 15.6x peer P/E leaves room for bulls to argue that the current pricing does not fully reflect the recent profitability metrics.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on United Bankshares's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

For all the strong margins and recent earnings, United Bankshares still combines higher non performing loans with only moderate forecast growth and an ongoing valuation debate.

If that mix leaves you wanting cleaner credit trends and steadier progress, use our stable growth stocks screener (2173 results) to focus on companies with more consistent earnings momentum and fewer balance sheet distractions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.