Please use a PC Browser to access Register-Tadawul

US Market Preview | ABVX Skyrocketed 500%+; WSB Frenzy! GPRO and DNUT Surged Pre-Market; GOOGL, TSLA Earnings Loom; Bessent: Trump Has Said He Won't Fire Powell

Alphabet Inc. Class A GOOGL | 296.72 | -3.21% |

Tesla Motors, Inc. TSLA | 467.26 | -4.62% |

Abivax S.A. ABVX | 110.82 | -0.14% |

Paul`s Place Inc Ordinary Shares PAPL | 2.37 | -10.57% |

GoPro, Inc. Class A GPRO | 1.52 | -1.94% |

- Bessent Comments on Fed and Powell's Position;

- Meme Stocks Surge in Pre-Market Trading;

- Ark Invest Buys Nvidia Dip;

- Tesla's Earnings Approaching Amid Sales Decline;

I. Market Report

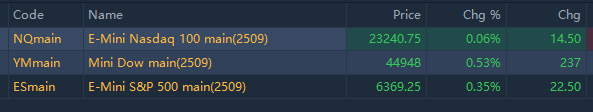

Stock futures surged on Wednesday following President Trump's announcement of a trade deal with Japan. As of 03:43 PM Riyadh time, futures linked to the Dow, S&P 500, and Nasdaq-100 gained 0.53%, 0.35%, and 0.06% respectively.

Trump revealed the deal on Truth Social, stating that it includes reciprocal tariffs of 15% on exports to the US. He also mentioned ongoing negotiations with European officials for a trade agreement.

The S&P 500 closed at a record high for the second consecutive day, while the Dow Jones Industrial Average climbed nearly 180 points. However, the tech-heavy Nasdaq fell 0.4% due to a decline in chip stocks.

Investors await earnings reports from Alphabet Inc. Class A(GOOGL.US) and Tesla Motors, Inc.(TSLA.US), which are expected after the market closes. These are the first earnings reports of the season from the megacap technology sector.

Other notable earnings releases include Chipotle and Mattel, amid a busy earnings week. So far, over 86% of S&P 500 companies that have reported have beaten Wall Street's expectations.

On the economic front, traders will focus on existing home sales data due on Wednesday morning.

As of 03:44 PM Riyadh Time, top pre-market movements are as follows:

Change | Price(US$) | Ticker (🌙 means "Shariah Compliant") | Additional Information |

514.9% | 61.49 | 🌙 Abivax S.A.(ABVX.US) | Met all key secondary endpoints in colitis trial. |

182.9% | 9.9 | Paul`s Place Inc Ordinary Shares(PAPL.US) | - |

88.3% | 2.58 | GoPro, Inc. Class A(GPRO.US) | Renewed interest in meme stocks.; Stock headed sharply up by 41.0% on last trading day |

77.6% | 3.25 | Anebulo Pharmaceuticals, Inc.(ANEB.US) | Reverse stock split announcement boosts shares. |

75.7% | 0.12 | Wang & Lee Group, Inc.(WLGS.US) | Stock soared by 36.1% on last trading day |

-18.7% | 0.42 | Dragonfly Energy Holdings Corp - Common Stock(DFLI.US) | Exchange 2.1 million shares for Series A stock elimination. |

II. Flash Headlines

EU Prepares €100 Billion No-Deal Plan Amid Threat of 30% US Tariffs

Market sources indicate that the EU is readying a swift response plan involving €100 billion ($117 billion) in tariffs on US products, should negotiations fail and President Trump impose a 30% tariff on most EU exports after August 1. An EU Commission spokesperson stated on Wednesday that the initial countermeasures will consolidate an approved tariff list targeting €21 billion of US goods with a proposed list affecting an additional €72 billion into a comprehensive package.

Market Calm May Encourage Further Tariffs, Warns BofA

Bank of America warns that the market's calm response to Trump's tariff policies is giving the government leeway to impose further taxes. The escalating trade war is pushing the Federal Reserve towards a more cautious stance. With effective tariff rates potentially rising to 16% or higher, investors face not just short-term volatility, but the risk of stagflation extending into 2026.

Bessent Comments on Fed and Powell's Position

US Treasury Secretary Bessent stated that there is no rush in nominating a new Fed Chair, and Trump's assurance that he won't fire Powell remains firm. Bessent noted that the Fed's tariff analysis may be flawed and expressed uncertainty about its rate decisions. He suggested a committee could review the Fed, similar to the Bank of England's approach, as the Fed's mission struggles and monetary policy independence face risks.

III. Stocks To Watch

Meme Stocks Surge in Pre-Market Trading

WSB concept stocks are gaining momentum with new meme stocks rising sharply. GoPro, Inc. Class A(GPRO.US) soared over 51%, Krispy Kreme, Inc.(DNUT.US) increased more than 31%, and Beyond Meat(BYND.US) rose over 22% in pre-market trading.

WSB stands for "WallStreetBets," which is a popular subreddit on Reddit. It's known for its community of retail investors who share investment ideas, strategies, and memes. The group gained significant attention for its role in the GameStop short squeeze in early 2021, where members coordinated to buy shares and options, driving up the price and impacting hedge funds with short positions. WSB is characterized by its high-risk, high-reward investment approach and often irreverent style.

Ark Invest Buys Nvidia Dip

Ark Invest buys 11,973 shares of NVIDIA Corporation(NVDA.US) worth US$1.99M amid Stargate AI project delays. Read in detail>>

Tesla's Earnings Approaching Amid Sales Decline

As Tesla Motors, Inc.(TSLA.US) nears its earnings report, Wall Street expects Q2 earnings per share of $0.33 and revenue of $22.63 billion, both down from last year's $0.52 and $25.5 billion. The decline is driven by a 13.5% drop in global deliveries, totaling about 384,000 vehicles. However, advancements in AI, robotics, and digital assets, including gains from Bitcoin, might provide positive highlights.

Texas Instruments Falls Over 9% Pre-Market on Q3 Outlook

Texas Instruments Incorporated(TXN.US) experienced a pre-market drop of over 9%. The company reported Q2 revenue of $4.45 billion, surpassing expectations of $4.36 billion, with operating profit at $1.56 billion and EPS at $1.41, both above forecasts. However, concerns over tariffs and slow automotive recovery affect demand. Q3 EPS guidance is set at $1.48, below the anticipated $1.50.

EU Likely to Approve Apple's App Store Rule Changes

Apple Inc.(AAPL.US) may receive approval from EU antitrust regulators for its App Store rule and fee adjustments, potentially avoiding hefty fines. Apple announced developers will incur a 20% fee for in-App Store purchases, while those directing customers outside will face fees of 5% to 15%. Developers can use multiple links for external payments. In April, the EU fined Apple €500 million, giving 60 days to comply with the Digital Markets Act.

PayPal to Launch PayPal World for Global Payment Integration

PayPal Holdings Inc(PYPL.US) has formed partnerships with major global payment systems and digital wallets. This fall, PayPal World will enable seamless connectivity between PayPal, Venmo, and partner wallets. The platform will allow consumers to use local digital wallets for payments at millions of merchants worldwide.

AT&T Reports Q2 Revenue Surpassing Expectations

AT&T Inc.(T.US) announced Q2 revenue of $30.8 billion, exceeding the forecast of $30.43 billion. The company anticipates saving $6.5 to $8 billion in taxes by 2027 due to Trump-era legislation. AT&T projects free cash flow to reach at least $18 billion by 2026 and $19 billion by 2027.

Pony.ai Shares Rise Nearly 5% Pre-Market as Autonomous Vehicles Launch

Pony AI Inc.(PONY.US) shares rose nearly 5% pre-market. The company announced the launch of its seventh-generation Arcfox Alpha T5 autonomous vehicles for public road testing in Beijing. This model received approval for testing in Shenzhen two weeks ago. Pony.ai now holds L4 autonomous driving test permits in Beijing, Guangzhou, and Shenzhen, paving the way for deploying a fleet of a thousand autonomous vehicles later this year.

Beyond Meat Shares Surge Over 17% Pre-Market Amid Record Beef Prices

Beyond Meat(BYND.US) shares jumped over 17% pre-market as U.S. beef prices hit historic highs. Following a spike in egg prices, consumers face new food inflation challenges with beef prices reaching unprecedented levels. USDA data shows beef retail prices have risen nearly 9% this year, reaching $9.26 per pound. June's CPI indicates annual increases of 12.4% for steaks and 10.3% for ground beef, further straining consumer budgets.

Abivax Shares Skyrocket Over 400% Pre-Market on Ulcerative Colitis Drug Success

Abivax S.A.(ABVX.US) shares surged over 400% pre-market after the company announced positive Phase III results for its novel oral miR-124 enhancer, Obefazimod, in the ABTECT 8-week induction trial for moderate to severe ulcerative colitis. Abivax plans to submit a New Drug Application to the FDA in the second half of 2026.

IV. Calendar

Day's Notable Event(s):

| Riyadh Time | Event | Previous Value | Forecast Value |

| 02:00 PM | MBA 30-Year Mortgage Rate | 6.82% | |

| 02:00 PM | MBA Mortgage Applications | -10% | |

| 02:00 PM | MBA Mortgage Market Index | 253.5 | |

| 02:00 PM | MBA Mortgage Refinance Index | 767.6 | |

| 02:00 PM | MBA Purchase Index | 159.6 | |

| 05:00 PM | Existing Home Sales | 4.03M | 4.0M |

| 05:00 PM | Existing Home Sales MoM | 0.8% | -0.7% |

| 05:30 PM | EIA Crude Oil Stocks Change | -3.859M | |

| 05:30 PM | EIA Gasoline Stocks Change | 3.399M | |

| 06:30 PM | 17-Week Bill Auction | 4.230% | |

| 08:00 PM | 20-Year Bond Auction | 4.942% |