Please use a PC Browser to access Register-Tadawul

Unusual Machines (UMAC): Assessing Valuation Following Investor Conference and Follow-On Equity Offering

Unusual Machines UMAC | 9.30 | +2.31% |

Most Popular Narrative: 38.2% Undervalued

The prevailing narrative points to Unusual Machines trading well below its estimated fair value, with strong catalysts driving an optimistic outlook for future growth.

"The buildout of new domestic manufacturing capacity for motors and headsets, along with the ability to scale production to tens of thousands of units monthly with further ramp potential, will enable Unusual Machines to quickly fulfill large, near-term orders and provide reliable, onshore supply to B2B and government customers. This is expected to support both revenue acceleration and gross margin expansion as supply chains become more efficient."

How does a company go from perennial losses to commanding a lofty valuation? This narrative’s appeal lies in its high growth assumptions and a future profit margin target comparable to leading technology companies. What are the bold forecasts underpinning this target and could they become reality? Find out which numbers shape the core of this bullish valuation thesis.

Result: Fair Value of $17.00 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, shifts in government spending priorities or unexpected operational setbacks could quickly challenge the company’s ambitious growth and margin targets.

Find out about the key risks to this Unusual Machines narrative.Another View: The Multiples Challenge

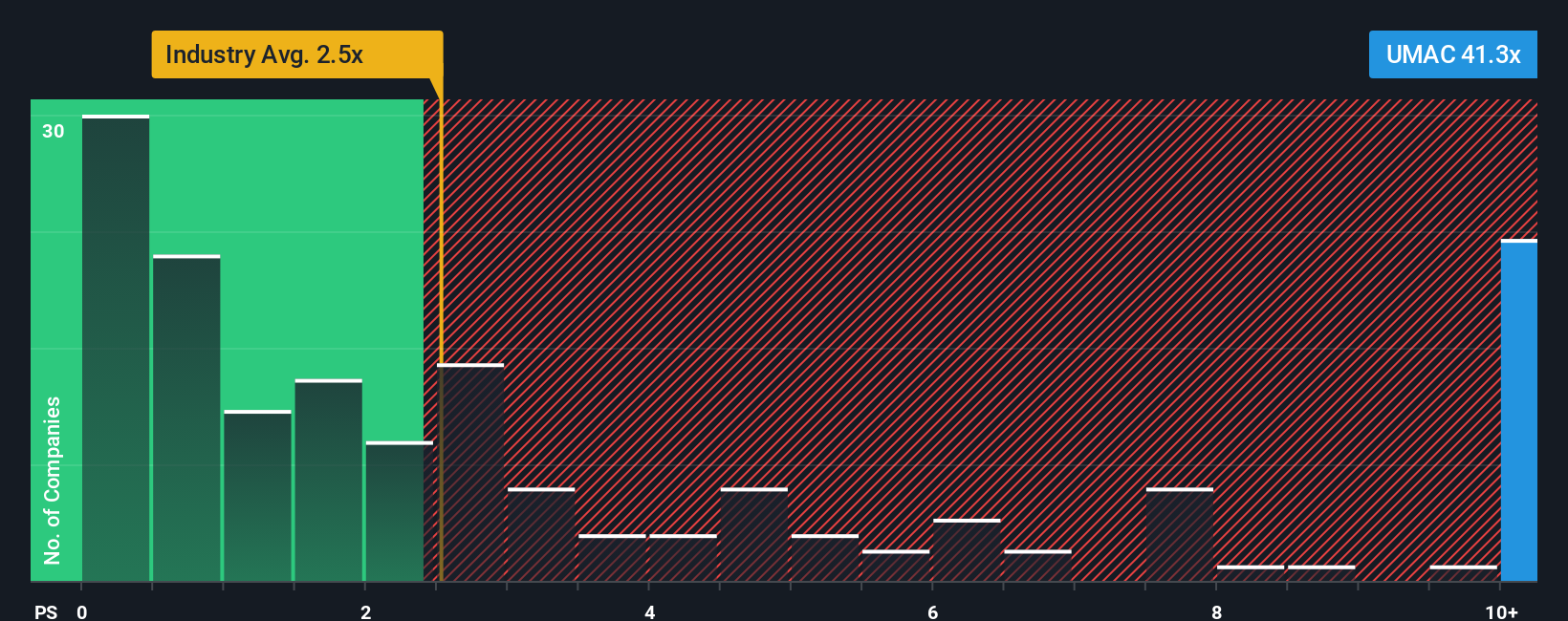

Looking at Unusual Machines from a different perspective, a comparison to the industry using price-to-sales suggests the shares may actually be trading at a steep premium. Could the optimism already be reflected in the price, or is the market missing something important?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Unusual Machines Narrative

If you have your own take, or want to dig into the numbers yourself, you can craft your own perspective in just a few minutes. Do it your way

A great starting point for your Unusual Machines research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for More Smart Opportunities?

Stay ahead by checking out handpicked stock ideas tailored for ambitious investors like you. Uncover unique advantages across these fast-moving, opportunity-packed areas right now.

- Maximize your income potential and learn which companies are paying out with generous yields above 3% via the dividend stocks with yields > 3%.

- Embrace the future and spot game-changing businesses positioning themselves at the forefront of real-world quantum breakthroughs with the quantum computing stocks.

- Target value and strengthen your portfolio by finding promising stocks priced below their true worth using the undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.