Please use a PC Browser to access Register-Tadawul

US Market Preview | PRAX Surges 186.0%; Snowflake Rises 6% on Palantir Partnership for AI Solutions; Fed Officials Back Rate Cuts, Futures Rise

Alibaba Group Holding Ltd. Sponsored ADR BABA | 155.68 153.63 | -0.78% -1.32% Pre |

Baidu, Inc. Sponsored ADR Class A BIDU | 125.01 122.40 | -2.57% -2.09% Pre |

Palantir PLTR | 183.57 183.71 | -2.12% +0.08% Pre |

Archer Aviation ACHR | 8.30 8.39 | -3.04% +1.08% Pre |

Salesforce.com, inc. CRM | 262.23 262.23 | -0.05% 0.00% Pre |

Most Important News

- Trump Admin Eyes More Rare Earth Investments;

- Tech Stocks Surge in Pre-Market Trading;

- Taiwan Semiconductor Manufacturing Co., Ltd. Reports Record Q3 Profit, Raises Outlook;

- Salesforce.com and Alphabet Inc. Expand AI Partnership;

US stock futures were higher on Thursday after big banks’ better-than-expected earnings and strong revenue forecasts from big technology firms shifted investors’ focus from a spate of recent escalations in the US-China trade war.

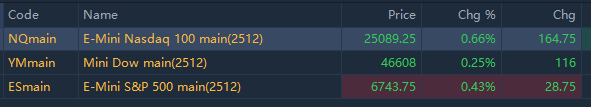

As of 03:49 PM Riyadh time, futures tied to the Dow Jones Industrial Average rose 116 points, or 0.25%. S&P futures gained 0.43%, while the Nasdaq 100 futures added 0.66%.

As of 03:50 PM Riyadh Time, top pre-market movements are as follows:

Change | Price($) | Ticker (🌙 means "Shariah Compliant") |

186.0% | 164.0 | PRAXIS PRECISION MEDICINES, INC.(PRAX.US) |

128.6% | 4.96 | rYojbaba Co. Ltd.(RYOJ.US) |

84.9% | 3.05 | Linkage Global Inc.(LGCB.US) |

82.2% | 0.54 | Vivakor, Inc.(VIVK.US) |

79.5% | 2.37 | 🌙 Mira Pharmaceuticals Inc Ordinary Shares(MIRA.US) |

-60.0% | 5.27 | Royce Global Value Trust, Inc.(RGT.US) |

Trump Admin Eyes More Rare Earth Investments

US President Trump's administration may invest in additional companies due to China's recent rare earth export restrictions, per Treasury Secretary Scott Bessent. Read in detail>>

Dalio: Gold Outshines AI in 2025

Ray Dalio claims on X that gold, not AI, could be the hottest asset for investors in 2025, sparking fresh debate. Read in detail>>

Trump to Visit Japan and South Korea in Late October

According to AFP, the US Treasury Secretary confirmed that President Trump will visit Japan in late October, before attending the 2025 APEC Leaders’ Informal Meeting in South Korea. The meeting is scheduled for October 31 to November 1 in Gyeongju. South Korea’s presidential office stated Trump is expected to arrive on October 29 and stay until October 30, though specific dates for the Japan visit remain undisclosed.

Fed Officials Discuss Rate Cuts

Federal Reserve Governor Waller suggested another rate cut is appropriate, citing weak labor market data over the past six weeks. He proposed a cautious approach, starting with a 25 basis point cut to assess market reactions before determining the next steps. Meanwhile, Governor Milan advocated for a 50 basis point cut but anticipated an actual reduction of 25 basis points.

China Responds to Potential US-China Trade Talks

During an October 16 press briefing, China's Ministry of Commerce addressed questions about potential trade talks following US Treasury Secretary Besant’s remarks on meeting Chinese Vice Premier He Lifeng before the APEC summit. Spokesperson He Yongqian stated that China remains open to equal consultations based on mutual respect, without confirming whether new trade talks will occur soon.

Cathie Wood's Ark Invest Shifts Stakes

Ark Invest, led by Cathie Wood, boosted Alibaba Group Holding Ltd. Sponsored ADR(BABA.US) and Baidu, Inc. Sponsored ADR Class A(BIDU.US) holdings by $26M, while cutting Palantir(PLTR.US) and Archer Aviation(ACHR.US) stakes. Read in detail>>

Tech Stocks Surge in Pre-Market Trading

Tech stocks showed strong pre-market gains, with Salesforce.com, inc.(CRM.US) rising over 6% and Micron Technology, Inc.(MU.US) up more than 3%. Additionally, NVIDIA Corporation(NVDA.US), Broadcom Limited(AVGO.US), and Oracle Corporation(ORCL.US) each increased by over 1%.

Semiconductor Stocks Climb in Pre-Market

Semiconductor stocks saw gains before the market opened, with Credo Technology rising over 2%. Broadcom Limited(AVGO.US), Arm Holdings(ARM.US), and Marvell Technology Group Ltd.(MRVL.US) each increased by over 1%, while Navitas Semiconductor Corp Ordinary Shares - Class A(NVTS.US) surged nearly 3%. Notably, Navitas Semiconductor Corp Ordinary Shares - Class A(NVTS.US)'s stock price has soared almost 96% over the past five trading days.

Taiwan Semiconductor Manufacturing Co., Ltd. Reports Record Q3 Profit, Raises Outlook

Taiwan Semiconductor Manufacturing Co., Ltd. Sponsored ADR(TSM.US) posted a record Q3 net profit of TWD452.3 billion, up 39% and beating forecasts of TWD405.47 billion. Revenue rose 30% to TWD989.92 billion. For Q4, sales are projected at $32.2-33.4 billion with a 59%-61% gross margin, exceeding estimates. $TSM expects 2025 revenue to grow at a mid-range of 30%, raising annual capital spending to $40-42 billion from $38-42 billion.

Salesforce.com and Alphabet Inc. Expand AI Partnership

Salesforce.com, inc.(CRM.US) and Alphabet Inc. Class A(GOOGL.US) announced an enhanced partnership, integrating Google's Gemini AI model into the Agentforce 360 platform. The collaboration aims to transform enterprise operations by boosting productivity through seamless integration of Agentforce 360 with Google Workspace tools in sales and IT services. Salesforce Gemini, already used in Gmail, will extend across the Workspace suite. $CRM projects annual revenue to exceed $60 billion by 2030, surpassing analysts' forecast of $58.37 billion.

Snowflake and Palantir Partner on Enterprise AI Solutions

Snowflake(SNOW.US) surged 6% pre-market as it announced a strategic partnership with Palantir(PLTR.US). The collaboration integrates Snowflake's AI Data Cloud with Palantir Foundry and AIP platforms, enabling businesses and public sector clients to build efficient data pipelines, accelerate analytics, and develop AI applications. Enhanced integration of Foundry with Snowflake Iceberg tables ensures seamless, bidirectional interaction without data replication, offering improved reliability and speed for shared customers.

| Riyadh Time | Event | Previous Value | Forecast Value |

| 03:00 PM | Fed Barkin Speech | ||

| 03:30 PM | Philadelphia Fed Manufacturing Index | 23.2 | 4 |

| 03:30 PM | Philly Fed Business Conditions | 31.5 | |

| 03:30 PM | Philly Fed CAPEX Index | 12.50 | |

| 03:30 PM | Philly Fed Employment | 5.6 | |

| 03:30 PM | Philly Fed New Orders | 12.4 | |

| 03:30 PM | Philly Fed Prices Paid | 46.80 | |

| 04:00 PM | Fed Barr Speech | ||

| 04:00 PM | Fed Miran Speech | ||

| 04:00 PM | Fed Waller Speech | ||

| 05:00 PM | Fed Bowman Speech | ||

| 05:00 PM | NAHB Housing Market Index | 32 | 34 |

| 05:30 PM | EIA Natural Gas Stocks Change | 80Bcf | |

| 06:30 PM | 4-Week Bill Auction | 4.030% | |

| 06:30 PM | 8-Week Bill Auction | 3.955% | |

| 07:00 PM | EIA Crude Oil Stocks Change | 3.715M | |

| 07:00 PM | EIA Gasoline Stocks Change | -1.6M | |

| 07:00 PM | 15-Year Mortgage Rate | 5.53% | |

| 07:00 PM | 30-Year Mortgage Rate | 6.30% | |

| 07:00 PM | EIA Crude Oil Imports Change | 0.731M | |

| 07:00 PM | EIA Cushing Crude Oil Stocks Change | -0.763M | |

| 07:00 PM | EIA Distillate Fuel Production Change | 0.21M | |

| 07:00 PM | EIA Distillate Stocks Change | -2.018M | |

| 07:00 PM | EIA Gasoline Production Change | 0.409M | |

| 07:00 PM | EIA Heating Oil Stocks Change | -0.06M | |

| 07:00 PM | EIA Refinery Crude Runs Change | 0.129M | |

| 07:45 PM | Fed Barkin Speech | ||

| 11:15 PM | Fed Miran Speech | ||

| 11:30 PM | API Crude Oil Stock Change | 2.78M | |

| 11:30 PM | Fed Balance Sheet | $6.59T | |

| 01:00 AM +1 | Fed Kashkari Speech |