Please use a PC Browser to access Register-Tadawul

UWM Holdings (UWMC): Assessing Valuation as Earnings Hopes and Forecast Uncertainty Drive Market Reactions

UWM Holdings Corp. Class A UWMC | 4.84 | +4.64% |

UWM Holdings (UWMC) is in focus as its upcoming quarterly earnings report on November 6 draws closer. This is stirring activity among investors who are weighing expectations for higher revenues against more cautious earnings forecasts.

UWM Holdings has seen notable momentum lately, with its share price jumping 34.5% over the past 90 days as investors focus on the upcoming earnings and shifting sentiment around growth prospects. However, its 1-year total shareholder return remains slightly negative, indicating that recent gains are building off a lower base.

If you're keeping an eye on market dynamics sparked by upcoming earnings events, now is a smart moment to broaden your search and discover fast growing stocks with high insider ownership

With shares rallying in advance of earnings, investors are left to wonder whether UWM Holdings' recent surge has left the stock undervalued, or if the market is already factoring in signs of future growth and optimism.

Most Popular Narrative: 11.3% Undervalued

According to the most widely followed narrative, UWM Holdings is trading at a discount to its estimated fair value of $6.59, with the last close at $5.85. The gap suggests market skepticism about the company’s growth scenario, despite analyst expectations.

Continued investment and successful deployment of advanced AI tools (like BOLT, ChatUWM, LEO, and Mia) are materially increasing broker productivity, efficiency, and borrower retention. This provides UWM with lower unit costs and the ability to handle significantly higher loan volumes without a proportional increase in costs, which should drive long-term revenue growth and operating margin expansion.

Want to know the numbers powering this valuation? The narrative hinges on aggressive growth projections and a future profit multiple more often seen in high-growth tech stocks. Find out which assumptions are fueling this surprisingly bullish fair value.

Result: Fair Value of $6.59 (UNDERVALUED)

However, persistently high interest rates or shifts in broker preferences could challenge UWM Holdings’ growth outlook and put pressure on margins moving forward.

Another View: Multiples Tell a Different Story

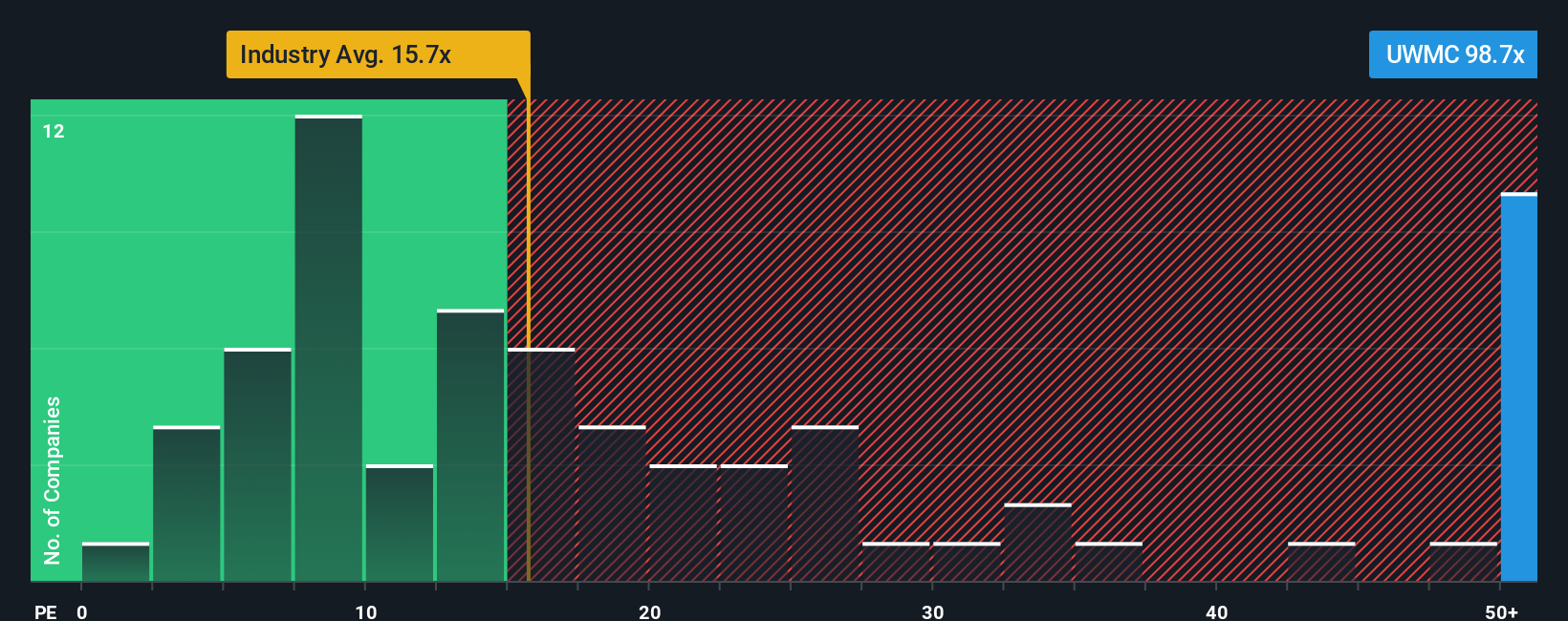

Looking at UWM Holdings through the lens of its price-to-earnings ratio paints a much less optimistic picture than fair value models suggest. The stock trades at 107.9x earnings, far above both the industry average (15.1x) and peers (9.4x), and well above a fair ratio of 34.6x. This hefty premium may signal overvaluation risk rather than an opportunity, especially if market sentiment changes.

Build Your Own UWM Holdings Narrative

If you have a different perspective or prefer a hands-on approach, you can analyze the data and shape your own narrative in just a few minutes. Do it your way

A great starting point for your UWM Holdings research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment opportunities?

Now is your chance to get ahead of the crowd and pinpoint game-changing stocks that match your financial goals. Don’t get left behind by sticking to just one idea.

- Uncover market gems with real growth potential by checking out these 840 undervalued stocks based on cash flows that are priced below their intrinsic worth, offering powerful value opportunities.

- Catch the next big tech wave by zeroing in on innovation front-runners. See these 27 AI penny stocks making breakthroughs in artificial intelligence.

- Spot companies rewarding shareholders through steady income growth when you review these 18 dividend stocks with yields > 3% with attractive yields over 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.