Please use a PC Browser to access Register-Tadawul

Utah Medical Products (UTMD) Margin Decline Challenges Steady Compounder Narrative

Utah Medical Products, Inc. UTMD | 67.82 | +1.88% |

Utah Medical Products (UTMD) closed FY 2025 with Q4 revenue of US$9.0 million and basic EPS of US$0.80, setting the tone for a year where earnings and sales moved within a relatively tight range. Over the past six quarters, quarterly revenue has run between US$9.0 million and US$10.0 million while basic EPS has ranged from about US$0.80 to US$1.02. This gives investors a clear look at how top line and EPS have tracked together through FY 2024 into FY 2025. With trailing net margins easing and recent earnings softening versus the prior year, the latest print keeps the focus firmly on how efficiently the business is converting sales into profit.

See our full analysis for Utah Medical Products.With the headline numbers on the table, the next step is to see how this earnings profile lines up against the prevailing stories around Utah Medical Products, including what investors expect on growth, resilience and profitability.

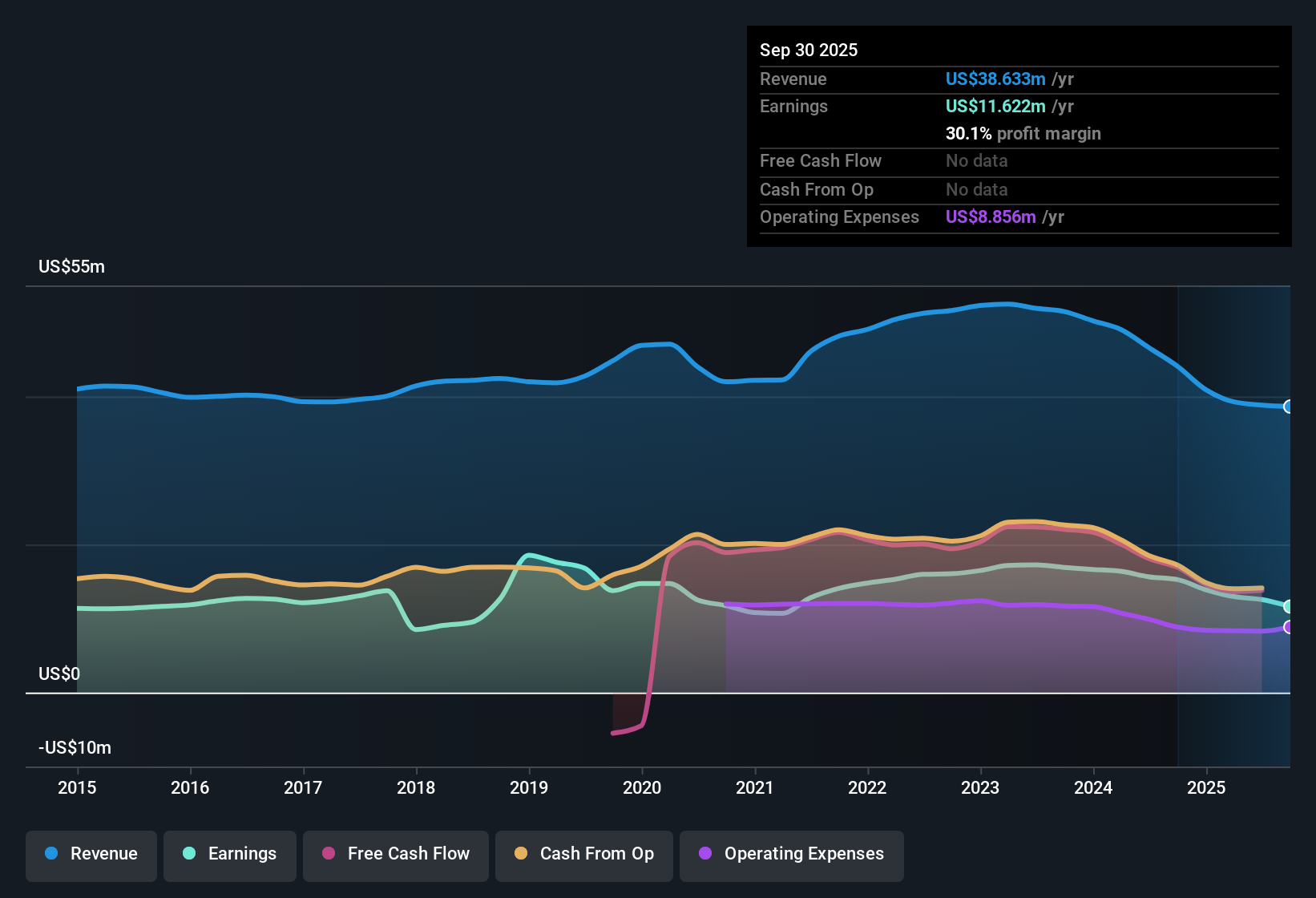

Margins Ease From 34.6% To 30.1%

- Over the last 12 months, net profit margin was 30.1% compared with 34.6% a year earlier, alongside trailing 12 month net income of US$11.6 million on US$38.6 million of revenue at the latest data point.

- Bears often focus on pressure in profitability, and the margin slide gives them data to point to, but it also needs context:

- Trailing 12 month EPS moved from US$4.34 at the 2024 Q2 snapshot to US$3.54 by 2025 Q3, while quarterly EPS in FY 2025 stayed in a fairly tight band between about US$0.80 and US$0.94, so the recent softness sits against a still profitable base.

- The company earned US$2.57 million of net income on US$9.04 million of Q4 2025 revenue, which keeps profitability positive even as margins have eased, rather than pointing to a sudden break in the business model.

Five Year EPS Trend Versus Latest Dip

- Trailing earnings growth averaged 1.3% per year over the past five years, yet the most recent trailing 12 month snapshot shows EPS stepping down from US$3.96 at 2024 Q4 to US$3.54 at 2025 Q3.

- What stands out for a bullish reader is how a long period of modest growth now sits next to a weaker recent patch:

- Across the last six quarters, quarterly net income excluding extra items ranged from US$2.57 million to US$3.56 million, which points to earnings that move but do not swing wildly, even as the latest year on year change is negative.

- Supporters who like steadier compounders may cite that 1.3% five year growth record, yet the recent decline in trailing EPS is a clear data point that challenges any simple story of uninterrupted progress and encourages you to check how durable those earnings really look.

P/E Of 16.8x And 2.03% Yield

- The shares trade on a trailing P/E of 16.8x versus peer and US Medical Equipment industry averages of 30.5x and 31.1x, while the stock price of US$61.06 sits well below a DCF fair value estimate of US$111.89 and the trailing dividend yield is 2.03%.

- Supporters of the stock see these numbers as a valuation and income combination that stands out against peers, yet the operating trends keep the story balanced:

- The gap between the current price of US$61.06 and the DCF fair value of US$111.89 suggests the shares trade about 45.4% below that modelled estimate. This aligns with bulls who argue the market is pricing in the weaker recent margins heavily.

- At the same time, the drop in net margin from 34.6% to 30.1% and the negative most recent year over year earnings movement are concrete reasons some investors may hesitate to pay even the current 16.8x multiple without seeing how profitability develops.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Utah Medical Products's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Utah Medical Products is still profitable, but the slide in net margin from 34.6% to 30.1% and softer trailing EPS raise questions about earnings resilience.

If that recent earnings wobble makes you want steadier compounding, check out CTA_SCREENER_STABLE_GROWTH to focus on companies with a clearer record of consistent revenue and EPS trends.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.