Please use a PC Browser to access Register-Tadawul

Verra Mobility (VRRM): $98.3 Million One-Off Loss Challenges Profit Margin Optimism

Verra Mobility Corp. Class A VRRM | 18.94 | +2.71% |

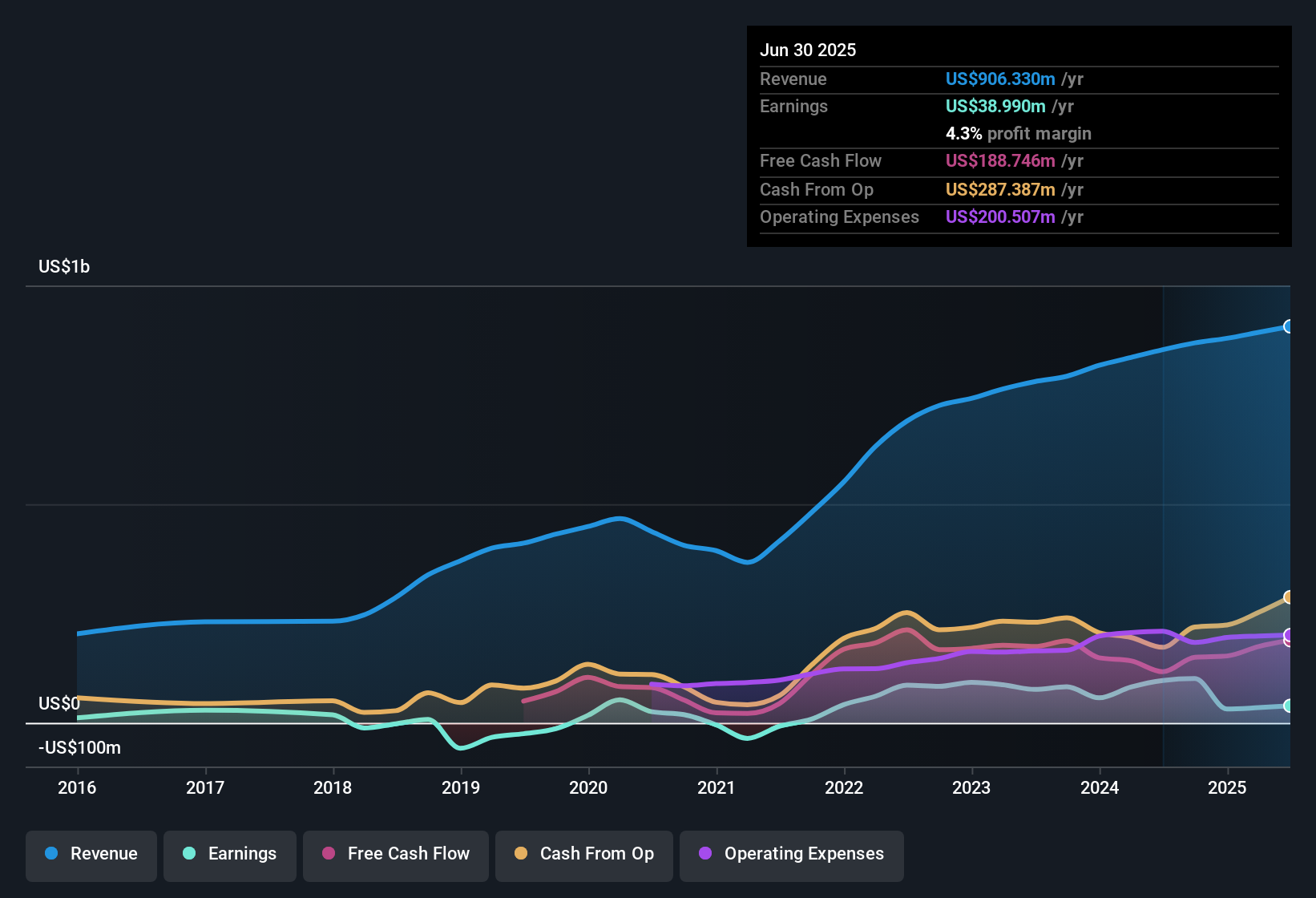

Verra Mobility (VRRM) posted a one-off loss of $98.3 million for the twelve months ending September 30, 2025, resulting in net profit margins falling to 5.4% from 11.6% a year ago. Over the past five years, however, earnings have grown at an impressive 21.9% annual rate and are projected to accelerate by 35% per year moving forward, outpacing US market averages. While lower margins and a dip in reported earnings quality raise some near-term questions, a strong growth forecast and a share price below fair value offer investors compelling reasons to stay tuned to this story.

See our full analysis for Verra Mobility.Now, let’s see how these headline figures compare to the key narratives in the market. We will also explore whether the latest results back up the prevailing stories or challenge them.

Analysts Project 35% Profit Upside

- Forecasts show profit margins rising sharply from 4.3% today to 26.0% in three years, with earnings expected to surge from $39.0 million to $289.5 million by 2028.

- According to the analysts' consensus view, this steep margin recovery is built on digital payments growth and lucrative contract renewals that support stronger recurring revenue and operational leverage.

- Legislative expansion across states is projected to drive double-digit revenue growth in Government Solutions as new programs convert to recurring ARR.

- High win rates for competitive bids and stable, multi-year contract renewals are set to underpin predictable, SaaS-style service revenue and long-term earnings growth.

- Consensus narrative highlights improving margin potential despite recent setbacks. See how analysts are updating long-term expectations.📊 Read the full Verra Mobility Consensus Narrative.

Concentration Risks Cast a Shadow

- Government Solutions revenue relies heavily on the largest customer, New York City, with contract renewal delays introducing concentration risk and potential for major revenue swings.

- Consensus narrative flags that, while legislative tailwinds and contract expansions are promising, customer churn and unresolved contracts raise doubts around the durability of top-line growth.

- The company faces headwinds from macro weakness, contract timing uncertainty, and limited SaaS adoption, which may restrict revenue and margin expansion.

- Any unfavorable developments in the New York City renewal or travel demand stagnation could cause actual results to fall short of guidance.

Share Trades Below DCF Fair Value

- With a current share price of $23.49, Verra Mobility trades at a 32.7% discount to its DCF fair value of $34.91, and about 21.3% below the top analyst price target of $29.83.

- The analysts' consensus view underscores that while discounted cash flow and price targets point to undervaluation, traditional multiples still show a premium versus peers. This makes confidence in future growth essential for justifying these valuation gaps.

- Future PE is expected to decline to 18.0x by 2028, lower than today's 99.9x and below the US Professional Services industry average of 26.3x.

- This valuation tension means investors need faith in the company meeting ambitious growth projections to see the current discount realized.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Verra Mobility on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a unique take on the figures? Share your version of the story and put your insights to work in just a few minutes: Do it your way

A great starting point for your Verra Mobility research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

See What Else Is Out There

Verra Mobility faces revenue concentration risk and uncertainty around contract renewals, which makes its long-term growth less predictable than investors might prefer.

If you want more predictability, discover companies showing consistent results and reliable momentum by focusing on stable growth stocks screener (2094 results) that sidestep these headline risks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.