Please use a PC Browser to access Register-Tadawul

US Market Preview | IMG Surges 138%; FLY Raises IPO Price Again, Set to Debut Tonight; NBIS Up 14% on 625% Revenue Growth; Trump's 100% Chip Tariff Plan

CIMG Inc. Ordinary Shares IMG | 1.17 | -31.98% |

CIM Commercial Trust Corporation CMCT | 3.40 | -4.49% |

Daxor Corporation DXR | 12.31 | +0.49% |

LQR House Inc Ordinary Shares YHC | 0.87 | +3.93% |

Outset Medical OM | 3.92 | -1.26% |

- Trump's 100% Chip Tariff Plan;

- Firefly Aerospace Raises IPO Price to $45/Share;

- Nebius Surges 14% Pre-Market on 625% Revenue Growth;

I. Market Report

Stock futures rose Thursday, led by tech, as President Donald Trump unveiled new chip tariffs that include broad exemptions.

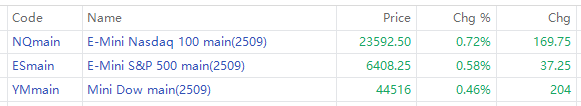

As of 03:10 PM Riyadh time, futures tied to the Dow Jones Industrial Average added 204 points, or 0.46%. S&P 500 futures and Nasdaq 100 futures advanced 0.58% and 0.72%, respectively.

As of 03:10 PM Riyadh Time, top pre-market movements are as follows:

Change | Price(US$) | Ticker (🌙 means "Shariah Compliant") | Additional Information |

137.8% | 0.48 | 🌙 CIMG Inc. Ordinary Shares(IMG.US) | Due to launch of premium Maotai-style liquor in China. |

34.2% | 9.0 | CIM Commercial Trust Corporation(CMCT.US) | - |

32.7% | 13.27 | Daxor Corporation(DXR.US) | FDA clearance for new Blood Volume Analyzer. |

30.8% | 1.57 | LQR House Inc Ordinary Shares(YHC.US) | - |

26.9% | 16.71 | Outset Medical(OM.US) | Raised FY25 sales guidance above estimates. |

II. Flash Headlines

US Jobless Claims Rise to 226K, Exceeding Forecasts

Initial jobless claims increased to 226,000 for the week ending August 2, above the 221,000 consensus estimate, while the prior week's figure was revised upward by 1,000 to 219,000, suggesting emerging softness in the labor market amid growing economic uncertainties.

Trump's 100% Chip Tariff Plan

Donald Trump plans to impose a 100% tariff on imported chips but will exempt companies like Apple that move production back to the US. CEO Tim Cook announced the plan in the Oval Office, revealing US$100 billion in new investments.

Fed Warning of Labor Market Weakness

Three Federal Reserve policymakers warned of continued labor market weakness and hinted at a September rate cut. Data showed July non-farm payrolls at 73,000, below expectations.

Dollar, Bonds Hit by Confidence Collapse

The US dollar and bonds have suffered due to a collapse of confidence. UBS ($Ubs Group Ag UBS$) warns that the dollar's 8% decline this year isn't over. Strategists note a weak US labor market and personnel changes at the Federal Reserve and Bureau of Labor Statistics could trigger further declines.

Fed's Cook Flags "Worrying" Jobs Data as Potential Economic Turning Point

Federal Reserve Governor Lisa Cook described July's employment report as "worrying" during a Boston Fed event Wednesday, noting recent labor market cooling could signal an economic inflection point, after data showed downward revisions to May/June payrolls and slowing hiring momentum.

Economist Warns Trump's India Tariff Hike Could Expose US Consumers as "Paper Tigers"

Prominent economist Peter Schiff cautioned that doubling tariffs on Indian imports to 50% may reveal the fragility of US consumer resilience, predicting dollar devaluation would "impoverish Americans while enriching foreign consumers, particularly in BRICS nations," during a Fox Business interview Wednesday.

Trump to Sign Executive Order Allowing Crypto, Real Estate in 401(k) Plans

President Trump will sign an executive order Thursday directing the Labor Department to revise retirement investment rules, permitting cryptocurrencies, private equity, and real estate to be included in 401(k) accounts—a move that could reshape the $7.3 trillion defined-contribution market.

III. Stocks To Watch

Trump Meets Nvidia CEO Amid Tariff Talk

Donald Trump met with Novo Nordisk A/S Sponsored ADR Class B(NVO.US) CEO Jensen Huang at White House. Meeting comes as president prepares to impose new tariffs on semiconductor imports.

Firefly Aerospace Raises IPO Price to $45/Share, Set for Nasdaq Debut Tonight

Space and defense tech firm Firefly Aerospace Inc.(FLY.US) has set its IPO price at $45 per share - above the upwardly revised $41-$43 range announced Monday and significantly higher than the initial $35-$39 target - as strong investor demand prompts a second pricing adjustment ahead of tonight's Nasdaq listing under ticker "FLY".

Nebius Surges 14% Pre-Market on 625% Revenue Growth, Raised Guidance

Nebius Group(NBIS.US) soared 14% in pre-market trading after reporting Q2 revenue of $105 million (up 625% YoY), while boosting its 2025 annual recurring revenue (ARR) forecast, capitalizing on AI infrastructure demand linked to its strategic partnership with Nvidia.

SoftBank Profits From AI Bets

SoftBank Group Corp turned profitable in Q1 due to gains from stakes in Nvidia Corp and Coupang Inc, supporting Masayoshi Son's plans to bet on artificial intelligence technology.

AMD Sees Strong AI Chip Demand

Advanced Micro Devices, Inc.(AMD.US) CEO Lisa Su reassures investors about strong demand for AI chips, expected to grow by hundreds of billions. The company aims to re-enter the Chinese market. AMD stock initially fell by over 6% post-earnings but narrowed the decline after Su's comments.

Intel CEO Under Fire

Intel Corporation(INTC.US) shares are trading lower after President Trump called for CEO's resignation on social media.

Corning Stock Rises On Apple Deal

Corning Incorporated(GLW.US) shares jump in after-hours trading after announcing expanded partnership with Apple Inc.(AAPL.US) to manufacture all iPhone, Apple Watch glass in the US.

Google's AI Training Commitment

Alphabet Inc. Class C(GOOG.US) subsidiary Google pledges US$1 billion for AI training at US universities, aiming to expand globally by providing educational resources and technical assistance to colleges and nonprofits.

Novo Nordisk Rises on Lilly's Trial Results

Novo Nordisk A/S Sponsored ADR Class B(NVO.US) shares are trading higher following Eli Lilly and Company(LLY.US) 's Phase 3 ATTAIN-1 trial results evaluating orforglipron in adults with obesity.

IV. Calendar

Day's Notable Event(s):

| Riyadh Time | Event | Previous Value | Forecast Value |

| 03:30 PM | Initial Jobless Claims | 218K | 220K |

| 03:30 PM | Nonfarm Productivity QoQ Prel | -1.5% | 1.8% |

| 03:30 PM | Unit Labour Costs QoQ Prel | 6.6% | 2.0% |

| 03:30 PM | Continuing Jobless Claims | 1946K | 1947K |

| 03:30 PM | Jobless Claims 4-week Average | 221K | 222K |

| 05:00 PM | Fed Bostic Speech | ||

| 05:00 PM | Wholesale Inventories MoM | -0.3% | 0.2% |

| 05:20 PM | Fed Musalem Speech | ||

| 05:30 PM | EIA Natural Gas Stocks Change | 48Bcf | |

| 06:00 PM | Consumer Inflation Expectations | 3% | 3% |

| 06:30 PM | 4-Week Bill Auction | 4.290% | |

| 06:30 PM | 8-Week Bill Auction | 4.290% | |

| 07:00 PM | 15-Year Mortgage Rate | 5.85% | |

| 07:00 PM | 30-Year Mortgage Rate | 6.72% | |

| 08:00 PM | 30-Year Bond Auction | 4.889% | |

| 10:00 PM | Consumer Credit Change | $5.1B | $10.0B |

| 11:30 PM | Fed Balance Sheet | $6.64T |