Please use a PC Browser to access Register-Tadawul

US High Growth Tech Stocks To Watch In August 2025

Arista Networks, Inc. ANET | 126.29 | +0.32% |

As the Nasdaq closes at a record high driven by surging chip stocks and Apple, the broader U.S. market reveals mixed signals with the S&P 500 ticking lower amid concerns about tariffs and economic health. In this climate, identifying promising high-growth tech stocks involves evaluating companies that demonstrate resilience to geopolitical tensions and possess strong potential for innovation and expansion within their sectors.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| ACADIA Pharmaceuticals | 10.93% | 22.54% | ★★★★★☆ |

| ADMA Biologics | 20.40% | 25.83% | ★★★★★☆ |

| Palantir Technologies | 25.20% | 31.74% | ★★★★★★ |

| Circle Internet Group | 30.80% | 60.66% | ★★★★★★ |

| Workday | 11.38% | 29.97% | ★★★★★☆ |

| Mereo BioPharma Group | 51.11% | 57.42% | ★★★★★★ |

| OS Therapies | 38.35% | 16.51% | ★★★★★☆ |

| RenovoRx | 62.57% | 63.11% | ★★★★★☆ |

| Gorilla Technology Group | 27.85% | 105.48% | ★★★★★☆ |

| Aldeyra Therapeutics | 41.72% | 74.79% | ★★★★★☆ |

Here's a peek at a few of the choices from the screener.

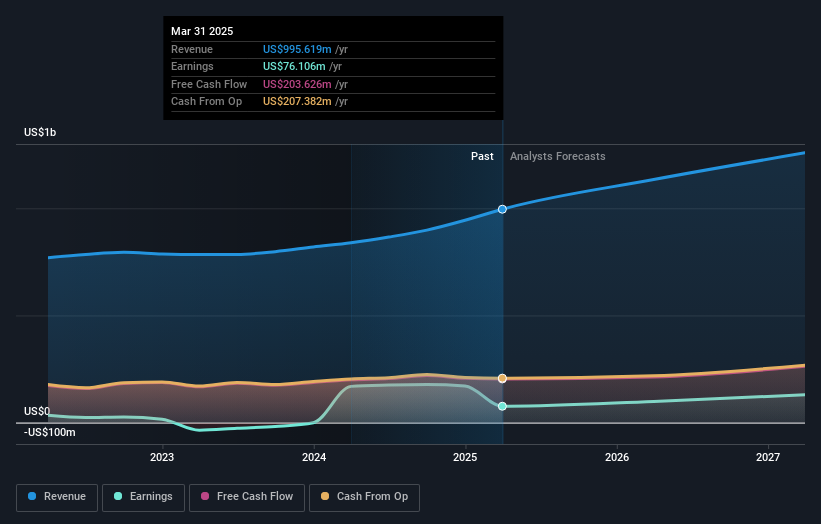

Commvault Systems (CVLT)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Commvault Systems, Inc. offers a cyber resilience platform focused on data protection and recovery for cloud-native applications globally, with a market cap of approximately $8.26 billion.

Operations: The company generates revenue primarily from its Software & Programming segment, amounting to $1.05 billion.

Commvault Systems, despite its recent -53.6% earnings dip, is positioned for a robust recovery with projected annual earnings growth of 25.1%. This forecast surpasses the broader U.S. market's 14.8%, signaling potential resilience and adaptability in its operational strategy. The firm's latest quarterly report shows a revenue jump to $281.98 million from $224.67 million year-over-year, paired with an increase in net income to $23.5 million from $18.53 million, reflecting effective execution amidst challenges. Additionally, Commvault's strategic focus on expanding its product offerings like Clumio Backtrack for DynamoDB indicates a forward-thinking approach to cloud data management—a critical area as enterprises increasingly rely on cloud-native technologies for scalability and performance.

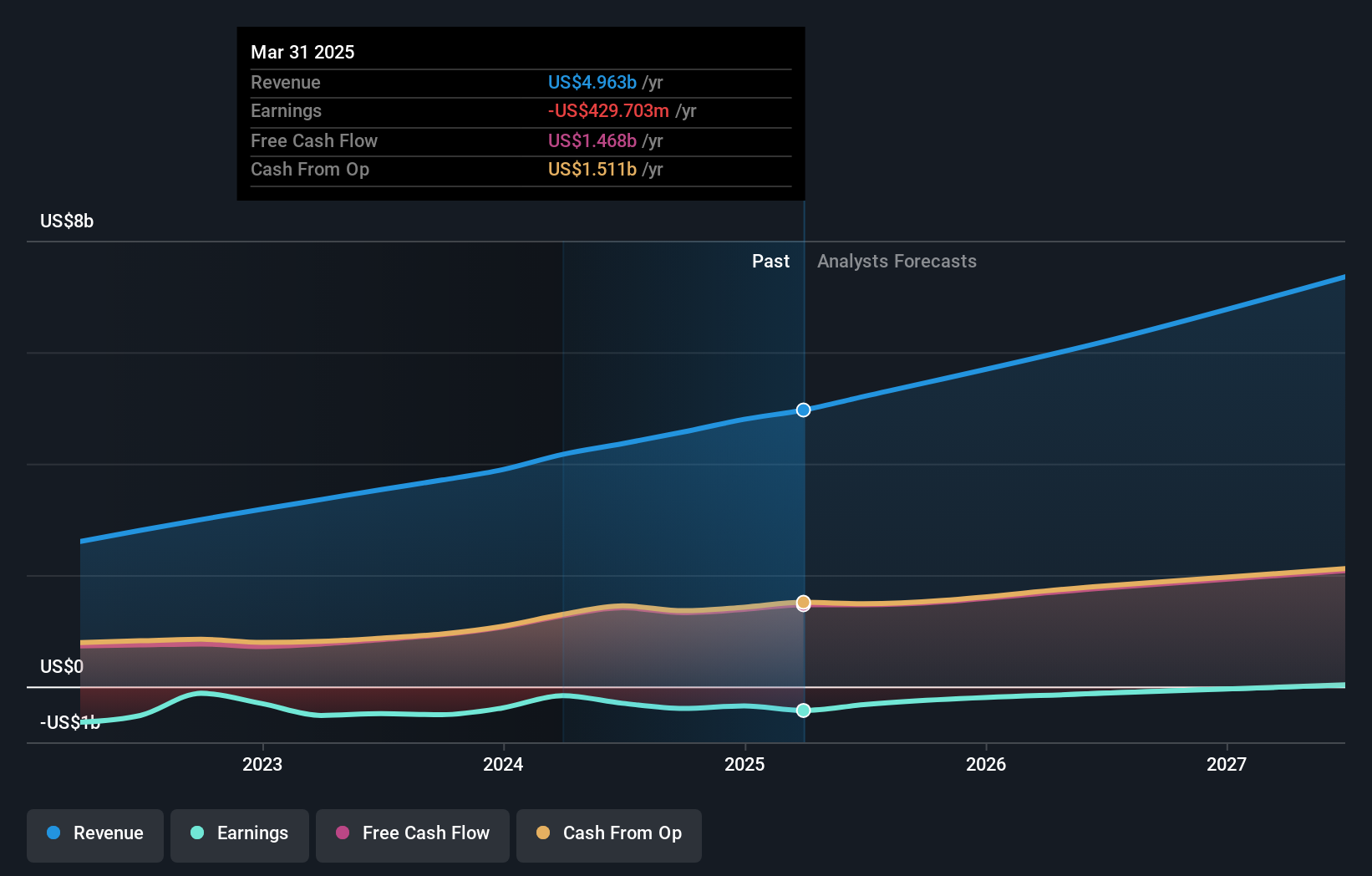

Atlassian (TEAM)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Atlassian Corporation, with a market cap of $48.69 billion, designs, develops, licenses, and maintains various software products worldwide through its subsidiaries.

Operations: The company generates revenue primarily from its Software & Programming segment, which contributed $4.96 billion. Its business model focuses on the development and licensing of software products globally.

Atlassian, amidst a challenging fiscal year, managed to increase its revenue by nearly 20% to $5.2 billion, demonstrating resilience and adaptability in its business model. The company's strategic pivot towards cloud-based solutions has deepened with a new partnership with Google Cloud, aiming to enhance AI capabilities across its platforms like Jira and Confluence. This collaboration is expected to not only boost Atlassian's product offerings but also solidify its position in the competitive tech landscape by leveraging advanced AI tools for improved customer productivity and innovation. With R&D expenses consistently aligned with industry standards, Atlassian is poised to maintain its momentum in developing cutting-edge technologies that meet evolving enterprise needs.

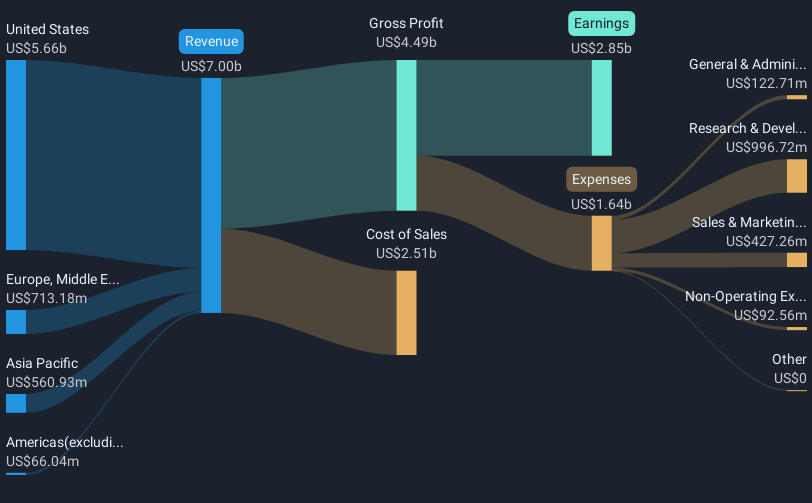

Arista Networks (ANET)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Arista Networks Inc specializes in creating and selling data-driven networking solutions for AI, data centers, campuses, and routing environments across various global regions with a market cap of $174.43 billion.

Operations: The company focuses on developing and marketing advanced networking solutions tailored for AI, data centers, campuses, and routing environments. Its operations span the Americas, Europe, the Middle East, Africa, and the Asia-Pacific regions.

Arista Networks has demonstrated robust financial performance and strategic expansion, particularly in the AI, cloud, and enterprise sectors. With a recent earnings guidance uplift for 2025, Arista now anticipates revenues to hit $8.75 billion—a significant increase driven by new product launches and market penetration. The acquisition of VeloCloud enhances its portfolio with advanced SD-WAN solutions, pivotal for today’s distributed workforce environments. This move not only diversifies Arista's offerings but also strengthens its competitive edge in a rapidly evolving tech landscape where secure, scalable network solutions are crucial.

Seize The Opportunity

- Click this link to deep-dive into the 71 companies within our US High Growth Tech and AI Stocks screener.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.