Please use a PC Browser to access Register-Tadawul

UnitedHealth Group (NYSE:UNH) Announces US$2.10 Per Share Dividend For March Payout

UnitedHealth Group Incorporated UNH | 341.84 | +1.52% |

UnitedHealth Group (NYSE:UNH) recently experienced a price move of 11.84% over the past week, amid the broader market trend where the S&P 500 and Nasdaq have both declined sharply due to investor concerns about economic outlooks and the impact of recent policies. The company's board affirmed its quarterly dividend of $2.10 per share, maintaining its commitment to shareholder returns, yet this appears not to have curbed negative sentiment. While UnitedHealth wasn't in the tech-heavy indexes, its performance aligns with a market facing overall declines of 3% over the same period, alongside decreasing consumer confidence. The healthcare sector's defensive reputation might not have fully shielded UNH from the market's current volatility. Despite this, the confirmed dividend underscores a steady approach to returning value to shareholders even as stock performance fluctuates.

Over the last five years, UnitedHealth Group has delivered a total shareholder return of 81.87%, a period marked by various corporate developments and strategic moves. Despite a challenging year where the company underperformed relative to the healthcare sector's benchmark, these longer-term gains reflect resilient growth strategies, sound financial management, and a focus on shareholder value. Notably, the company maintained its dividend payments with regular affirmations, reinforcing investor confidence.

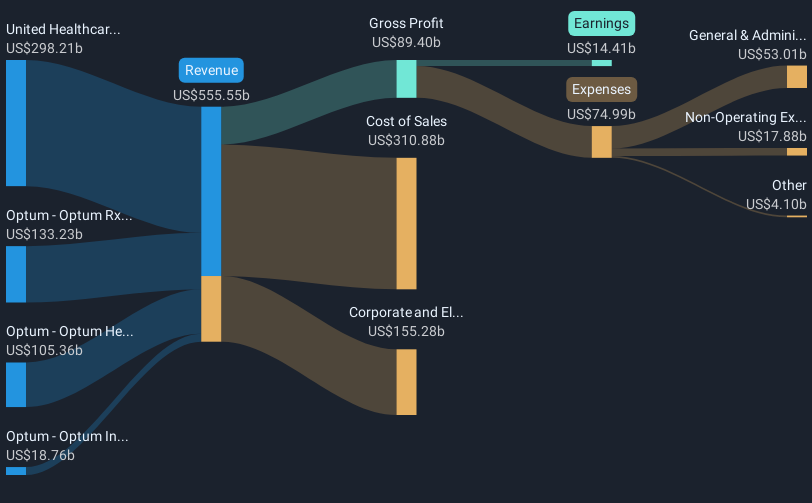

Significant earnings reports showed steady revenue streams, with Q4 2024 bringing in US$100.81 billion, alongside pivotal executive shifts such as Tim Noel's promotion to CEO of UnitedHealthcare. Such leadership changes underscore the company's adaptability and continuity in strategy. Additionally, the partnership with Goodwill Industries to expand workforce development initiatives illuminates a broader focus on holistic growth beyond core operations, potentially supporting the overall positive return observed over the past half-decade.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.