Please use a PC Browser to access Register-Tadawul

US Market Preview | VLCN Up 180.2%; US June Retail Sales Beat; Trump Clarifies Powell Firing Rumor; SRPT Soars 30% on Strategic Restructuring Plan

Volcon, Inc. VLCN | 10.57 | 0.00% |

22nd Century Group, Inc. XXII | 0.98 | -6.67% |

Bolt Projects Holdings Inc. Ordinary Shares - Class A BSLK | 1.61 | -11.05% |

Above Food Ingredients Inc. Ordinary Shares ABVE | 1.76 | -3.83% |

Windtree Therapeutics, Inc. WINT |

|

- US June Retail Sales Rise 0.6%, Topping Forecasts;

- JPMorgan: Fed Independence Is a "False Notion";

- Trump Clarifies Powell Firing Rumor;

I. Market Report

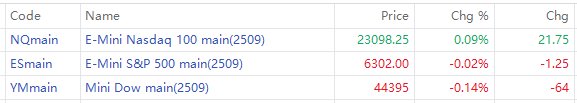

US stock futures were little changed on Thursday as traders pored through the latest earnings and weighed the latest in President Donald Trump’s feud with Federal Reserve Chairman Jerome Powell.

As of 03:10 PM Riyadh Time, futures tied to the Dow Jones Industrial Average fell 64 points, or 0.14%. S&P 500 futures and Nasdaq 100 futures hovered near the flatline.

As of 03:15 PM Riyadh Time, top pre-market movements are as follows:

Change | Price(US$) | Ticker (🌙 means "Shariah Compliant") | Additional Information |

180.2% | 25.85 | Volcon, Inc.(VLCN.US) | - |

88.0% | 8.61 | 22nd Century Group, Inc.(XXII.US) | Expansion of VLN partnerships causes pre-market surge. |

76.5% | 3.9 | Bolt Projects Holdings Inc. Ordinary Shares - Class A(BSLK.US) | - |

63.7% | 2.75 | Above Food Ingredients Inc. Ordinary Shares(ABVE.US) | - |

60.0% | 1.44 | 🌙 Windtree Therapeutics, Inc.(WINT.US) | - |

II. Flash Headlines

US June Retail Sales Rise 0.6%, Topping Forecasts

U.S. retail sales increased 0.6% MoM in June, marking the strongest growth since March and exceeding market expectations of a 0.1% gain, signaling resilient consumer demand.

US Jobless Claims Fall to 221K, Below Estimates

Initial jobless claims dropped to 221,000 for the week ending July 12, coming in below the 235,000 consensus estimate and showing improvement from the prior week's revised 228,000 figure, suggesting ongoing labor market resilience.

Apollo Economist Warns AI Bubble May Dwarf Dot-Com Crisis

Apollo Global Management, LLC Class A(APO.US) Chief Economist Torsten Sløk issued a stark warning that the AI-driven market surge shows more extreme valuations than the 1990s dot-com bubble, with the S&P 500's top 10 companies - many central to the AI revolution - now trading at more inflated multiples than during the tech mania's peak.

JPMorgan: Fed Independence "Myth" to Fuel Stock Rally as Rate Cut Bets Grow

JPMorgan's Ilan Benhamou contends the Federal Reserve's political independence is a "myth," predicting continued US equity market gains amid rising rate cut expectations, while recommending clients maintain long positions on the S&P 500 and VIX index as investors shift toward high-risk assets like crypto and AI stocks.

Trump Clarifies Powell Firing Rumor

Rumor of Fed Chairman Powell's dismissal causes market turmoil . Gold rises, dollar falls, US stocks drop. Trump clarifies 'no action planned' an hour later, markets rebound.

III. Stocks To Watch

Google Sets August 20 Event for New Pixel Phone, Watch & Headphones Launch

Alphabet Inc. Class A(GOOGL.US) has officially scheduled its Pixel product launch event for August 20, 2025, at 1 PM ET in New York, where the tech giant will unveil its latest Pixel smartphones, smartwatches, and headphones, according to Wednesday's invitations.

TSMC Q2 Profit Jumps 61% on AI Chip Boom, Beating Estimates

Taiwan Semiconductor Manufacturing Co., Ltd. Sponsored ADR(TSM.US) reported a 61% year-over-year surge in Q2 net profit to NT$398.27 billion ($12.7 billion), exceeding analysts' expectations, as robust demand for AI chips drove revenue to NT$933.8 billion ($31.7 billion) - both topping consensus forecasts.

Novartis Launches $10B Buyback, Raises Guidance as Drug Demand Boosts Q2

Swiss pharma giant Novartis AG Sponsored ADR(NVS.US) announced a $10 billion share repurchase program and raised its full-year profit outlook after strong demand for key drugs drove better-than-expected Q2 sales and earnings.

Opendoor Surges 36% Pre-Market, Up 90% This Week Amid Social Media Buzz

U.S. instant home-buying platform OpenDoor Technologies, Inc.(OPEN.US) saw its shares jump over 36% in pre-market trading, extending this week's rally to more than 90%, as discussions about the company surged across multiple social media platforms.

Sarepta Therapeutics Soars 30% Pre-Market on Strategic Restructuring Plan

US biotech firm Sarepta Therapeutics, Inc.(SRPT.US) surged nearly 30% in pre-market trading after announcing a strategic reorganization plan focused on cost savings and regulatory solutions, sparking investor optimism.

PepsiCo Q2 Beats EPS, Sales Estimates

PepsiCo, Inc.(PEP.US) Q2 EPS US$2.12 beats US$2.03 est; sales US$22.726B beats US$22.292B est.

IV. Calendar

Day's Notable Event(s):

| Riyadh Time | Event | Previous Value | Forecast Value |

| 03:30 PM | Retail Sales MoM | -0.9% | 0.2% |

| 03:30 PM | Export Prices MoM | -0.9% | -0.1% |

| 03:30 PM | Import Prices MoM | 0% | 0.1% |

| 03:30 PM | Initial Jobless Claims | 227K | 230.0K |

| 03:30 PM | Philadelphia Fed Manufacturing Index | -4.0 | -3 |

| 03:30 PM | Retail Sales Control Group MoM | 0.4% | 0.3% |

| 03:30 PM | Retail Sales Ex Autos MoM | -0.3% | 0.2% |

| 03:30 PM | Continuing Jobless Claims | 1965K | 1970.0K |

| 03:30 PM | Export Prices YoY | 1.7% | 1.9% |

| 03:30 PM | Import Prices YoY | 0.2% | 0.2% |

| 03:30 PM | Jobless Claims 4-week Average | 235.5K | 237.0K |

| 03:30 PM | Philly Fed Business Conditions | 18.3 | |

| 03:30 PM | Philly Fed CAPEX Index | 14.50 | |

| 03:30 PM | Philly Fed Employment | -9.8 | |

| 03:30 PM | Philly Fed New Orders | 2.3 | |

| 03:30 PM | Philly Fed Prices Paid | 41.40 | |

| 03:30 PM | Retail Sales Ex Gas/Autos MoM | -0.1% | 0.1% |

| 03:30 PM | Retail Sales YoY | 3.3% | 3.6% |

| 05:00 PM | Business Inventories MoM | 0% | -0.1% |

| 05:00 PM | Fed Kugler Speech | ||

| 05:00 PM | NAHB Housing Market Index | 32 | 31 |

| 05:00 PM | Retail Inventories Ex Autos MoM | 0.3% | 0.2% |

| 05:30 PM | EIA Natural Gas Stocks Change | 53Bcf | |

| 06:30 PM | 4-Week Bill Auction | 4.235% | |

| 06:30 PM | 8-Week Bill Auction | 4.275% | |

| 07:00 PM | 15-Year Mortgage Rate | 5.86% | |

| 07:00 PM | 30-Year Mortgage Rate | 6.72% | |

| 08:30 PM | Fed Cook Speech | ||

| 11:00 PM | Net Long-term TIC Flows | $-7.8B | |

| 11:00 PM | Foreign Bond Investment | $-40.8B | |

| 11:00 PM | Overall Net Capital Flows | $-14.2B | |

| 11:30 PM | Fed Balance Sheet | $6.66T | |

| 01:30 AM +1 | Fed Waller Speech |