Please use a PC Browser to access Register-Tadawul

US Market Preview | Lucid Q1 Revenue Falls Short, Loss Less Than Expected; Trump Teases ‘Very Big’ Announcement; Fed Rate 97% Chance of No Change

Strive ASST | 0.86 | -6.36% |

CN Energy Group Inc CNEY | 0.65 | -19.25% |

New Century Logistics (BVI) Ltd. NCEW | 4.86 | +12.76% |

Watson Wyatt Worldwide Inc Ordinary Shares - Class A WW | 25.49 | -2.07% |

Apple Inc. AAPL | 278.28 | +0.09% |

- Trump Teases Big News Soon;

- Fed Likely to Hold Rates Steady Amid Tariff Tensions;

- Lucid Q1 Earnings: Revenue Miss, Smaller-Than-Expected Loss;

I. Market Report

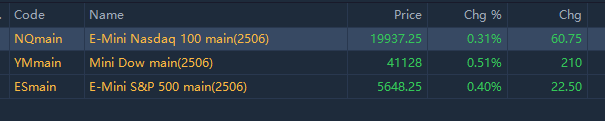

Stock futures advanced Wednesday as investors monitored the latest updates on US trade negotiations and looked toward the Federal Reserve interest rate announcement expected later in the day.

As of 03:41 PM Riyadh Time, Dow Jones Industrial Average futures added 210 points, or 0.51%. S&P 500 futures popped about 0.4%, along with Nasdaq 100 futures rose 0.31%.

As of 03:41 PM Riyadh Time, top pre-market movements are as follows:

Change | Price(US$) | Ticker (🌙 means "Shariah Compliant") | Additional Information |

140.2% | 1.46 | 🌙 Asset Entities Inc.(ASST.US) | After announcing merger with Strive Asset Management. |

70.6% | 0.28 | 🌙 CN Energy Group Inc(CNEY.US) | - |

53.4% | 3.42 | 🌙 New Century Logistics (BVI) Ltd.(NCEW.US) | Signing MOU with Soradynamics for drone logistics system. |

-54.4% | 0.36 | 🌙 WEIGHTWATCHERS INTERNATIONAL INC(WW.US) | Missed EPS and no FY25 guidance provided. |

II. Flash Headlines

Trump Teases Big News Soon

Donald Trump hints at a "big", "positive", and "significant" announcement scheduled for Thursday, Friday, or next Monday before his trip to the Middle East.

China Prepares for US Trade Talks in Switzerland

The Chinese Foreign Ministry announced Vice Premier He Lifeng's visit to Switzerland from May 9-12 for talks requested by the US. Spokesperson Lin Jian stated that China remains opposed to US tariffs. While open to dialogue, China insists it must be based on equality, respect, and reciprocity, rejecting any pressure or coercion. China is committed to protecting its interests and international justice.

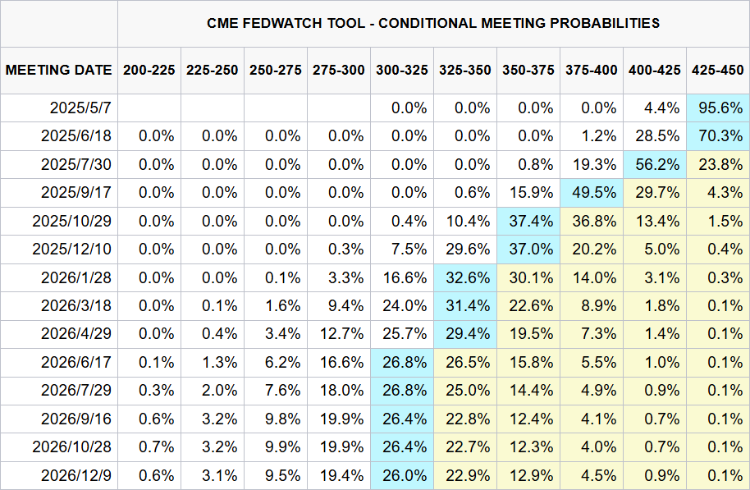

Fed Likely to Hold Rates Steady Amid Tariff Tensions

Despite pressure from Trump, the Fed is expected to maintain interest rates tonight, given strong US economic data and a softer government stance on tariffs. Attention will focus on comments about tariff impacts and future rate cut guidance. Jerome Powell may reiterate a cautious approach, monitoring how tariff policies affect economic data before deciding on further actions.

US Companies Boost Stock Buybacks Amid Policy Challenges

US-listed companies are countering Trump's policies by leveraging cash reserves for stock buybacks. Deutsche Bank reports that last week, $192 billion in buybacks were announced by S&P 500 firms, marking a record since 1995. Over the past three months, buyback plans have reached $518 billion, a historic high. This trend may continue, with Apple Inc.(AAPL.US) and American International Group, Inc.(AIG.US) potentially using bond proceeds for buybacks.

III. Stocks To Watch

Disney Shares Surge on Strong Q1 Results

Shares of Walt Disney Company(DIS.US) rose over 7% pre-market as the company reported Q1 adjusted earnings per share of US$1.45, surpassing expectations of US$1.20. Disney anticipates full-year adjusted earnings per share of US$5.75, exceeding market estimates of US$5.44. The company also projects an annual operating cash flow of US$17 billion.

Uber Shares Fall on Missed Revenue and Booking Estimates

Uber Technologies,Inc.(UBER.US) shares dropped over 5% pre-market as first-quarter revenue reached US$11.53 billion, below the expected US$11.62 billion. Adjusted EBITDA was US$1.87 billion, slightly above the forecast of US$1.84 billion. Total bookings were US$42.82 billion, missing the estimated US$43.14 billion. Uber projects second-quarter bookings between US$45.75 billion and US$47.25 billion, with market expectations at US$45.85 billion.

Rivian Sticks To R2 Price Despite Tariffs

Rivian Automotive, Inc.(RIVN.US) will maintain its US$45,000 starting price for the R2 EV despite tariff pressures, beating Q1 estimates with EPS of US$-0.41 and revenue of US$1.24 billion. Read in detail>>

AMD Profit Soars 476% in Q1

Advanced Micro Devices, Inc.(AMD.US) first-quarter financial results exceeded expectations with a 476% increase in net profit. The company's data centre division reported a 57% revenue increase, while client and gaming segments grew by 28%. AMD completed the acquisition of ZT Systems and provided a strong second-quarter revenue outlook slightly above analysts' expectations. Read in detail>>

Lucid Q1 Earnings: Revenue Miss, Smaller-Than-Expected Loss

Lucid Group Inc Ordinary Shares(LCID.US) reported first-quarter revenue of $235.05 million, missing analyst estimates of $250 million, according to Benzinga Pro. The electric vehicle maker reported a first-quarter loss of 20 cents per share, beating analyst estimates for a loss of 23 cents per share. Read in detail>>

IV. Calendar

Day's Notable Event(s):

| Riyadh Time | Event | Previous Value | Forecast Value |

| 02:00 PM | MBA 30-Year Mortgage Rate | 6.89% | |

| 02:00 PM | MBA Mortgage Applications | -4.2% | |

| 02:00 PM | MBA Mortgage Market Index | 223.7 | |

| 02:00 PM | MBA Mortgage Refinance Index | 649.0 | |

| 02:00 PM | MBA Purchase Index | 146.6 | |

| 05:30 PM | EIA Crude Oil Stocks Change | -2.696M | |

| 05:30 PM | EIA Gasoline Stocks Change | -4.002M | |

| 06:30 PM | 17-Week Bill Auction | 4.190% | |

| 09:00 PM | Fed Interest Rate Decision | 4.5% | 4.5% |

| 09:30 PM | Fed Press Conference | ||

| 10:00 PM | Consumer Credit Change | $-0.81B | $7.0B |