Please use a PC Browser to access Register-Tadawul

UnitedHealth Group (UNH): Reassessing Valuation as 78% of Medicare Advantage Plans Earn Top Ratings and Guidance Restated

UnitedHealth Group Incorporated UNH | 331.75 | -2.74% |

If you find yourself second-guessing your next move with UnitedHealth Group stock, that is perfectly understandable. The company just announced that 78% of its Medicare Advantage members are projected to be enrolled in plans eligible for federal bonus payments, based on preliminary Medicare rating data. For investors, this development targets the core of UnitedHealth Group's profits and signals a reassuring direction after periods of headline-grabbing regulatory and operational questions.

This was not an isolated headline. Over the past month, the stock soared nearly 16%, which is a striking gain given the backdrop of regulatory investigations and some misses on quarterly earnings. Confidence got another boost as management reaffirmed earnings expectations in recent shareholder and analyst calls, emphasizing ongoing dividend strength and future growth strategies. Still, despite this rebound, UnitedHealth Group lags behind its long-term averages, a reminder that last year's sell-off and ongoing risk have not faded from memory.

So, after this sharp move higher and a management team seeking to restore investor trust, is UnitedHealth Group a recovering stock trading at a bargain, or is the market already pricing in all the good news?

Most Popular Narrative: 5.7% Overvalued

The latest consensus narrative suggests that UnitedHealth Group is trading above what analysts consider a fair value. Fresh earnings visibility and confidence in future margin recovery are playing key roles in shaping this view.

Positive reiteration of 2025 earnings guidance, including the effects of the Amedisys deal, as well as renewed confidence in multi-year margin recovery, supported multiple upward price target adjustments and a strengthening investment thesis.

Want to see what bold projections are fueling this price? This narrative is built on robust revenue growth, tighter margins, and a future profit multiple that diverges from tradition. Curious what analysts are betting on for UnitedHealth’s next five years? Dive into the details for the full financial blueprint.

Result: Fair Value of $333.42 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, risks remain, as ongoing regulatory investigations or further volatility in Medicare plans could quickly undermine analysts’ optimism and shift sentiment once again.

Find out about the key risks to this UnitedHealth Group narrative.Another View: What Does Our DCF Model Say?

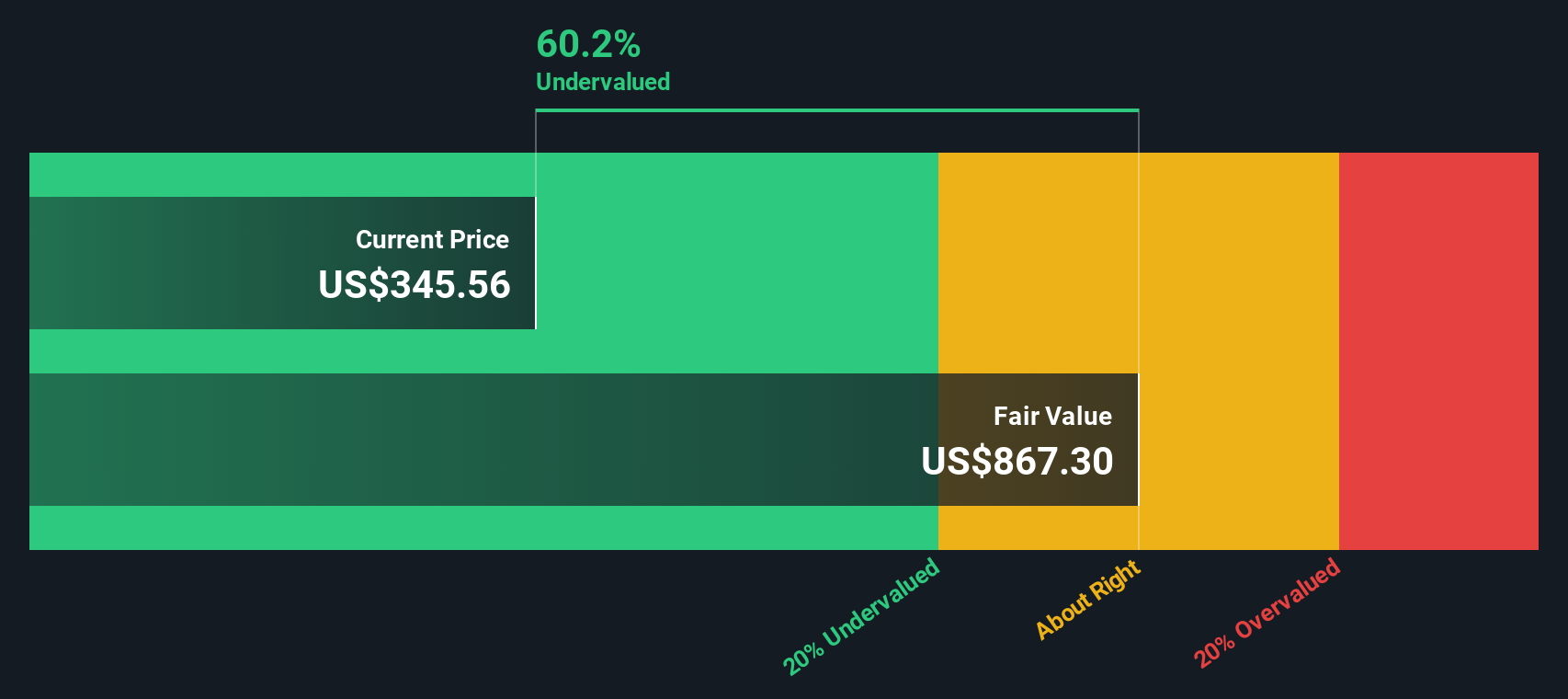

Taking a different approach, our DCF model paints a much more optimistic picture compared to analyst targets. This suggests UnitedHealth Group could be significantly undervalued right now. So, which forecast will prove correct as events unfold?

Build Your Own UnitedHealth Group Narrative

If these perspectives do not fully capture your outlook, or if you prefer forming your own conclusions, you can quickly build a personalized view from the ground up in just a few minutes. Do it your way

A great starting point for your UnitedHealth Group research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Ideas?

Do not let your strategy stop here. There are compelling opportunities across the market just waiting for savvy investors like you to take notice. Broaden your search and get an edge today.

- Accelerate your growth journey by spotting emerging innovators leading artificial intelligence breakthroughs with AI penny stocks.

- Power up your portfolio with companies paying reliable, high yields by checking out dividend stocks with yields > 3%.

- Seize undervalued opportunities before the crowd by searching for stocks trading below their true potential with undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.