Please use a PC Browser to access Register-Tadawul

Verra Mobility’s NYC Camera Deal And What It May Mean For Valuation

Verra Mobility Corp. Class A VRRM | 18.94 | +2.71% |

- Verra Mobility secured a new five year contract with the New York City Department of Transportation to expand and manage automated enforcement camera programs.

- The agreement broadens red light and bus lane safety coverage across all five boroughs and adds technology upgrades and community focused commitments.

- The contract extends a long running relationship between Verra Mobility and NYC DOT and is tied to legislatively supported program growth.

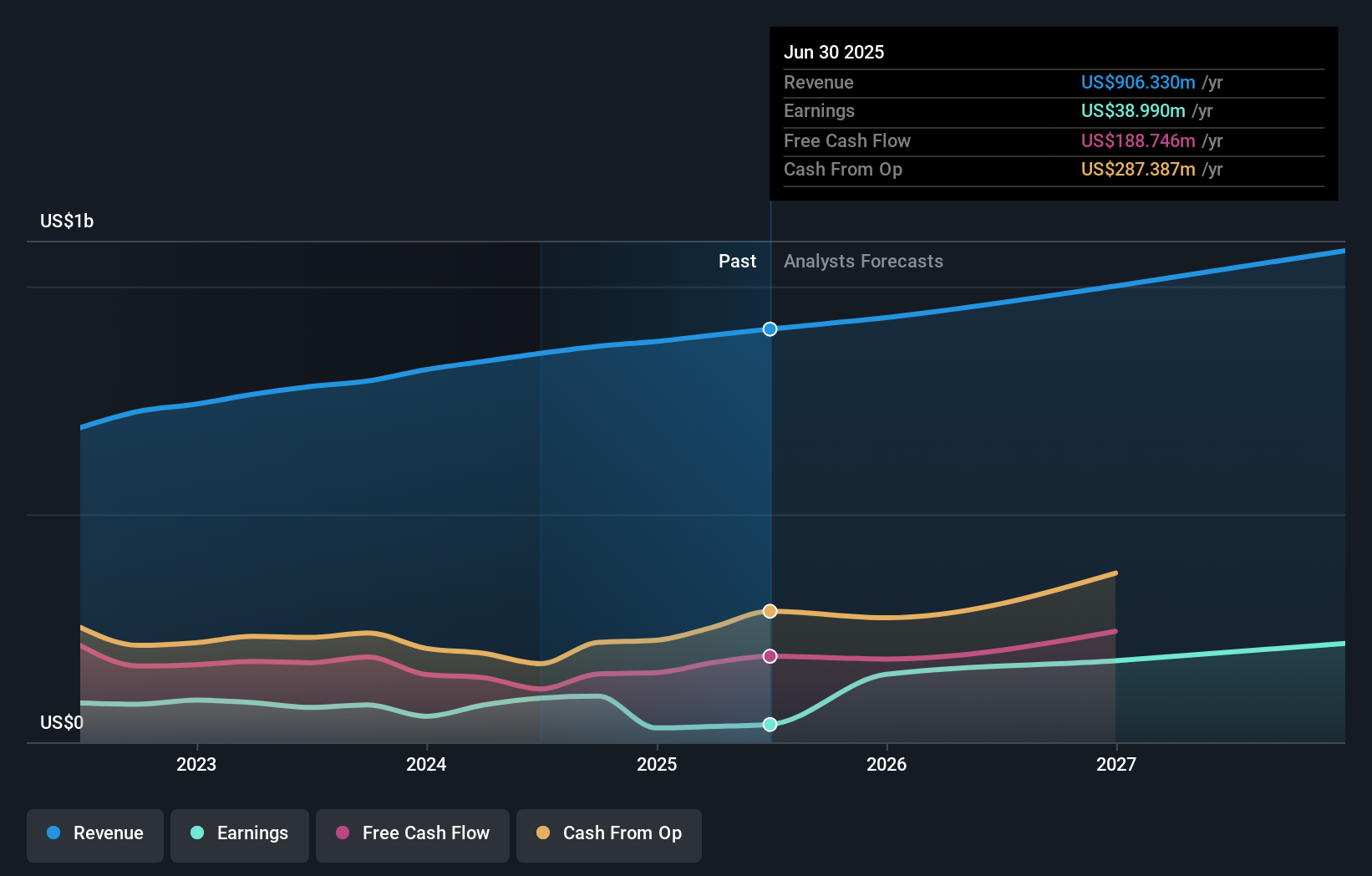

For investors watching Verra Mobility, NasdaqCM:VRRM, this New York City contract arrives at a time when the stock trades at $18.58 after a 16.8% decline year to date and a 28.8% decline over the past year. Over a longer horizon, returns of 15.0% over three years and 33.0% over five years show a different picture, which some investors may weigh against the near term share price pressure.

This expanded NYC engagement increases Verra Mobility’s role in one of the largest traffic enforcement markets in the US, affecting both revenue potential and public safety outcomes. As the contract rolls out, investors may focus on execution, the pace of deployment scaling, and how the company communicates any financial impact tied to this multi year agreement.

Stay updated on the most important news stories for Verra Mobility by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on Verra Mobility.

Investor Checklist

Quick Assessment

- ✅ Price vs Analyst Target: At US$18.58, Verra Mobility trades about 35% below the US$28.71 analyst price target.

- ✅ Simply Wall St Valuation: The shares are flagged as undervalued, trading 57.4% below the Simply Wall St fair value estimate.

- ❌ Recent Momentum: The stock has a 30 day return of roughly 19.7% decline.

There is only one way to know the right time to buy, sell or hold Verra Mobility. Head to Simply Wall St's company report for the latest analysis of Verra Mobility's Fair Value.

Key Considerations

- 📊 The five year New York City automated enforcement contract ties Verra Mobility more closely to a large municipal customer, which some investors may see as helpful context for discussions about long term revenue stability.

- 📊 Watch how management quantifies contract related revenue, capital needs and margins over time, especially relative to the current P/E of about 58x and analyst targets.

- ⚠️ Profit margins of 5.4% compared with 11.6% a year ago, combined with a high level of debt, make execution quality and cash generation on this contract important to monitor.

Dig Deeper

For the full picture, including more risks and rewards, check out the complete Verra Mobility analysis. Alternatively, you can visit the community page for Verra Mobility to see how other investors believe this latest news will impact the company's narrative.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.