Please use a PC Browser to access Register-Tadawul

Veracyte (VCYT) Is Up 15.1% After Raising 2025 Revenue Guidance Amid Strong Testing Growth

Veracyte, Inc. VCYT | 36.19 36.19 | +3.82% 0.00% Pre |

- In August 2025, Veracyte raised its full-year 2025 revenue guidance to a range of US$477 million to US$483 million, citing strong year-over-year revenue growth and increased expectations for its testing business despite a pause in its Envisia test.

- This update, together with reporting improved revenues for both the second quarter and first half of 2025, signals management’s growing confidence in ongoing operational momentum and future performance.

- We will now assess how Veracyte’s higher 2025 revenue guidance and robust quarterly growth shape its investment narrative moving forward.

Find companies with promising cash flow potential yet trading below their fair value.

Veracyte Investment Narrative Recap

To own Veracyte shares, investors need conviction in the company’s ability to achieve continued demand for its genomic cancer diagnostics and successfully expand its test offerings. The recent upward revision in 2025 revenue guidance reinforces optimism around core test growth, but highlights revenue concentration in Decipher and Afirma. In the short term, the biggest near-term catalyst remains solid uptake of these products, while the most pressing risk is heightened reimbursement and competitive pressure, neither of which is materially changed by this guidance update.

The launch of the Decipher Prostate Metastatic Genomic Classifier, covered by Medicare, stands out as a recent development directly supporting Veracyte’s growth story. As this new test enters the market, it supports management’s revised guidance, underlining the importance of strong payer coverage and further market penetration for revenue diversification. However, this will only drive sustainable growth if adoption meets expectations and reimbursement hurdles do not materialize.

On the other hand, investors should keep in mind that even as guidance rises, concentrated risk in just a couple of core products means revenue visibility can change quickly if ...

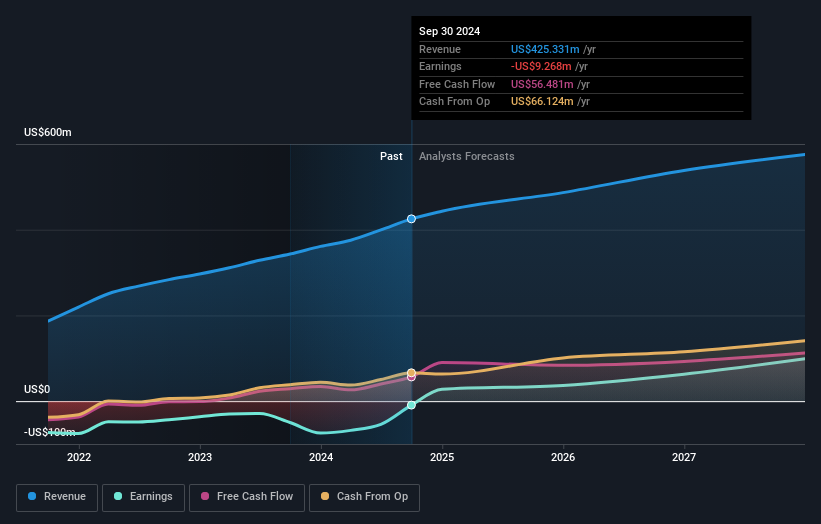

Veracyte's outlook anticipates $627.6 million in revenue and $132.4 million in earnings by 2028. Achieving this will require 9.4% annual revenue growth and a $106.1 million increase in earnings from the current $26.3 million.

Uncover how Veracyte's forecasts yield a $40.33 fair value, a 44% upside to its current price.

Exploring Other Perspectives

Five members of the Simply Wall St Community have set fair value targets for Veracyte stock, ranging sharply from US$24.31 to US$84.40. While community opinions vary, management’s focus on core test adoption and market expansion remains central to earnings growth, making it vital to review a wide mix of views before taking a position.

Explore 5 other fair value estimates on Veracyte - why the stock might be worth 13% less than the current price!

Build Your Own Veracyte Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Veracyte research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Veracyte research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Veracyte's overall financial health at a glance.

Want Some Alternatives?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 20 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.