Please use a PC Browser to access Register-Tadawul

VeriSign (VRSN) Margin Decline Reinforces Investor Focus on Long-Term Profit Quality

VeriSign, Inc. VRSN | 242.00 242.00 | -0.85% 0.00% Pre |

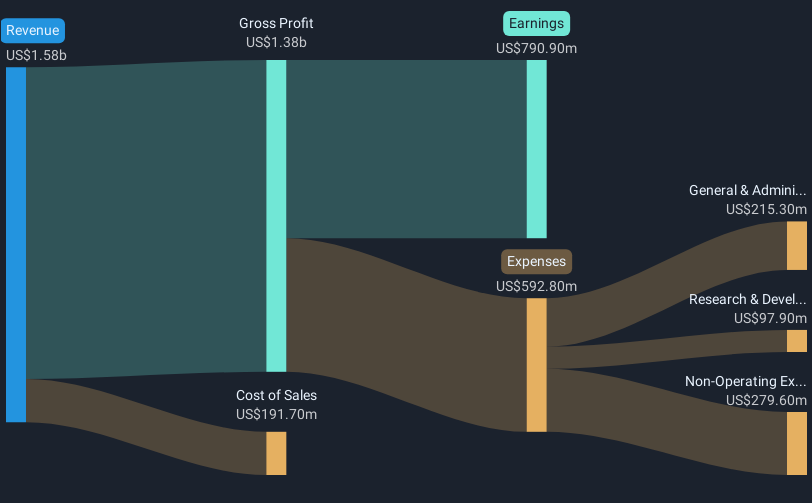

VeriSign (VRSN) reported that earnings are forecast to grow at 5.8% per year, with revenue expected to increase by 4.7% annually. Profit margins narrowed this year, landing at 49.9%, compared to 55.7% last year. Despite negative earnings growth over the past year, earnings have grown at 2.8% per year over the last five years, and the company’s profits are still considered high quality.

See our full analysis for VeriSign.The next section will put these earnings trends head to head with community narratives to highlight where consensus holds strong and where there may be surprises.

Profit Margin Slips but Still Strong

- Net profit margin is now 49.9%, down substantially from 55.7% a year ago. This level remains high compared to many industry peers.

- Analysts' consensus view argues that ongoing improvements in domain registration rates and the introduction of new marketing initiatives should help support margins in coming quarters.

- They highlight that new domain registrations and renewal rates are moving up, providing a base for future profit stability.

- However, even with these positives, the narrowing margin means future growth may be more dependent on top-line expansion rather than cost efficiency.

See how analysts weigh these profit trends in their latest forecasts. 📊 Read the full VeriSign Consensus Narrative.

Discounted Value Versus Fair Value

- With a current share price of $247.08, VeriSign trades below the analyst price target of $304.00. It remains well above its DCF fair value of $217.80.

- Analysts' consensus view considers this relatively small gap (less than 7.5%) between the share price and price target as a sign that the market sees the stock as fairly valued in light of steady, if not spectacular, growth prospects.

- They note that the current PE ratio of 33.4x outpaces the US IT industry average of 29.0x, which could limit future upside unless growth accelerates beyond current forecasts.

- Consensus still leans positive, as ongoing buybacks and the introduction of dividends are seen as confidence signals, supporting the case for sustained value at these prices.

Revenue Growth Underpinned by Domain Trends

- Revenue is forecast to grow at 4.7% per year, bolstered by sequential improvements in domain name registrations and successful new marketing programs.

- Analysts' consensus view believes continued growth depends on sustaining these trends, but warns that regulatory hurdles around the .web registry and competitive pressure could challenge further expansion.

- Positive momentum in core geographies (US, EMEA, Asia Pacific) could lift top-line growth if current patterns persist.

- However, consensus cautions that overcoming regulatory challenges in new domain initiatives, like .web, is crucial for unlocking additional upside.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for VeriSign on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Think you have a different take on the latest figures? Bring your perspective to life and share your own view in just a few minutes. Do it your way

A great starting point for your VeriSign research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

See What Else Is Out There

Despite VeriSign’s solid profitability, narrowing margins and premium valuation could make future growth less certain as the business depends more on continued revenue expansion.

If you would prefer steadier performers, use our stable growth stocks screener (2099 results) to find companies with consistent revenue and earnings growth across economic cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.