Please use a PC Browser to access Register-Tadawul

US Market Preview | INTC Dives 8%; Tesla Set to Launch Robotaxi Service in San Francisco; Goldman Sachs Upgrades Apple Ahead of Q2 Earnings

Tesla Motors, Inc. TSLA | 476.63 | +3.85% |

NVIDIA Corporation NVDA | 176.95 | +1.10% |

Intel Corporation INTC | 37.66 | -0.38% |

Apple Inc. AAPL | 274.61 | -1.32% |

Deckers Outdoor Corporation DECK | 103.25 | +2.04% |

- Top Investment Banks Recommend "Cheap" Hedging Amid Market Risks;

- Tesla to Launch Robotaxi Service in San Francisco;

- Intel Shares Drop Over 7% Pre-Market Amid Widening Losses;

I. Market Report

Stock futures were relatively unchanged on Friday after the S&P 500 and Nasdaq Composite reached another record closing high, and major indexes looked to close out a positive week.

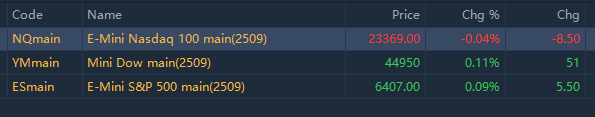

As of 03:50 PM Riyadh time, S&P 500 futures traded up 0.09%, while Nasdaq 100 futures traded around the flatline. Futures tied to the Dow Jones Industrial Average rose 51 points, or 0.11%.

As of 03:44 PM Riyadh Time, top pre-market movements are as follows:

Change | Price($) | Ticker (🌙 means "Shariah Compliant") |

94.3% | 10.94 | Linkhome Industries(LHAI.US) |

75.1% | 3.24 | Mill City Ventures III, Ltd.(MCVT.US) |

52.0% | 7.19 | 🌙 Fusion Fuel Green PLC Ordinary Shares - Class A(HTOO.US) |

37.0% | 1.96 | Eightco Holdings Inc. - Common Stock(OCTO.US) |

36.1% | 2.9 | 180 Life Sciences Corp Ordinary Shares(ATNF.US) |

-41.3% | 0.18 | 🌙 OceanPal Inc(OP.US) |

II. Flash Headlines

Top Investment Banks Recommend "Cheap" Hedging Amid Market Risks

Leading firms like Goldman Sachs and Citadel are advising clients to purchase affordable hedging tools to guard against potential US stock market losses. Despite record highs driven by strong earnings and trade agreements, risks loom. The "fear index" has hit its lowest since February, with the S&P 500 up 28% since April 8. This environment has made the cost of hedging against a market downturn relatively low. In an ETF tracking the S&P 500, the cost of protecting against a 10% drop is at its lowest since January.

Is It Time for the Fed to Change Its "Anchor"? Wall Street Debates the Relevance of the Federal Funds Rate

There is growing debate on Wall Street about the relevance of the federal funds rate, with voices like Cleveland Fed President Loretta Mester, JPMorgan's Teresa Ho, and Wrightson ICAP's Lou Crandall highlighting its limitations. Some suggest the Fed should consider alternative measures for assessing monetary supply. In an April event, Mester questioned the relevance of the federal funds rate compared to other interest rates.

As Tariff Deadline Looms, Will India Be the Next to Compromise?

India faces a tough decision between protecting its sensitive agricultural sectors and meeting US market access demands. With farmers being a crucial voting bloc, agriculture remains a key negotiation point. However, analysts suggest that India's trade talks with the UK, EU, and others have provided it with greater leverage. This strategy allows India to have more options and flexibility, reducing dependence on a single market and enhancing its negotiating power in the face of US tariff threats.

Is Trump's Pressure on Powell Reducing Fed Rate Cut Chances?

Wall Street Journal columnist James Mackintosh suggests that the clash between Trump and Fed Chair Jerome Powell highlights a conflict between institutional independence and populism. Trump's pressure is counterproductive, eroding investor confidence and raising long-term bond yields. After Trump's attacks, the 10-year term premium increased from zero to 0.84%.

III. Stocks To Watch

Tesla to Launch Robotaxi Service in San Francisco

Tesla Motors, Inc.(TSLA.US) plans to launch its Robotaxi service in San Francisco this weekend, according to a Business Insider report. The rollout has been expedited, with some owners invited to use the service. The geofenced area includes much of the Bay Area, extending to San Jose. Initially, safety drivers will be present. The California DMV confirmed a recent meeting with Tesla but noted no permit application for autonomous testing or deployment yet.

Nvidia Boosts H20 GPU Production for the China Market

The US has allowed NVIDIA Corporation(NVDA.US) to resume H20 GPU sales in China, benefiting its supply chain. Reports indicate Nvidia is ramping up production of these GPUs, which are predecessors to the GB series, namely the H100 and H200. Previously restricted from the Chinese market, Nvidia had maintained inventory, and with the recent policy change, further production is expected soon.

Intel Shares Drop Over 8% Pre-Market Amid Widening Losses

Intel Corporation(INTC.US) reported Q2 revenue of $12.86 billion, slightly above expectations of $11.88 billion, but net losses widened to $2.92 billion from $1.61 billion last year. Adjusted gross margin fell to 29.7%, down 9 percentage points from last year's 38.7%, and below the expected 36.6%. CEO Chen Liwu announced the cancellation of some factory projects and a shift to more conservative spending. Additionally, Intel plans a major restructuring, including a 15% workforce reduction.

Goldman Sachs Upgrades Apple Ahead of Q2 Earnings

Goldman Sachs has issued a "buy" rating for Apple Inc.(AAPL.US), setting a target price of $251. Ahead of Apple's Q2 2025 earnings report on July 31, Goldman predicts revenue and EPS will surpass expectations. They forecast Q2 revenue at $89.5 billion, a 4% year-over-year increase, exceeding the market's $89.1 billion estimate. EPS is expected to be $1.45, above the anticipated $1.42. Key drivers include a 11% growth in services revenue, strong performance across the iPhone, Mac, iPad, and wearables, and better-than-expected gross margin improvements due to optimized tariff costs and reduced forex headwinds.

Deckers Outdoor Shares Surge Over 12% Pre-Market on Strong Fiscal Q1 Performance

Shares of Deckers Outdoor Corporation(DECK.US) rose more than 12% pre-market after the company reported robust fiscal Q1 2026 results. Revenue reached $965 million, marking a 17% year-over-year increase and surpassing expectations. The EPS was $0.93, significantly higher than the predicted $0.68, exceeding forecasts by 36.76%.

Newmont Mining Surges Over 2% Pre-Market on Strong Q2 Earnings

Newmont Mining Corporation(NEM.US), the world's largest gold miner, reported impressive Q2 earnings amid a 40% surge in gold prices. Revenue reached $5.32 billion, up 20.9% year-over-year, exceeding expectations by $400 million. Non-GAAP EPS was $1.43, surpassing forecasts by $0.27. Net profit soared from $838 million last year to $2.06 billion.

Google Cloud Secures $1.2 Billion Deal with ServiceNow Amid Soaring AI Demand

Alphabet Inc. Class A(GOOGL.US) has signed a significant deal with ServiceNow, Inc.(NOW.US) worth over $1 billion to provide cloud computing services, including AI training and inference capabilities. This partnership marks a major win for Google Cloud as it aims to attract more large enterprises to its platform. The agreement is expected to boost revenue growth in Google’s rapidly expanding cloud computing business amid the AI boom.

Bezos Sells $1.5B Amazon Stock Ahead Of Q2 Report

Amazon.com, Inc.(AMZN.US) founder Jeff Bezos sold $1.5 billion worth of shares ahead of Q2 earnings, plans to sell more under a 10b5-1 plan. Read in detail>>

C3.ai Stock Plummets on CEO Health Concerns, Acquisition Likelihood Rises

C3.ai Inc(AI.US) saw its stock drop following news of CEO Tom Siebel's health issues, prompting the company to seek a successor. Wedbush analyst Dan Ives noted that the likelihood of C3.ai being acquired in the next 3 to 12 months has significantly increased. He maintains an "Outperform" rating on the stock with a price target of $35.

IV. Calendar

Day's Notable Event(s):

| Riyadh Time | Event | Previous Value | Forecast Value |

| 03:30 PM | Durable Goods Orders MoM | 16.4% | -9% |

| 03:30 PM | Durable Goods Orders Ex Transp MoM | 0.5% | -0.1% |

| 03:30 PM | Durable Goods Orders ex Defense MoM | 15.7% | -6% |

| 03:30 PM | Non Defense Goods Orders Ex Air | 2% | 0.1% |

| 08:00 PM | Baker Hughes Oil Rig Count | 422 | |

| 08:00 PM | Baker Hughes Total Rigs Count | 544 |