Please use a PC Browser to access Register-Tadawul

US Market Preview | TELO Soars 173.6%; HSBC Forecasts CoreWeave to Plunge 76%; Morgan Stanley: US Equities Set for New Bull Run

Telomir Pharmaceuticals TELO | 1.40 1.41 | -1.41% +0.71% Pre |

Blaize Holdings Inc. Ordinary Shares - Class A BZAI | 2.24 2.25 | +4.19% +0.45% Pre |

Robot Consulting Co., Ltd. LAWR | 3.75 3.75 | Delist 0.00% Pre |

Expion360 Inc. XPON | 0.94 0.96 | -4.09% +2.14% Pre |

Bit Origin BTOG | 0.21 0.22 | +0.23% +2.34% Pre |

- US House Passes Key Crypto Bills;

- Morgan Stanley: US Equities Set for New Bull Run;

- HSBC Forecasts CoreWeave to Plunge 76%;

I. Market Report

Stock futures moved higher on Friday, a day after the S&P 500 posted a record close, as traders digested more earnings. The major U.S. stock benchmarks were also on track to post weekly gains.

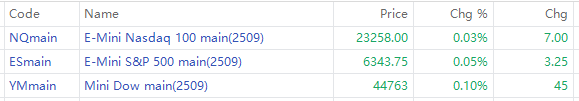

As of 03:10 PM Riyadh Time, S&P 500 futures added 0.05%, along with Nasdaq-100 futures. Futures linked to the Dow Jones Industrial Average added 45 points, or 0.1%.

As of 03:15 PM Riyadh Time, top pre-market movements are as follows:

Change | Price(US$) | Ticker (🌙 means "Shariah Compliant") | Additional Information |

173.6% | 3.31 | 🌙 Telomir Pharmaceuticals(TELO.US) | Due to promising Telomir-1 data on prostate cancer cells. |

87.8% | 5.69 | 🌙 Blaize Holdings Inc. Ordinary Shares - Class A(BZAI.US) | $120 million hybrid AI platform agreement with Starshine. |

46.0% | 5.14 | Robot Consulting Co., Ltd.(LAWR.US) | - |

39.4% | 1.45 | 🌙 Expion360 Inc.(XPON.US) | - |

31.2% | 0.83 | Bit Origin(BTOG.US) | Plans to create Dogecoin treasury drive gains.; Stock soared by 90.2% on last trading day |

II. Flash Headlines

US House Passes Key Crypto Bills

House of Representatives passes GENIUS Act, CLARITY Act, and Anti-Central Bank Digital Currency bill, cheered by crypto industry leaders like SEC Chair Paul Atkins, Coinbase CEO Brian Armstrong, and Circle CEO Jeremy Allaire, but criticized by Bitcoin critic Peter Schiff.

Morgan Stanley's Mike Wilson Predicts Short-Term S&P 500 Pullback Before New Bull Market

Morgan Stanley Chief Investment Officer Mike Wilson, formerly one of Wall Street's most prominent bears, now forecasts a new bull market for U.S. stocks but warns the S&P 500 may first experience a near-term decline, citing potential pressures from corporate earnings and macroeconomic headwinds before the anticipated rally takes hold.

Fed Governor Waller Calls for Rate Cut

Federal Reserve Governor Christopher Waller says policymakers should cut interest rates this month to support a softening labor market, despite most colleagues believing employment remains solid.

Crypto Market Value Hits US$4T

Global cryptocurrency market cap reaches US$4.003T. Bitcoin accounts for 59.91%, while altcoins like Ripple, Solana, Dogecoin, and Cardano see stronger gains. US "Crypto Week" progresses with key bills passed.

Citi Upgrades EM Local Bonds to "Overweight" on Dovish Fed Bets, Dollar Weakness

Citigroup analysts led by Dirk Willer and Adam Pickett upgraded emerging market local currency sovereign bonds to "overweight," anticipating Fed rate cuts in late 2025 despite early tariff-induced inflation signals, as slowing service prices may keep inflation contained - a scenario that typically benefits EM assets amid dollar weakness.

III. Stocks To Watch

Meta Hires AI Experts From Apple

Meta Platforms(META.US) hires Mark Lee and Tom Gunter from Apple for its Superintelligence Lab. Their boss, Ruoming Pang, was also poached by Meta earlier this month.

Netflix Raises 2025 Revenue Guidance

Netflix, Inc.(NFLX.US) boosts full-year revenue guidance to US$45.2B, citing member growth, strong content, and accelerating ad sales, supported by global ad tech rollout and new content partnerships.

HSBC Forecasts CoreWeave to Plunge 76%

HSBC assigned a "Reduce" rating to AI cloud service provider CoreWeave(CRWV.US) with a $32 price target - 76% below Thursday's closing price - citing low returns, lack of competitive differentiation, and heavy reliance on Microsoft Corporation(MSFT.US) and NVIDIA Corporation(NVDA.US) .

American Express Q2 Revenue And Earnings Beat Estimates

American Express Company(AXP.US) reported Q2 earnings of $4.08 per share, beating expectations of $3.87; Q2 revenue was $17.86 billion, above the estimated $17.71 billion. FedEx still anticipates full-year revenue growth of 8-10%. The company continues to expect full-year earnings per share of $15-15.5, while the market estimates $15.24.

3M Q2 Adjusted EPS Up 12%

3M Company(MMM.US) reported second-quarter GAAP sales of $6.3 billion (up 1.4% YoY) with operating margin declining 230 basis points to 18.0%, while adjusted sales reached $6.2 billion (up 1.5%) with adjusted EPS growing 12% to $2.16 - offsetting a 38% drop in GAAP EPS to $1.34, reflecting ongoing restructuring impacts.

IV. Calendar

Day's Notable Event(s):

| Riyadh Time | Event | Previous Value | Forecast Value |

| 03:30 PM | Building Permits Prel | 1.394M | 1.37M |

| 03:30 PM | Housing Starts | 1.256M | 1.29M |

| 03:30 PM | Building Permits MoM Prel | -2% | -1.7% |

| 03:30 PM | Housing Starts MoM | -9.8% | 2.7% |

| 05:00 PM | Michigan Consumer Sentiment Prel | 60.7 | 60.5 |

| 05:00 PM | Michigan 5 Year Inflation Expectations Prel | 4% | 4.0% |

| 05:00 PM | Michigan Consumer Expectations Prel | 58.1 | 58 |

| 05:00 PM | Michigan Current Conditions Prel | 64.8 | 64.6 |

| 05:00 PM | Michigan Inflation Expectations Prel | 5% | 4.7% |

| 08:00 PM | Baker Hughes Oil Rig Count | 424 | |

| 08:00 PM | Baker Hughes Total Rigs Count | 537 |