Please use a PC Browser to access Register-Tadawul

Unity Software (NYSE:U): Taking Stock of Valuation as Share Price Stays Rangebound

Unity Software Inc. U | 46.16 | -6.24% |

Unity’s share price has moved sideways for much of the year, and recent headlines have not sparked any major momentum shift. While excitement around the company’s future remains, the 1-year total shareholder return of just 0.89% points to muted long-term gains even as the broader software sector evolves rapidly.

If you’re keeping an eye on software and tech disruptors, this is a good opportunity to see what’s happening across the high-growth tech and AI landscape. See the full list for free.

With shares trading near recent lows and a modest total return, some investors are now asking whether Unity is undervalued or if the company’s growth prospects are already fully reflected in its stock price.

Most Popular Narrative: 1.6% Overvalued

The fair value estimate in the most-followed narrative is $38.48, just below the current share price of $39.10. This suggests Unity might be slightly ahead of where the narrative’s long-term assumptions would place it. The context is that those assumptions are bold and focus on Unity’s future market opportunities and operating improvements.

Unity's increasingly diversified revenue streams in non-gaming sectors decrease its riskiness and bolster its long-term growth potential. Significant restructuring progress with the new management addressing past missteps is evident by the rollback of the controversial runtime fee.

How is Unity expected to transform market doubts into a springboard for future growth? The answer lies in optimistic assumptions about how management’s changes boost margins and unlock new revenue. You’ll need to dig into the full narrative to see which projections could turn everything around.

Result: Fair Value of $38.48 (OVERVALUED)

However, persistent competition in gaming and potential execution missteps could quickly test the optimism surrounding Unity’s transformation and growth story.

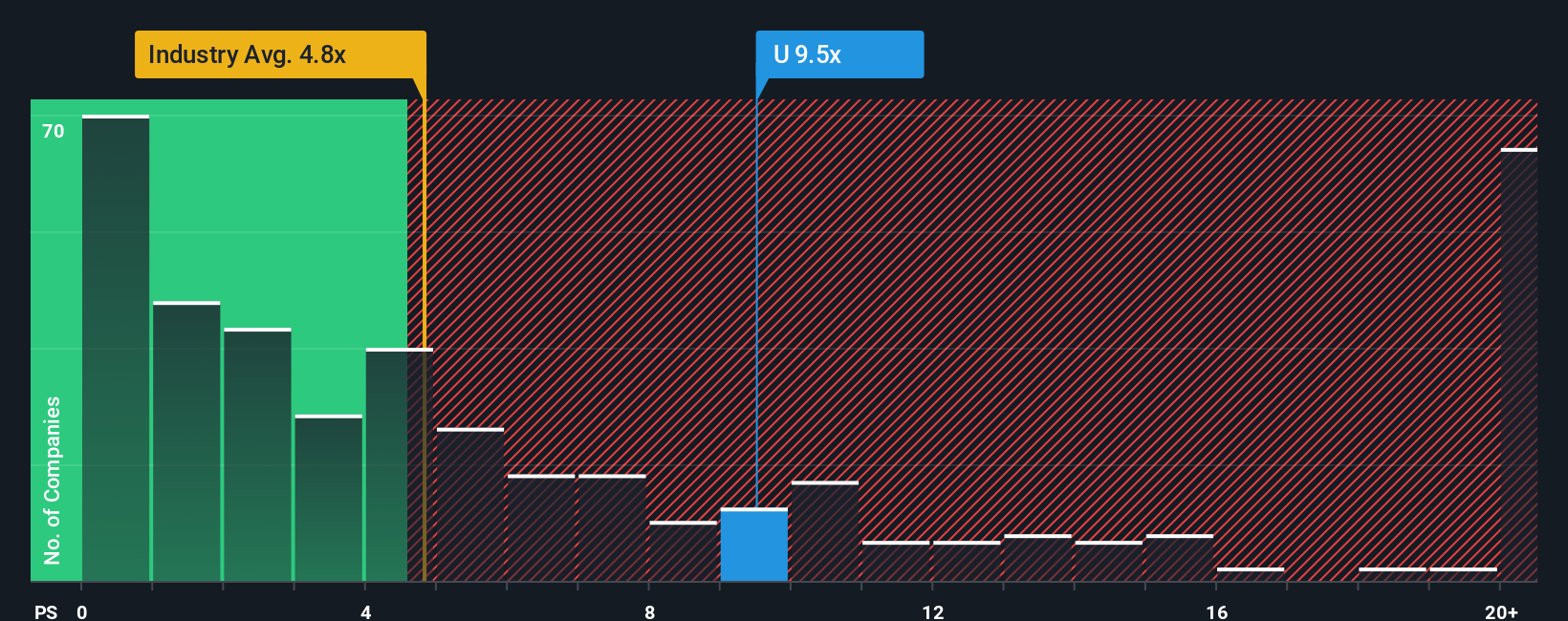

Another View: Valuation by Sales Ratio

Looking from a different angle, Unity’s price-to-sales ratio sits at 9.3x, below its peer average of 10.3x but well above the broader US software sector at 5.3x. Importantly, this is still higher than its fair ratio of 7.8x, meaning there is valuation risk if the market corrects toward that fair level. Does this suggest a premium that needs to be reconsidered or a market willing to pay more?

Build Your Own Unity Software Narrative

If you want to dig into the details or take a different perspective, you can easily build your own Unity view in just a few minutes with Do it your way.

A great starting point for your Unity Software research is our analysis highlighting 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Why stop at just one opportunity? Widen your investment lens by jumping into our screeners built around powerful, real-world financial shifts. These could help you catch tomorrow’s winners before everyone else.

- Boost your portfolio’s income stream by targeting these 19 dividend stocks with yields > 3%, offering attractive yields above 3% and a focus on financial resilience.

- Capitalize on the explosive growth in artificial intelligence by checking out these 24 AI penny stocks. These early movers are defining the next digital frontier.

- Target strong cash flow potential with these 904 undervalued stocks based on cash flows, spotlighting companies trading below their intrinsic value as calculated by future earnings power.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.