Please use a PC Browser to access Register-Tadawul

Universal Technical Institute (UTI) Valuation in Focus After New Durham School Services Partnership Expands Career Pathways

Universal Technical Institute, Inc. UTI | 26.09 | +5.03% |

If you’re following Universal Technical Institute (UTI), you might have noticed some buzz this week as the company rolled out a new partnership with Durham School Services. Durham has signed on to UTI’s Tuition Reimbursement Program, pledging to help pay down student debt and even offering a $3,000 relocation bonus for graduates of UTI’s Diesel Technology program who take jobs and move for the company. For anyone weighing the investment case on UTI, this kind of employer collaboration directly addresses two of the big questions: how job-ready are UTI graduates, and what makes the school stand out in the education and training space?

This collaboration comes after a stretch when UTI's shares have been on a bit of a ride. Over the past year, the stock is up an impressive 73%, and it’s also in positive territory year-to-date. That said, the past 3 months have brought some pullback as the momentum has cooled, and short-term moves have gotten choppier lately. Strategic partnerships like the new Durham agreement continue to highlight UTI’s ability to create tangible career pipelines after graduation, which could factor into how investors evaluate the underlying value and future trajectory of the stock.

With the stock climbing over the longer term but taking a breather recently, the question becomes clear: is Universal Technical Institute priced at a compelling level for buyers, or is the market already factoring future growth into today’s share price?

Most Popular Narrative: 24.8% Undervalued

The prevailing narrative suggests that Universal Technical Institute is trading well below its calculated fair value, with analysts expecting meaningful growth opportunities ahead despite some earnings headwinds.

“The recently lifted growth restrictions on Concorde Career Colleges now allow for accelerated program launches and the addition of multiple new campuses a year ahead of plan. This positions the company for faster-than-anticipated revenue growth and increased market share starting as early as 2026.”

Curious how Universal Technical Institute could outpace the status quo? The story behind this valuation rests on aggressive expansion, regulatory shifts, and ambitious assumptions for growth and profit. Want a peek at the surprising numbers and the bold financial logic supporting a price target far above today’s market? Dive into the narrative and discover which projections could shape the company’s future and investor returns.

Result: Fair Value of $37.6 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, if enrollment fails to materialize due to regulatory hurdles or new competition, the bullish case could unravel faster than many expect.

Find out about the key risks to this Universal Technical Institute narrative.Another View: Testing the Valuation with a Different Lens

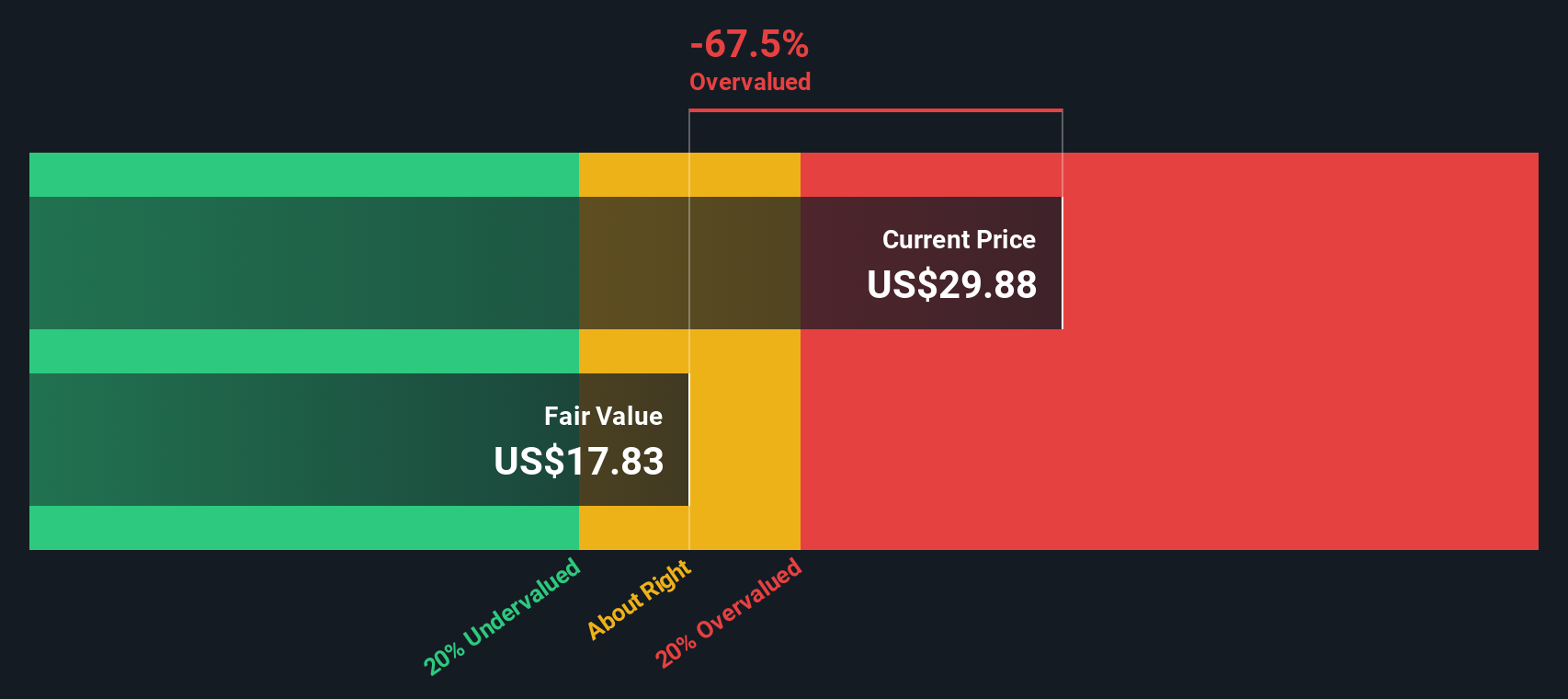

Looking at Universal Technical Institute through a different model, the SWS DCF approach, we see a result that runs counter to the earlier optimism. In this case, the company appears to be overvalued. Could the market be too hopeful?

Build Your Own Universal Technical Institute Narrative

If you’d like to challenge these perspectives or prefer to dig into the numbers on your own terms, you can construct your own Universal Technical Institute view in just a few minutes using Do it your way.

A great starting point for your Universal Technical Institute research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Make your next investing move even smarter by uncovering unique growth stories you might have missed. Put your money to work where opportunities are taking shape now. These screens offer a shortcut to edge and insight:

- Multiply your returns with up-and-coming companies showing real financial strength by seizing penny stocks with strong financials.

- Capture the potential of game-changing breakthroughs in health and biotech through healthcare AI stocks.

- Boost your passive income stream in today’s market by targeting companies with attractive yields via dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.