Please use a PC Browser to access Register-Tadawul

Vertex CASGEVY Approval Adds Gene Editing Pillar To Growth Story

Vertex Pharmaceuticals Incorporated VRTX | 465.02 465.00 | +0.82% 0.00% Post |

- Vertex Pharmaceuticals (NasdaqGS:VRTX) received FDA approval for CASGEVY, a CRISPR/Cas9 gene edited therapy for transfusion dependent beta thalassemia.

- The decision marks the first FDA approved CRISPR/Cas9 based treatment for this condition.

For investors watching NasdaqGS:VRTX, CASGEVY adds a new pillar to a business already closely followed for its work in serious diseases. The stock closed at $468.41, with a 3 year return of 45.7% and a 5 year return of 104.5%, which highlights how the market tracks Vertex around major pipeline events.

The CASGEVY approval also gives you another concrete data point when thinking about the role of gene editing in Vertex's potential product mix. As the company advances additional programs that use similar technologies, you may want to track how regulators respond, how quickly real world adoption takes shape, and how that feeds into the broader pipeline story over time.

Stay updated on the most important news stories for Vertex Pharmaceuticals by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on Vertex Pharmaceuticals.

The FDA approval of CASGEVY for transfusion dependent beta thalassemia broadens Vertex Pharmaceuticals' presence beyond cystic fibrosis into gene edited therapies, which opens a new treatment category tied directly to CRISPR/Cas9 technologies. For you as an investor, this adds another potential revenue stream that is less correlated with the existing franchise and ties the company more tightly to demand for advanced genetic engineering tools.

How This Fits Into The Vertex Pharmaceuticals Narrative

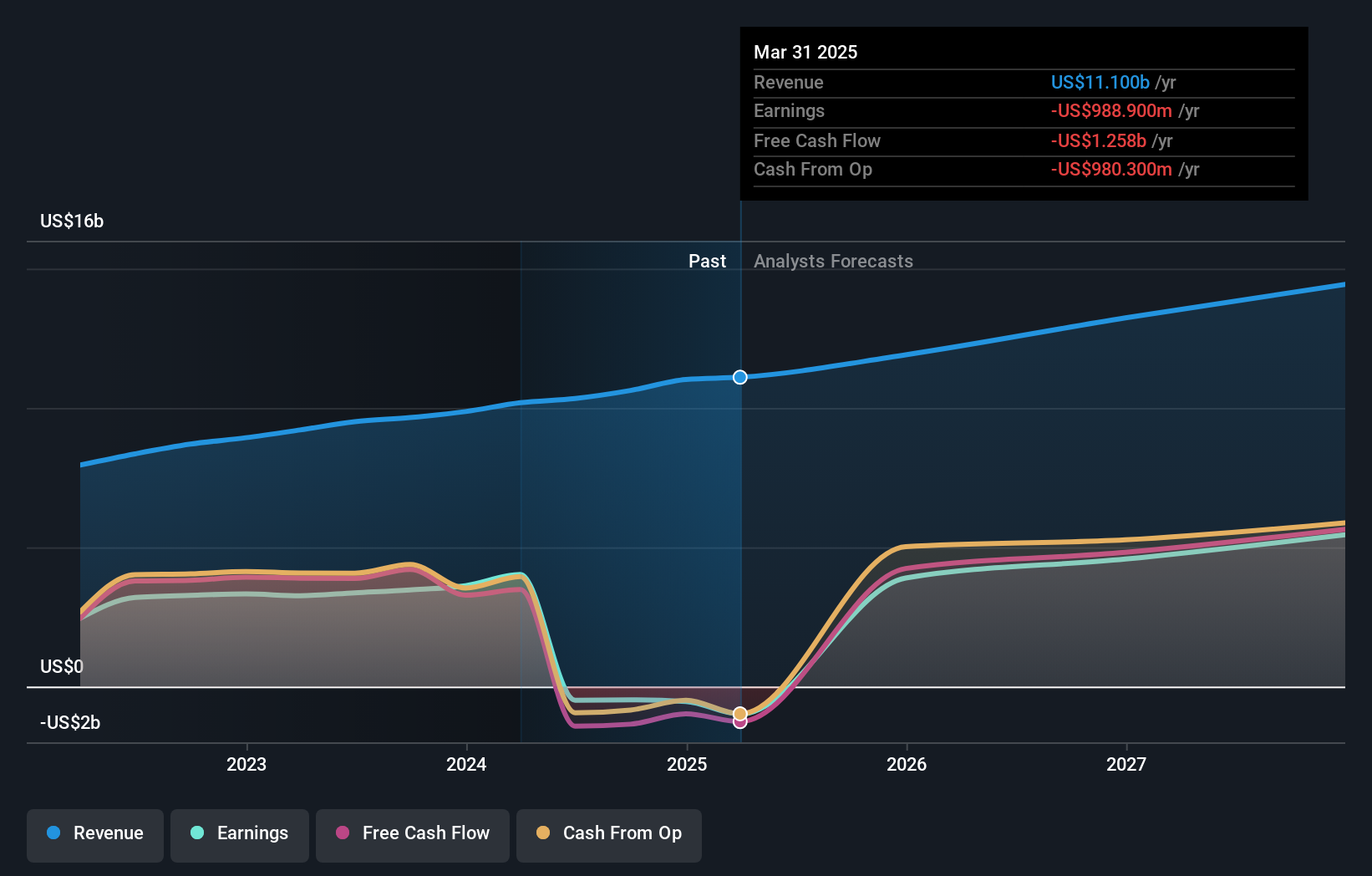

Vertex is already closely watched for its work in serious diseases, and CASGEVY adds another example of the company taking complex biology into commercial products. With upcoming Q4 and full year 2025 results and a mixed Q3 where revenue met expectations and EPS came in ahead, this approval may shape how you think about the balance between current earnings power and the long term story around gene editing and broader pipeline execution.

CASGEVY, Risks And Rewards For Investors

- CASGEVY validates Vertex's use of CRISPR/Cas9, which may support confidence in other gene edited programs that reach later stage development.

- The therapy targets a serious condition with clear medical need, giving Vertex exposure to an area where regulators are already engaging with its science.

- Gene therapies can face scrutiny on pricing and reimbursement, so investor expectations on margins and uptake may not always align with payer decisions.

- Competitive pressure from other precision medicine and gene therapy developers could limit Vertex's share of future genetic disease markets.

What To Watch Next

From here, it is worth tracking how quickly CASGEVY adoption develops, how physicians and payers respond, and what management says about gene editing during upcoming earnings calls, and you can stay plugged into how other investors are framing this by following the community discussion in this narrative hub.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.