Please use a PC Browser to access Register-Tadawul

VEON (NasdaqCM:VEON): Assessing Valuation Following S&P Global BMI Inclusion and Digital Finance Expansion

VEON Ltd. Sponsored ADR VEON | 52.75 | +0.41% |

If you have VEON (NasdaqCM:VEON) on your watchlist, this is a moment that deserves a closer look. The company has just been added to the S&P Global BMI Index, a move that usually puts a stock on the radar of a much wider pool of investors, especially institutions and funds that follow major indices. Meanwhile, the fanfare around the JazzCash Experience Lounge in Pakistan showcases how VEON is setting itself apart in the fast-growing world of digital financial services, particularly in emerging markets that are making big strides toward cashless economies.

Both these events arrive at a time when momentum for VEON has been picking up. Over the past year, the stock has delivered a return of 84%, while the past three months alone have seen a gain of 33%. Recent months have included new product launches and clear progress on digital inclusion efforts. However, most of the activity has been concentrated since these announcements. The question is not just how much room remains for VEON to grow, but also whether the market is recalibrating how it values both the company and its leadership role in digital finance.

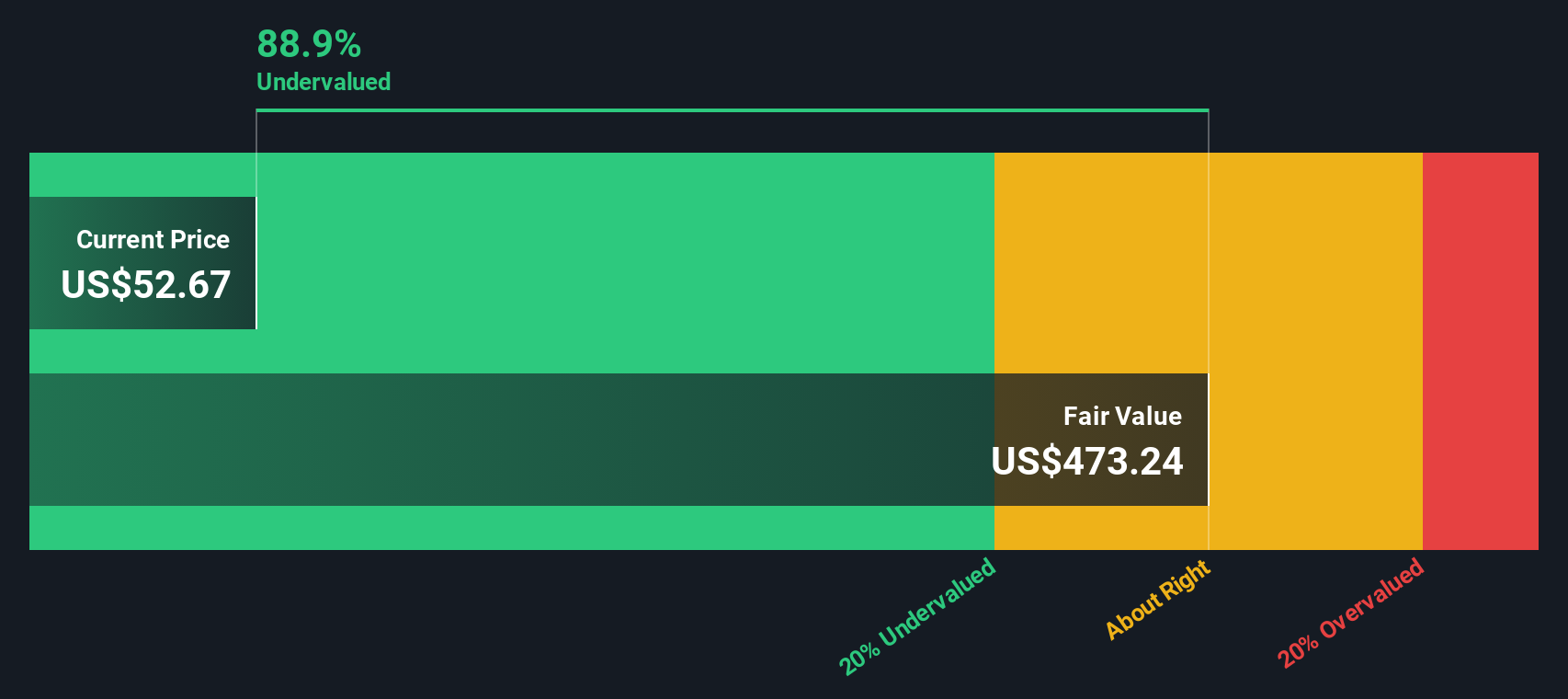

After this wave of positive developments and strong stock gains, the question remains whether there is more upside left for investors or if the market has already priced in VEON's next stage of growth.

Most Popular Narrative: 21.1% Undervalued

According to the most widely followed narrative, VEON shares are trading well below consensus fair value. Analysts believe the market has not yet fully priced in the company's future growth prospects, digital innovation, and operational restructuring.

"Ongoing shift toward an asset-light operational model and restructuring (including tower sales, selective market exits, and 4G-focused infrastructure investments) is driving operational efficiency, freeing up capital for reinvestment or shareholder returns, and improving ROIC, which is expected to boost long-term net margins and capital returns."

Curious why analysts see so much upside? The narrative points to bold financial moves, a profit mix in transition, and ambitious future expectations baked into that fair value. Want to uncover the exact metrics, projections, and strategic maneuvers that set this target price apart from the market's current view? The answers may surprise you because there could be more to the story than recent returns or headline revenue growth suggest.

Result: Fair Value of $69.64 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, there are still real risks. Macroeconomic turmoil or currency shocks in VEON’s core markets could limit the optimistic outlook for future earnings growth.

Find out about the key risks to this VEON narrative.Another View: What Does Our DCF Model Say?

Looking through the lens of our DCF model offers a fresh angle. This approach suggests VEON is still undervalued, supporting the conclusions drawn from the multiples analysis. However, do all methods agree for the same reasons?

Build Your Own VEON Narrative

If you have a different perspective or want to dig deeper into the numbers yourself, shaping your own take is quick and easy. Do it your way.

A great starting point for your VEON research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

Ready to Unlock More Investment Opportunities?

Your journey doesn't have to stop with VEON. Set yourself up for success by targeting unique stocks that could reshape your portfolio. Miss these, and you might miss tomorrow’s winners.

- Spot companies spearheading the AI revolution and catch early movers in tech with AI penny stocks shaping everything from automation to analytics.

- Capture hidden gems that trade below their true worth by using undervalued stocks based on cash flows to zero in on stocks primed for a potential re-rating.

- Amplify your passive income with steady yield plays and handpick market favorites through dividend stocks with yields > 3% offering consistent returns over time.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.