Please use a PC Browser to access Register-Tadawul

Unusual Machines (UMAC): Valuation in Focus After Acquisition, U.S. Expansion, and New Growth Initiatives

Unusual Machines UMAC | 10.02 | -7.90% |

Most Popular Narrative: 22.9% Undervalued

The leading narrative views Unusual Machines as significantly undervalued. This perspective suggests that its future earnings, strong contract potential, and large addressable market are not fully reflected in the share price.

The accelerating adoption of automation, robotics, and IoT, combined with the expansion of the U.S. drone market and increased demand for advanced, NDAA-compliant components, is expanding Unusual Machines' long-term addressable market beyond drones to encompass broader smart hardware and embedded electronics. This positions the company for durable, above-market revenue growth well into the future.

Want to know why analysts think this company could be a future standout? There is a blend of rapid growth assumptions and margin upgrades powering this bold fair value call. Can the business hit those ambitious targets and justify this valuation? The real story is in the numbers behind the forecast.

Result: Fair Value of $17.00 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, sudden changes in government drone spending or operational missteps could quickly undermine Unusual Machines' positive outlook and future growth forecasts.

Find out about the key risks to this Unusual Machines narrative.Another View: Multiples Tell a Different Story

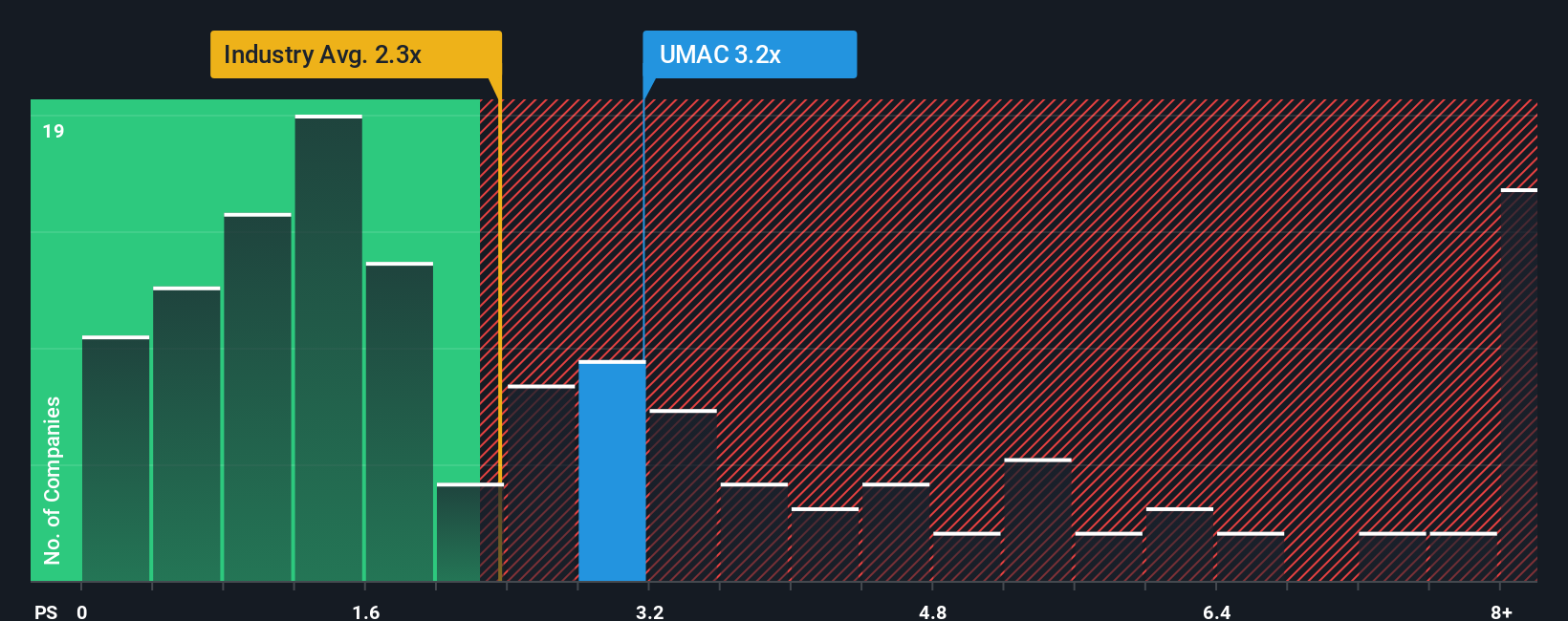

Yet when compared to its industry using another well-known approach, Unusual Machines actually looks expensive. This method challenges the idea of it being undervalued and raises a new question: is the optimism priced in?

Build Your Own Unusual Machines Narrative

If you see things differently or enjoy diving into your own analysis, it only takes a few minutes to shape your own view. Do it your way

A great starting point for your Unusual Machines research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Why stop at just one opportunity? Give yourself an edge and uncover stocks that fit your unique strategy, backed by reliable data and fresh insights.

- Tap into strong growth trends by checking out AI-powered businesses transforming entire industries with AI penny stocks.

- Seek out real value with companies overlooked by the crowd by exploring our selection of undervalued stocks based on cash flows.

- Target consistent income by researching companies with attractive yields through dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.