Please use a PC Browser to access Register-Tadawul

US Market Preview | Trade War Hits Streaming, Netflix Falls 4.45% Pre-Market; OPEC+ Growth Hits Oil Prices; Buffett Names Greg Abel as Successor

Hyperscale Data Inc. Ordinary Shares GPUS | 0.26 | -7.85% |

NuCana plc NCNA | 3.72 | -8.15% |

N2OFF, Inc. - Common Stock NITO | 3.02 | -1.31% |

SciSparc Ltd Ordinary Shares SPRC | 1.84 | -3.66% |

Haoxi Health Technology Ltd. HAO | 1.05 | -1.87% |

- Trump Has No Plans to Replace Fed Chair Powell, Considers Permanent Tariffs;

- Streaming Stocks Fall Amid Tariff Announcement;

- Lucid Partners with KAUST to Advance EV Technology;

I. Market Report

Stock futures fell to start the week as investors hoping for news of trade deals instead had to grapple with another set of tariffs after President Donald Trump announced surprise levies on movies made outside the U.S.

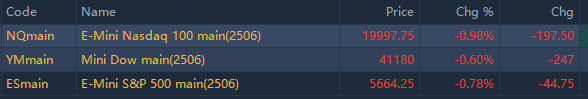

As of 03:40 PM Riyadh Time, Futures tied to the S&P 500 fell around 0.78%. Dow Jones Industrial Average futures shed 246 points, or 0.6%, and Nasdaq-100 futures lost 0.98%.

As of 03:34 PM Riyadh Time, top pre-market movements are as follows:

Change | Price(US$) | Ticker (🌙 means "Shariah Compliant") |

156.2% | 3.51 | 🌙 Hyperscale Data Inc. Ordinary Shares(GPUS.US) |

101.3% | 0.93 | 🌙 NuCana plc(NCNA.US) |

92.2% | 0.54 | 🌙 N2OFF, Inc. - Common Stock(NITO.US) |

32.2% | 0.38 | 🌙 SciSparc Ltd Ordinary Shares(SPRC.US) |

-28.0% | 0.95 | 🌙 Haoxi Health Technology Ltd.(HAO.US) |

-27.4% | 1.3 | 🌙 Nexalin Technology, Inc.(NXL.US) |

II. Flash Headlines

Trump Has No Plans to Replace Fed Chair Powell, Considers Permanent Tariffs

President Trump stated he does not intend to dismiss Federal Reserve Chair Jerome Powell, despite criticizing the pace of interest rate cuts. In an NBC interview, Trump mentioned he could replace Powell quickly if desired, but sees no need to do so. Trump faces increasing pressure from his tariff policies. Powell's term as Chair ends in May 2026.

Dollar Decline Spurs Surge in Asian Currencies

Trump's unpredictable tariff policies have heightened recession fears in the U.S., leading investors to reduce their holdings in American assets. Speculative traders are increasingly bearish on the dollar, reaching a peak since September. Bloomberg reports that Asian currency indices hit their highest levels since 2022, while emerging market forex returns set a record high. Goldman Sachs analysts, led by Kamakshya Trivedi, suggest that rising recession risks and potential interest rate cuts could further boost Asian currencies like the yuan, Taiwanese dollar, and Malaysian ringgit.

OPEC+ Boost Hits Oil Prices

OPEC and allies' decision to increase production by more than 400,000 barrels per day from June caused oil prices to fall sharply, with Brent crude down 4.6% to US$58 a barrel and WTI near US$56.

III. Stocks To Watch

Streaming Stocks Fall Amid Tariff Announcement

U.S. President Trump announced a 100% tariff on foreign films, dropping streaming stocks. Netflix, Inc.(NFLX.US) fell nearly 5%, Walt Disney Company(DIS.US) declined over 3%, and Amazon.com, Inc.(AMZN.US) decreased more than 1.5% in pre-market trading.

Gold Stocks Rise as Spot Gold Surpasses US$3,300

Spot gold prices climbed above US$3,300, boosting US-listed gold stocks in pre-market trading. Gold Fields Limited Sponsored ADR(GFI.US) surged over 8%, Harmony Gold Mining Co. Ltd. Sponsored ADR(HMY.US) increased more than 6%, and Coeur Mining, Inc.(CDE.US) rose over 3%.

NVIDIA Shares Dip Amid Proposed AI Chip Legislation

NVIDIA Corporation(NVDA.US) fell over 1% pre-market as US Representative Bill Foster (Democrat-Illinois) plans to introduce legislation to monitor AI chip sales. The proposal aims to prevent the smuggling of AI hardware, including NVIDIA's products, into China, which could impact the company's international sales strategies.

Greg Abel to Become Berkshire Hathaway CEO in 2026

Berkshire Hathaway Inc. Class B(BRK.B.US) / Berkshire Hathaway Inc. Class A(BRK.A.US) announced that its board voted on May 4 to appoint Greg Abel as CEO starting January 1, 2026. Warren Buffett will remain as Chairman. As of the report's release, shares of Berkshire Hathaway Inc. Class B(BRK.B.US) fell over 2%.

BP Shares Rise on Shell Acquisition Speculation

Shell PLC(SHEL.US) is reportedly exploring the possibility of acquiring BP p.l.c. Sponsored ADR(BP.US), according to insiders. No action has been taken yet, as Shell monitors oil prices and BP's declining stock value, which has dropped nearly 30% in the past year. Shell's decision may depend on further devaluation or BP signaling openness to offers. Pre-market, $BP shares rose nearly 3%.

Lucid Partners with KAUST to Advance EV Technology

Lucid Group Inc Ordinary Shares(LCID.US) and King Abdullah University of Science and Technology have announced a strategic partnership aimed at advancing electric vehicle technology. The collaboration leverages Saudi Arabia's resources to enhance Lucid Group's leadership in the sector. The university, known for its focus on science and technology innovation, is expected to contribute significantly to shaping the future of EV advancements.

IV. Calendar

Day's Notable Event(s):

| Riyadh Time | Event | Previous Value | Forecast Value |

| 04:45 PM | S&P Global Composite PMI Final | 53.5 | 51.2 |

| 04:45 PM | S&P Global Services PMI Final | 54.4 | 51.4 |

| 05:00 PM | ISM Services PMI | 50.8 | 50.3 |

| 05:00 PM | ISM Services Business Activity | 55.9 | 52.9 |

| 05:00 PM | ISM Services Employment | 46.2 | 47 |

| 05:00 PM | ISM Services New Orders | 50.4 | 49.2 |

| 05:00 PM | ISM Services Prices | 60.9 | 61.2 |

| 06:30 PM | 3-Month Bill Auction | 4.2% | |

| 06:30 PM | 6-Month Bill Auction | 4.065% | |

| 08:00 PM | 3-Year Note Auction | 3.784% |