Please use a PC Browser to access Register-Tadawul

Universal Technical Institute Expands Trade And Healthcare Campuses As Growth Test

Universal Technical Institute, Inc. UTI | 30.57 | -3.63% |

- Universal Technical Institute (NYSE:UTI) is expanding its U.S. footprint with new campuses in Atlanta and San Antonio.

- The San Antonio location is planned as the company’s first campus focused exclusively on skilled trades.

- UTI is also adding a new healthcare facility in Phoenix and planning more than 20 new programs for 2026.

- The expansion is aimed at addressing ongoing skilled labor and healthcare worker shortages across the country.

Universal Technical Institute, listed on the NYSE under ticker UTI, operates career-focused schools that train students for roles in transportation, skilled trades, and healthcare. The latest expansion aligns the company with ongoing demand for technicians, tradespeople, and clinical support staff as employers continue to report hiring challenges in these fields.

For investors watching longer term business drivers, this broad build out of campuses and programs highlights how UTI is positioning its training portfolio toward areas of persistent labor need. How effectively the company fills and runs these new locations, and how employers respond to the talent pipeline, will be key points to track in the coming years.

Stay updated on the most important news stories for Universal Technical Institute by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on Universal Technical Institute.

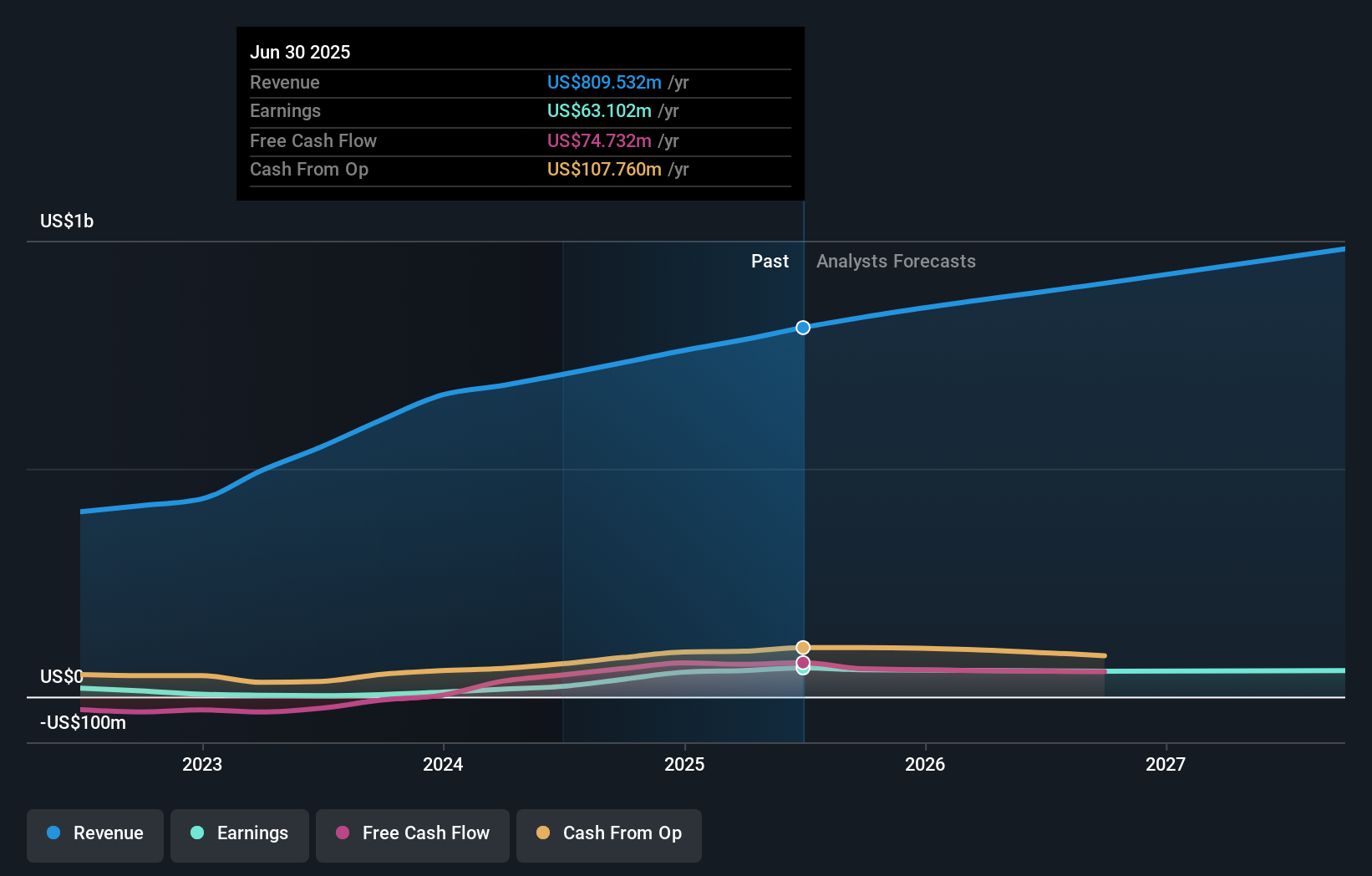

For Universal Technical Institute, this expansion push sits alongside mixed but growing financials, with Q1 fiscal 2026 sales at US$220.84 million compared to US$201.43 million a year earlier and net income at US$12.83 million versus US$22.15 million. Management is continuing to put capital into new campuses, such as Atlanta, San Antonio and the planned Concorde healthcare facility in Phoenix, while reiterating full year 2026 revenue guidance of US$905 million to US$915 million. This indicates that the company views these projects as central to its growth plan rather than secondary initiatives.

How the Universal Technical Institute Narrative Connects to This Expansion

The new campuses and more than 20 planned programs for 2026 align with the existing narrative that UTI is focusing on skilled trades and allied health training as more students rethink four year degrees. They also connect to the view that regulatory changes and employer partnerships can support enrollment in shorter, career focused programs, while expansion in areas like HVAC, aviation and healthcare extends the business beyond its traditional auto and diesel core.

Risks and Rewards Investors Should Weigh

- The campus build out targets areas of ongoing skilled labor shortages, which could support student demand in transportation, trades and healthcare compared with peers like Strategic Education or Adtalem Global Education.

- Management reaffirmed revenue guidance while investing in new locations, which suggests confidence that enrollment and program launches can support the broader multi year growth plan.

- Net income in the latest quarter was US$12.83 million compared to US$22.15 million a year earlier, illustrating how upfront spending on new campuses can pressure margins even when revenue is higher.

- Analysts have noted that aggressive expansion and integration work carry execution and regulatory approval risks, especially if student demand or funding does not keep pace with added capacity.

What to Watch Next

From here, the key factors to monitor include fill rates at the new Atlanta and San Antonio campuses, early progress at the planned Phoenix healthcare facility, and whether earnings adjust as the initial investment phase matures. For different viewpoints on how this expansion fits into the longer term story, you can review community narratives and analyst commentary by visiting the UTI page with community narratives before making any decisions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.