Please use a PC Browser to access Register-Tadawul

Upward Revenue Guidance and Data Center Growth Might Change the Case for Investing in Iron Mountain (IRM)

Iron Mountain, Inc. IRM | 83.35 | -5.32% |

- On August 6, 2025, Iron Mountain's Board of Directors declared a quarterly cash dividend of US$0.785 per share for the third quarter and raised its full-year 2025 revenue guidance to a range of US$6.79 billion to US$6.94 billion, following the release of its second quarter results showing revenue growth but a net loss of US$44.92 million.

- This period also saw increased institutional interest, with Baron Real Estate Income Fund acquiring shares, underscoring confidence in Iron Mountain's expansion opportunities, particularly within its data center segment.

- We'll explore how Iron Mountain's upward guidance revision reflects ongoing business transformation in the high-growth data center segment.

Find companies with promising cash flow potential yet trading below their fair value.

Iron Mountain Investment Narrative Recap

To be an Iron Mountain shareholder, you need to believe in the company’s ongoing shift from its legacy records storage to high-growth data centers and digital solutions. The recent uptick in full-year revenue guidance reflects management’s confidence in new business initiatives, but does not materially change the most important short-term catalyst: data center expansion and lease signings. The principal risk remains the company’s elevated leverage, especially as it continues with capital-intensive projects in a competitive market.

Iron Mountain’s decision to raise its 2025 revenue outlook, announced alongside its latest dividend declaration, is closely tied to these expansion plans. This optimism in guidance stands out, even as the company reported a net loss for the quarter, highlighting the importance of sustainable growth in the newer data center segment and the need for close monitoring of cash flow and capital structure.

However, investors should know there are growing concerns about leverage and refinancing risk, particularly if...

Iron Mountain's outlook anticipates $8.0 billion in revenue and $702.9 million in earnings by 2028. This is based on an 8.4% annual revenue growth rate and an increase in earnings of $580.9 million from the current $122.0 million.

Uncover how Iron Mountain's forecasts yield a $115.30 fair value, a 25% upside to its current price.

Exploring Other Perspectives

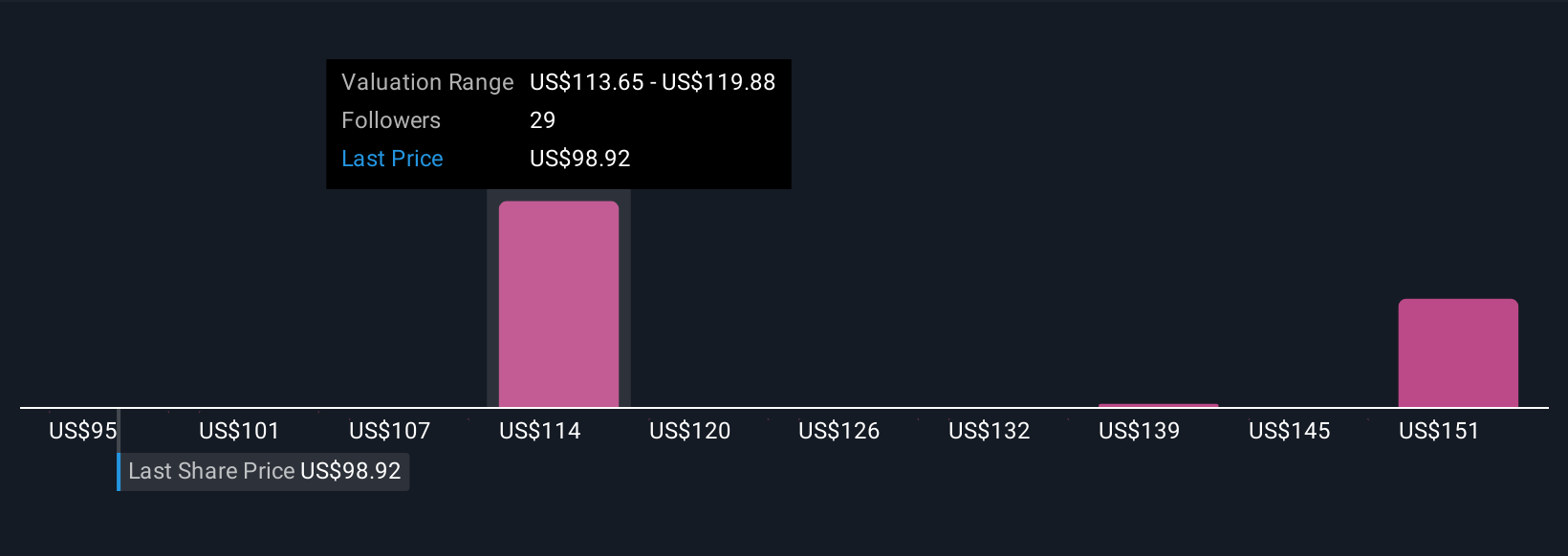

Five fair value estimates from the Simply Wall St Community range from US$94.95 to US$156.71, signaling a wide spread of opinion about where the shares could settle. With ongoing capital spending and a competitive data center market, you may want to explore how these viewpoints reflect differing expectations for Iron Mountain’s next phase.

Explore 5 other fair value estimates on Iron Mountain - why the stock might be worth as much as 70% more than the current price!

Build Your Own Iron Mountain Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Iron Mountain research is our analysis highlighting 3 key rewards and 6 important warning signs that could impact your investment decision.

- Our free Iron Mountain research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Iron Mountain's overall financial health at a glance.

Seeking Other Investments?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Rare earth metals are the new gold rush. Find out which 27 stocks are leading the charge.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 25 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.