Please use a PC Browser to access Register-Tadawul

Up 502% This Month! This US "Meme Stock" is Astonishing: Retail Investors Rally to "Opendoor"...

OpenDoor Technologies OPEN | 6.73 6.79 | +4.02% +0.90% Pre |

① Remember the US meme stock Opendoor (OpenDoor Technologies, Inc.(OPEN.US))we introduced to investors just last Thursday?

② On Monday, this "meme stock" that US retail investors have been rallying to "Opendoor" and speculate on recently, exploded further...

Market data shows Opendoor continued its wild run from last week on Monday. After seeing its stock price double at one point during the session and experiencing a volatility halt in the final hour of trading, it ultimately closed up 42%.

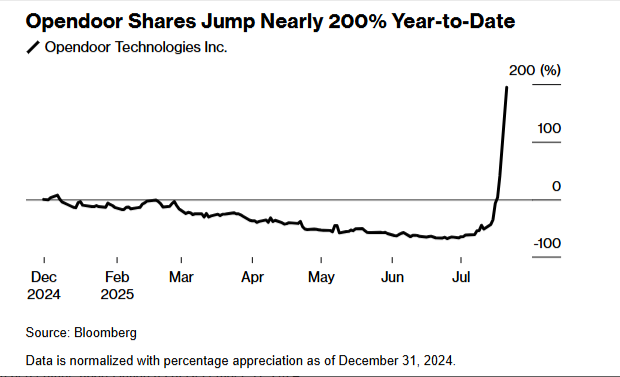

Currently, Opendoor has achieved an astonishing 502% gain this month, closing at $3.21 on Monday – far above the ~$1 level it had hovered around for the past several months. This scene has reminded many of the "retail vs. Wall Street" battle four years ago – when US retail investors' frenzied pursuit of meme stocks drove the surge in speculative stocks like GameStop and AMC.

In fact, after Monday's close, industry insiders compiled multiple data points that vividly demonstrate just how staggering the speculative frenzy around Opendoor has been:

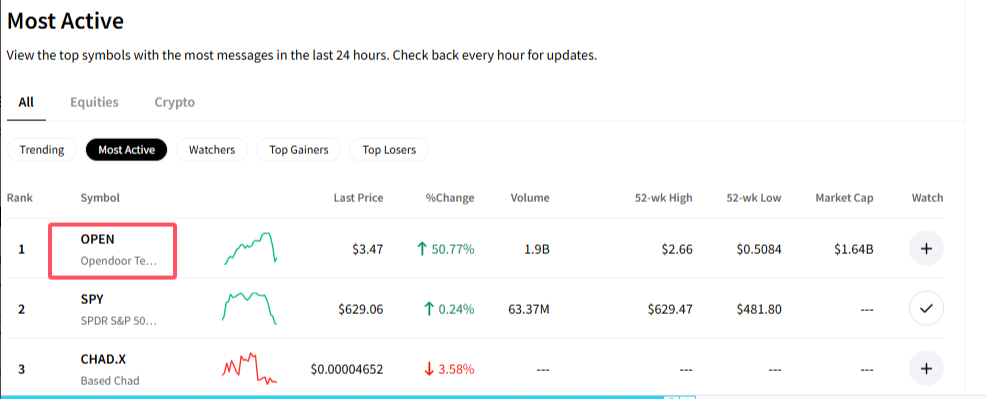

Data shows that on Monday, trading volume in this online real estate platform's stock reached an astonishing 1.9 billion shares, accounting for nearly 10% of the entire US exchange market's total trading volume for the day!

Put another way, Opendoor's trading value last night exceeded that of Meta, whose market cap is nearly 1000 times larger...

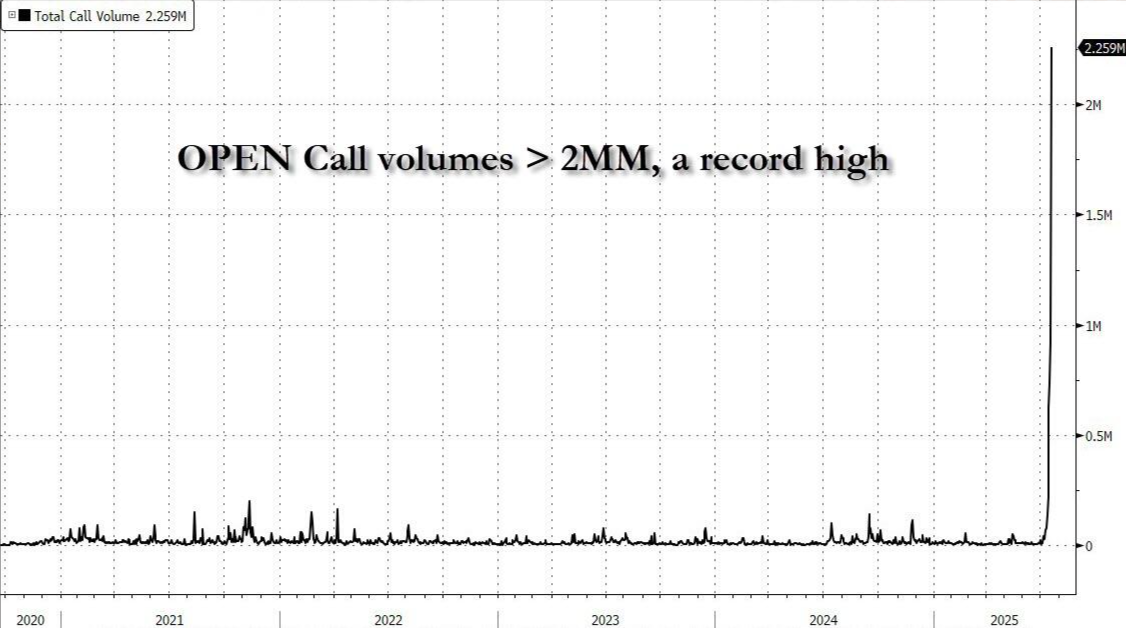

And the truly insane scene wasn't even in the stock itself, but in the options market. As call options exploded higher, a historic gamma squeeze unfolded. As shown in the chart below, Opendoor call option volume exceeded 2 million contracts on Monday, far surpassing any day in the company's history and marking the third-highest single-day call option volume total for any US stock this year.

Trading in this meme stock was so intense that even Goldman Sachs couldn't help but note in its midday recap that the primary driver of Monday's market volume was "continued retail footprint building since 9:30am – Opendoor has traded 1 billion shares, ~9% of market volume thus far."

Retail Rally

As mentioned last Thursday, Opendoor has recently become a hot topic among US retail investors on social media.

Tom Bruni, VP of Community & Editor in Chief at Stocktwits (a well-known US social media platform for exchanging and discussing investment ideas), stated at the time that interest in Opendoor, measured by page views related to its ticker symbol on Stocktwits, surged 400% between last Monday and Tuesday.

On Monday, Opendoor was again listed as the most actively traded stock on Stocktwits and was heavily mentioned by users in the WallStreetBets subreddit.

Opendoor's surge undoubtedly inflicted further pain on short sellers. According to data compiled by S3 Partners, short interest in the stock represents about 24% of its float.

OpenDoor's initial surge actually began with a series of buy recommendations by Eric Jackson, founder of Toronto hedge fund EMJ Capital, on social media platform X recently. Jackson stated he was bullish on the stock and predicted Opendoor's share price could exceed $80 within a year or two.

It's worth noting that Opendoor isn't the first highly speculative stock to take off in 2025. So-called "penny stocks" – which by some definitions include Opendoor – have seen trading activity surge persistently.

"Retail investors are partying like it’s 1999," noted Matt Maley, Chief Strategist at Miller Tabak + Co. "Some of these new meme stock moves are very reminiscent of what we saw in 1999. Opendoor’s move is just the most dramatic of them."

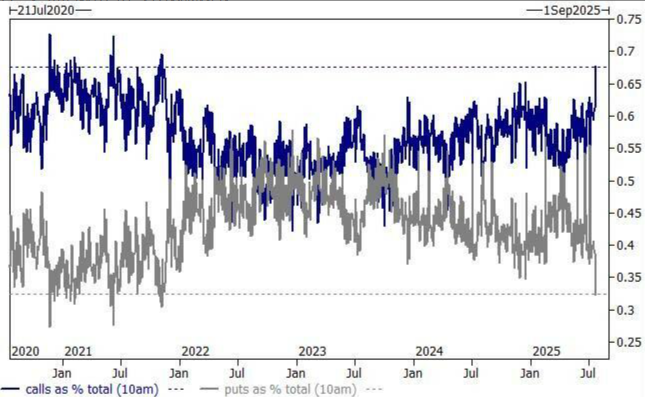

Meanwhile, a Goldman Sachs derivatives strategist stated they are "starting to feel the vibe of 2021" because the market seems very "chasey": "Call option volume is nearly 70% of total market volume (observed at 10am ET Monday)... This ratio hasn't been this high since the meme frenzy of 2021."

However, the enormous risks behind these hyped meme stocks are also glaringly obvious. Many industry insiders also warn that the recent wild performance of stocks like Opendoor often disconnects from company fundamentals.

Public information shows Opendoor Technologies Inc. is an e-commerce platform for residential real estate transactions. The company aims to provide a digital, on-demand transaction experience for buyers and sellers through software, data science, product design, and operational strengths. According to FactSet data, since going public via SPAC in December 2020, Opendoor has not reported a single profitable fiscal year, although its stock price did rise modestly in May after its Q1 earnings showed losses were smaller than expected.